Question: my project question in Screen shot and also send a demo format for this project: Now sending a DEMO of Project: THIS upper are the

my project question in Screen shot and also send a demo format for this project:

Now sending a DEMO of Project:

Now sending a DEMO of Project:

THIS upper are the project question and Demo.

Now sending the details of Strategies & KPIs below

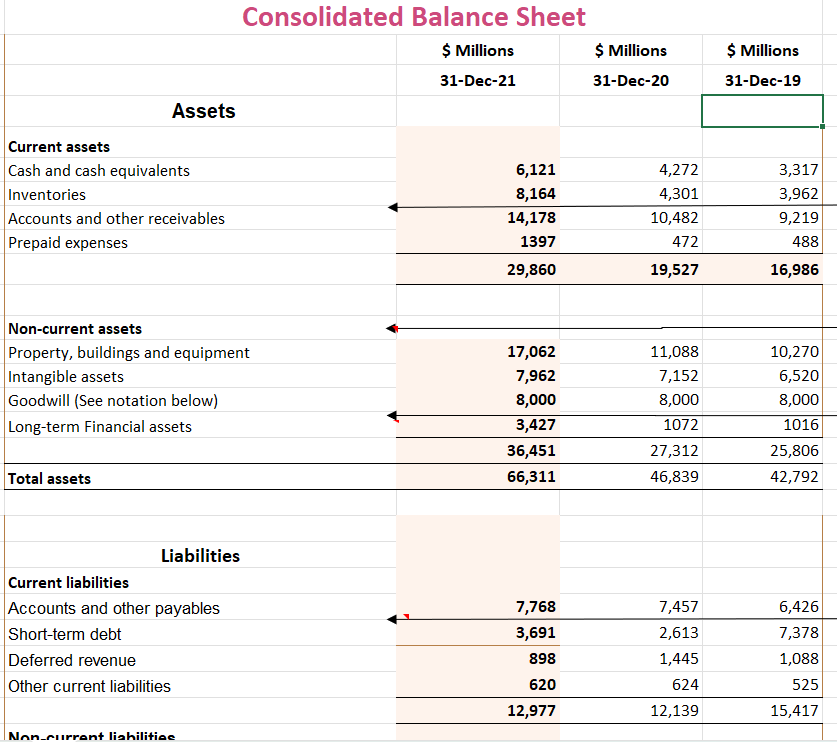

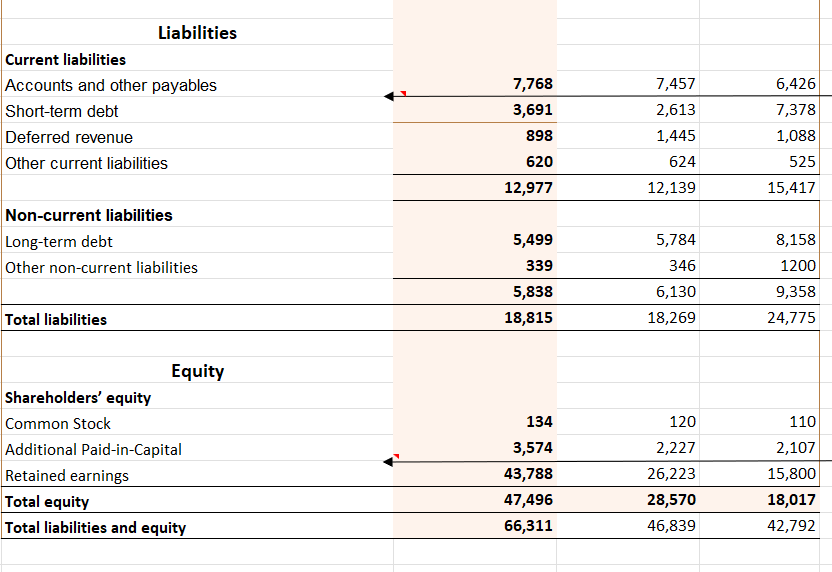

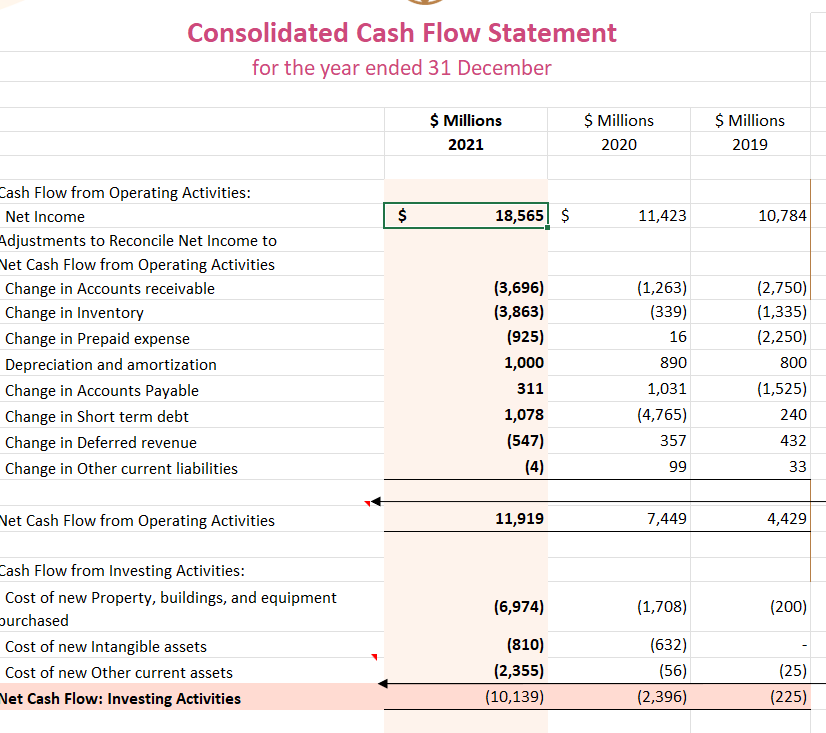

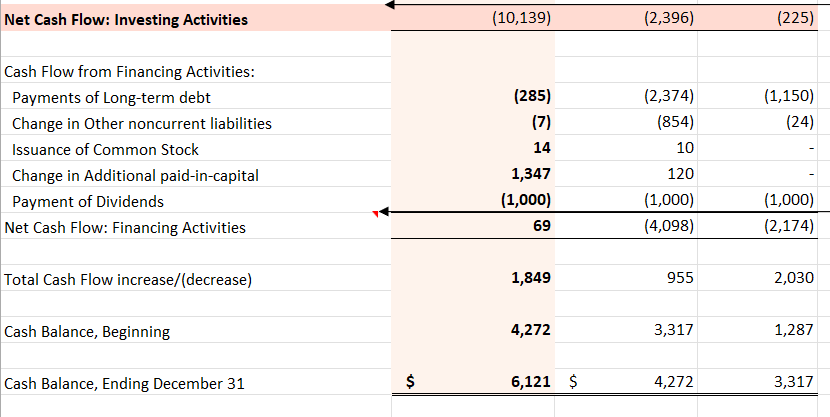

now sending FINANCIAL STATEMENTS details:

now sending FINANCIAL STATEMENTS details:

those are my project questions

. try to solve it and send me a project just like project demo

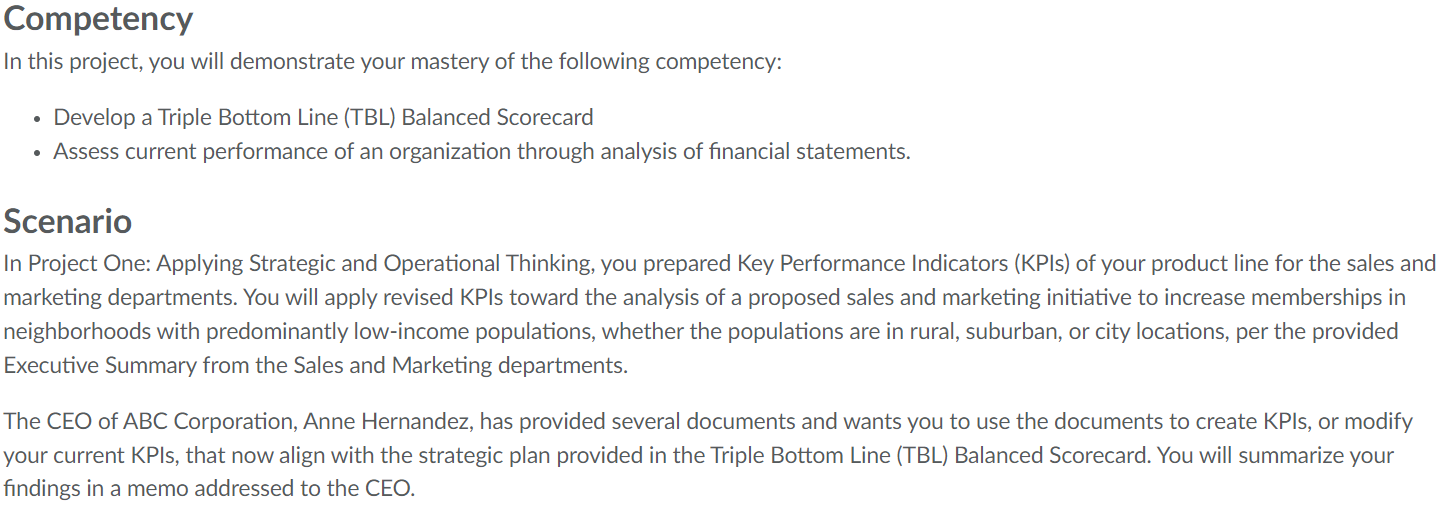

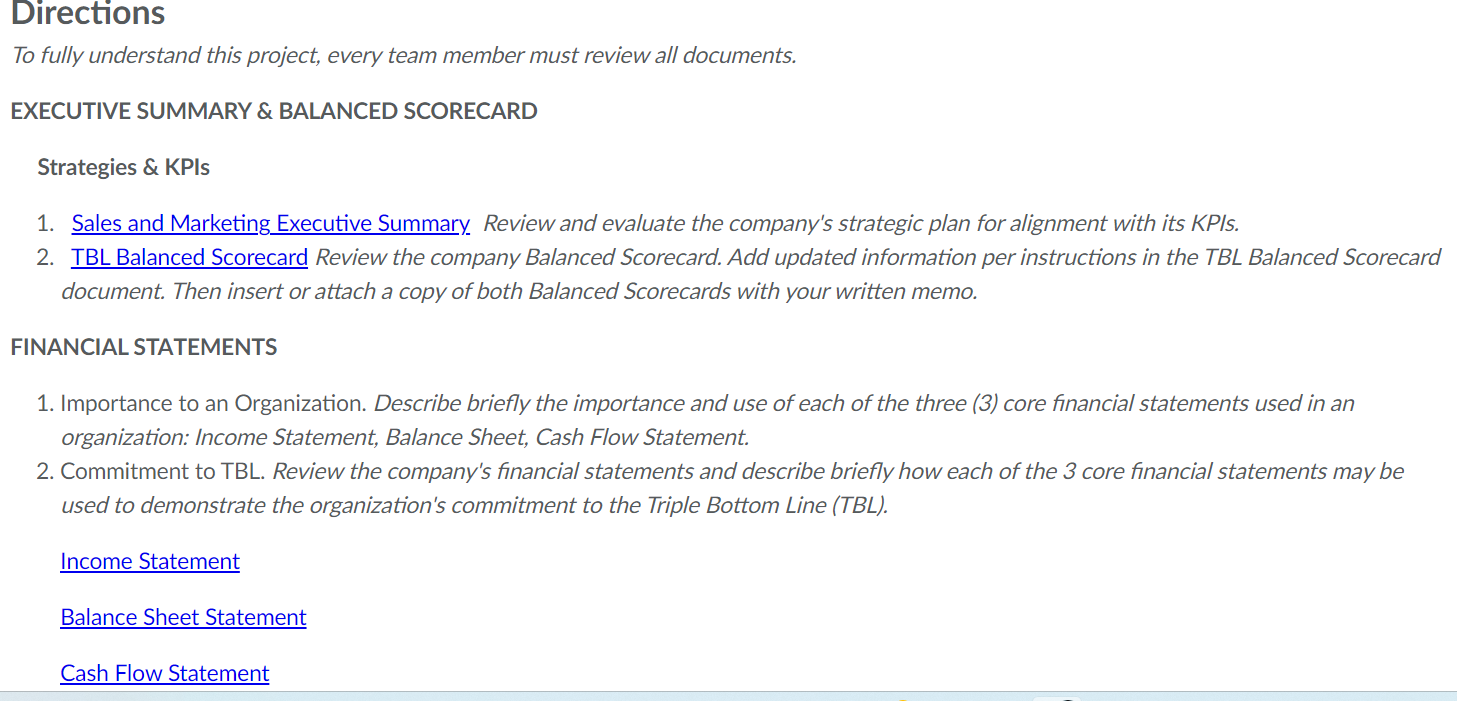

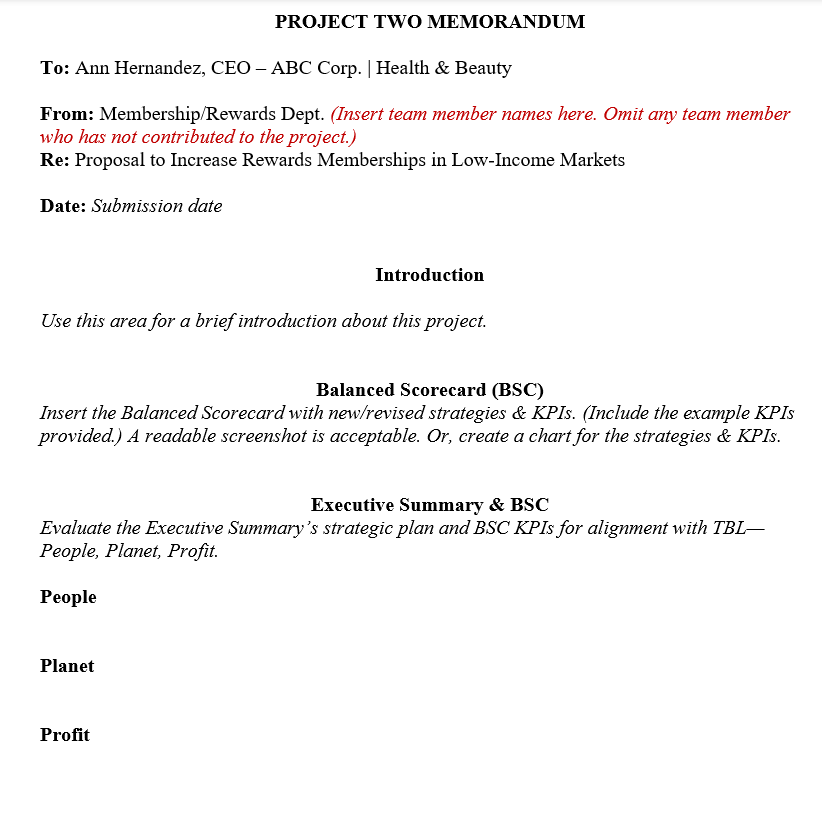

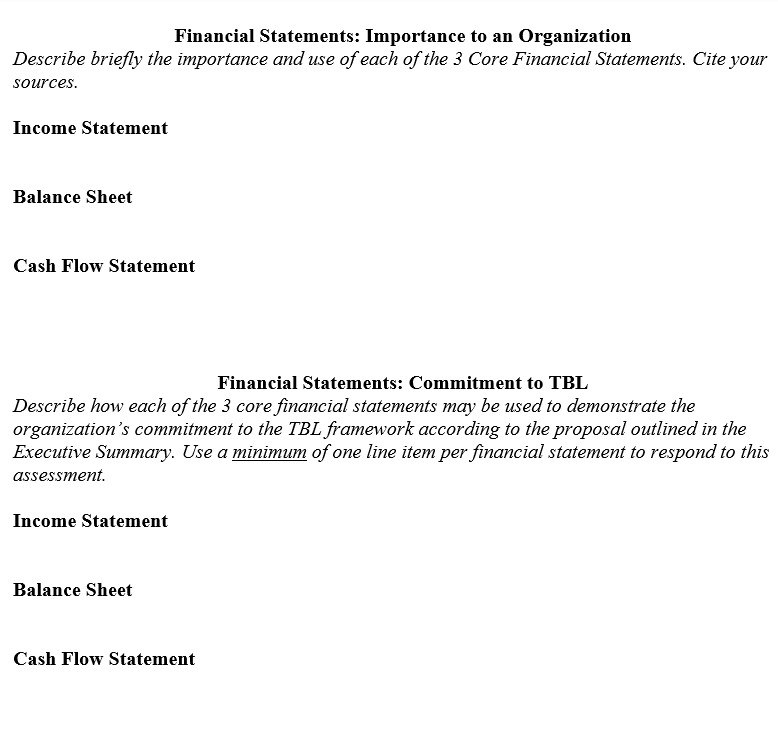

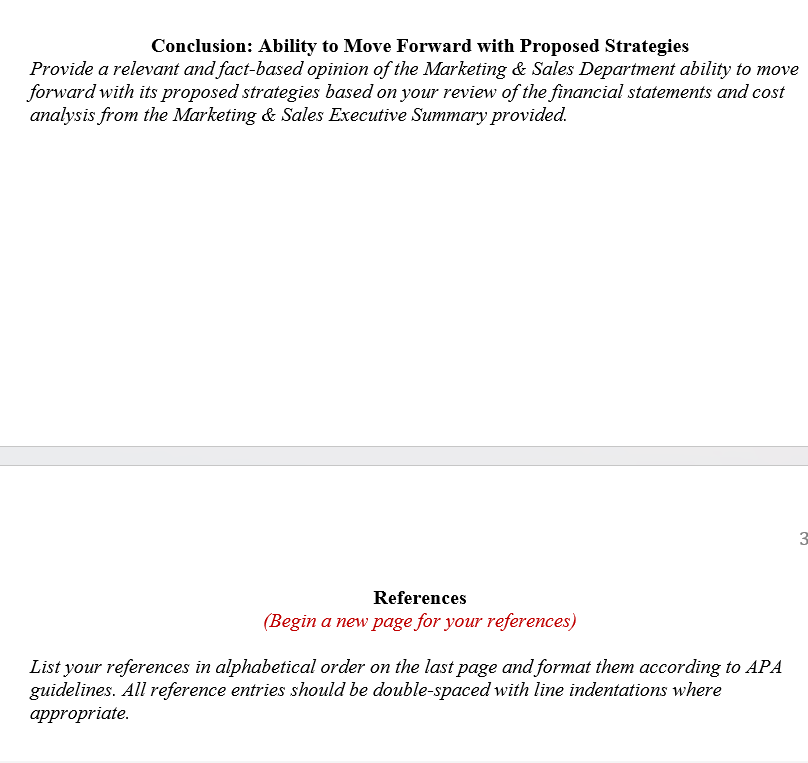

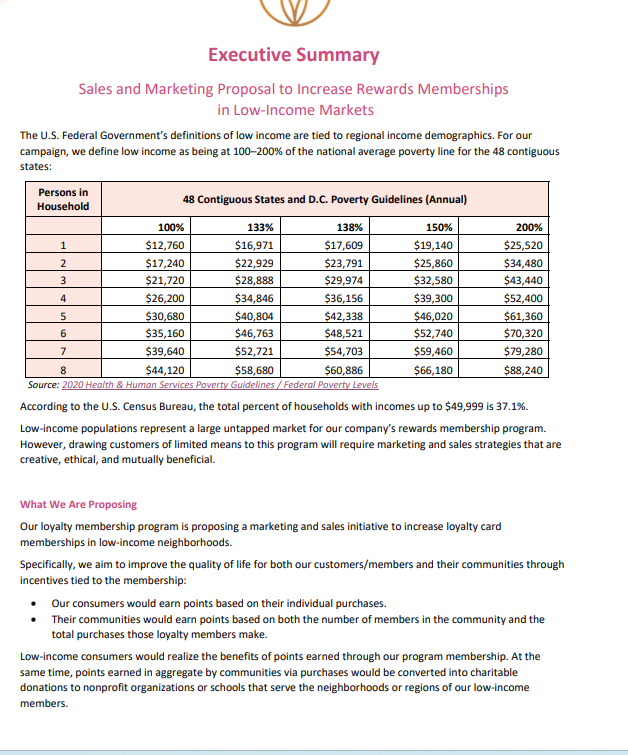

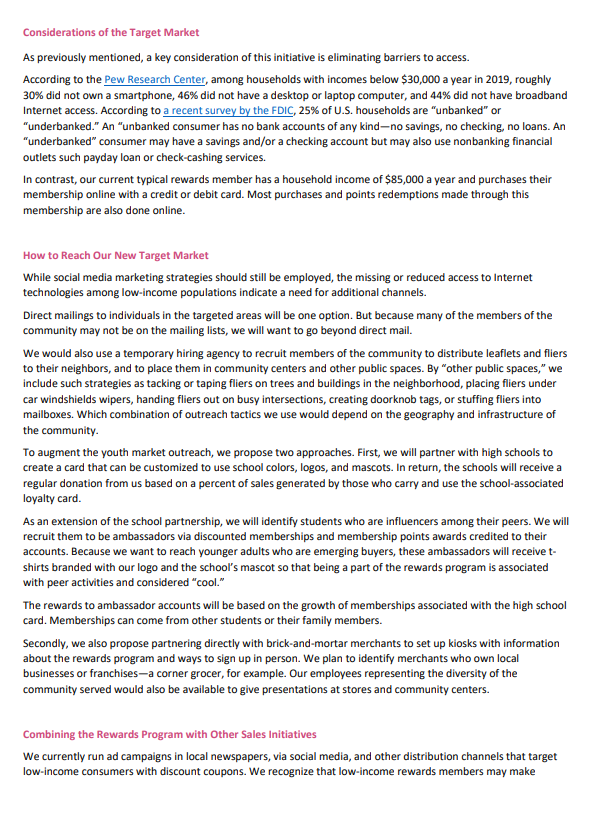

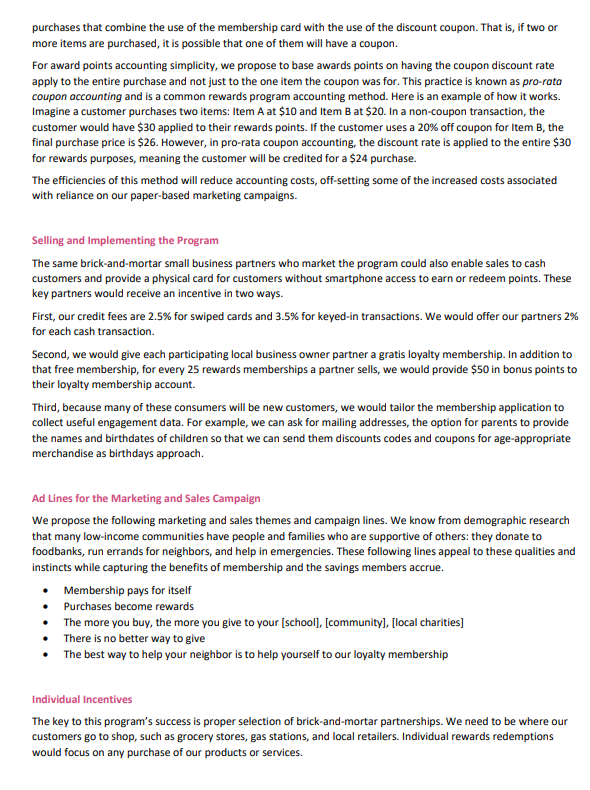

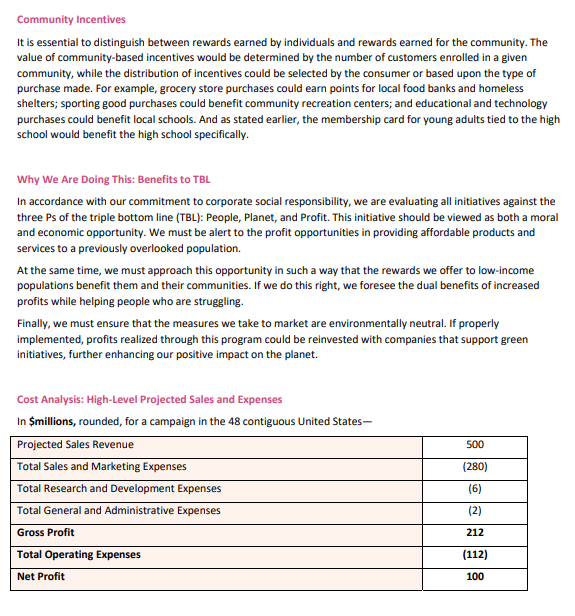

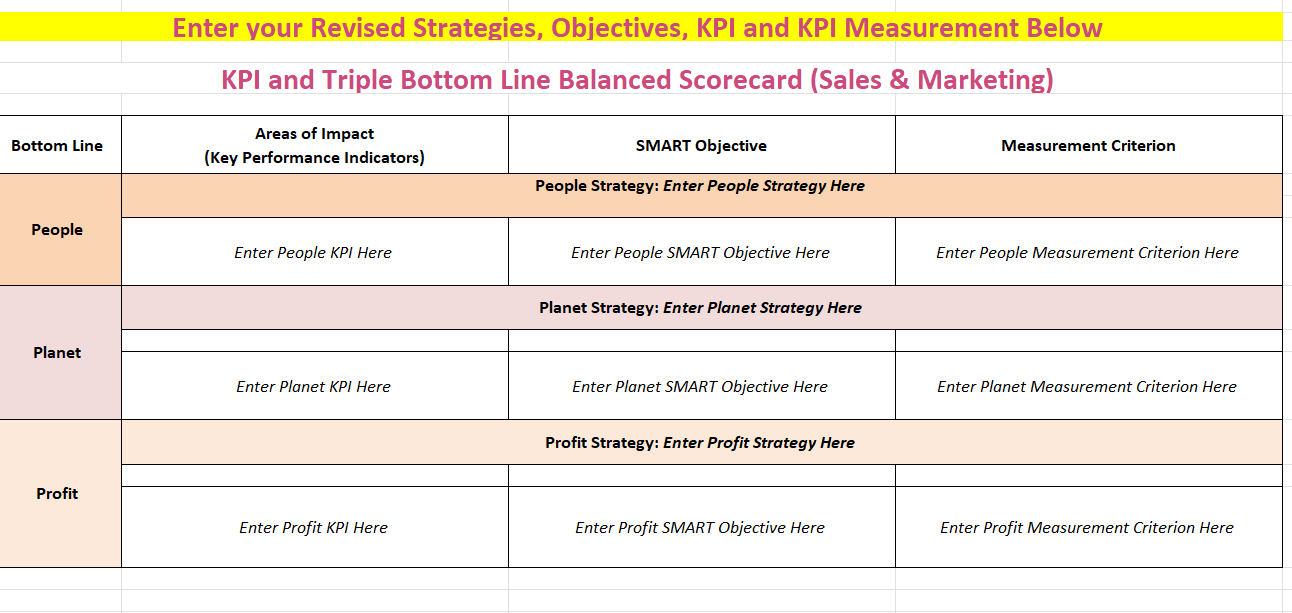

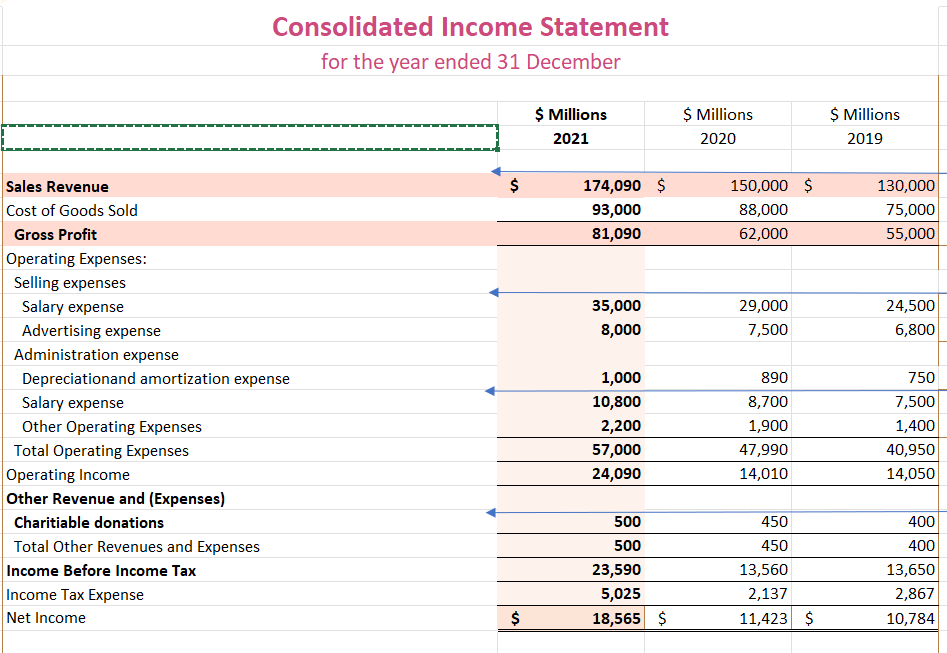

Competency In this project, you will demonstrate your mastery of the following competency: - Develop a Triple Bottom Line (TBL) Balanced Scorecard - Assess current performance of an organization through analysis of financial statements. Scenario In Project One: Applying Strategic and Operational Thinking, you prepared Key Performance Indicators (KPIs) of your product line for the sales and marketing departments. You will apply revised KPls toward the analysis of a proposed sales and marketing initiative to increase memberships in neighborhoods with predominantly low-income populations, whether the populations are in rural, suburban, or city locations, per the provided Executive Summary from the Sales and Marketing departments. The CEO of ABC Corporation, Anne Hernandez, has provided several documents and wants you to use the documents to create KPIs, or modify your current KPIs, that now align with the strategic plan provided in the Triple Bottom Line (TBL) Balanced Scorecard. You will summarize your findings in a memo addressed to the CEO. To fully understand this project, every team member must review all documents. EXECUTIVE SUMMARY \& BALANCED SCORECARD Strategies \& KPls 1. Sales and Marketing Executive Summary. Review and evaluate the company's strategic plan for alignment with its KPIs. 2. TBL Balanced Scorecard Review the company Balanced Scorecard. Add updated information per instructions in the TBL Balanced Scorecard document. Then insert or attach a copy of both Balanced Scorecards with your written memo. FINANCIAL STATEMENTS 1. Importance to an Organization. Describe briefly the importance and use of each of the three (3) core financial statements used in an organization: Income Statement, Balance Sheet, Cash Flow Statement. 2. Commitment to TBL. Review the company's financial statements and describe briefly how each of the 3 core financial statements may be used to demonstrate the organization's commitment to the Triple Bottom Line (TBL). 1. Provide a relevant, fact-based, and researched opinion of the Sales \& Marketing Department's ability to move forward with its proposed strategies based on your review of the financial statements and cost analysis from the Sales \& Marketing Executive Summary provided. PROJECT TWO MEMORANDUM To: Ann Hernandez, CEO - ABC Corp. | Health \& Beauty From: Membership/Rewards Dept. (Insert team member names here. Omit any team member who has not contributed to the project.) Re: Proposal to Increase Rewards Memberships in Low-Income Markets Date: Submission date Introduction Use this area for a brief introduction about this project. Balanced Scorecard (BSC) Insert the Balanced Scorecard with new/revised strategies \& KPIs. (Include the example KPIs provided.) A readable screenshot is acceptable. Or, create a chart for the strategies \& KPIs. Executive Summary \& BSC Evaluate the Executive Summary's strategic plan and BSC KPIs for alignment with TBL People, Planet, Profit. Financial Statements: Importance to an Organization Describe briefly the importance and use of each of the 3 Core Financial Statements. Cite your sources. Income Statement Balance Sheet Cash Flow Statement Financial Statements: Commitment to TBL Describe how each of the 3 core financial statements may be used to demonstrate the organization's commitment to the TBL framework according to the proposal outlined in the Executive Summary. Use a minimum of one line item per financial statement to respond to this assessment. Income Statement Balance Sheet Cash Flow Statement Conclusion: Ability to Move Forward with Proposed Strategies Provide a relevant and fact-based opinion of the Marketing \& Sales Department ability to move forward with its proposed strategies based on your review of the financial statements and cost analysis from the Marketing \& Sales Executive Summary provided. References (Begin a new page for your references) List your references in alphabetical order on the last page and format them according to APA guidelines. All reference entries should be double-spaced with line indentations where appropriate. Executive Summary Sales and Marketing Proposal to Increase Rewards Memberships in Low-Income Markets The U.S. Federal Government's definitions of low income are tied to regional income demographics. For our campaign, we define low income as being at 100200% of the national average poverty line for the 48 contiguous states: According to the U.S. Census Bureau, the total percent of households with incomes up to $49,999 is 37.1%. Low-income populations represent a large untapped market for our company's rewards membership program. However, drawing customers of limited means to this program will require marketing and sales strategies that are creative, ethical, and mutually beneficial. What We Are Proposing Our loyalty membership program is proposing a marketing and sales initiative to increase loyalty card memberships in low-income neighborhoods. Specifically, we aim to improve the quality of life for both our customers/members and their communities through incentives tied to the membership: - Our consumers would earn points based on their individual purchases. - Their communities would earn points based on both the number of members in the community and the total purchases those loyalty members make. Low-income consumers would realize the benefits of points earned through our program membership. At the same time, points earned in aggregate by communities via purchases would be converted into charitable donations to nonprofit organizations or schools that serve the neighborhoods or regions of our low-income members. Considerations of the Target Market As previously mentioned, a key consideration of this initiative is eliminating barriers to access. According to the among households with incomes below $30,000 a year in 2019 , roughly 30% did not own a smartphone, 46% did not have a desktop or laptop computer, and 44% did not have broadband Internet access. According to . 25\% of U.S. households are "unbanked" or "underbanked." An "unbanked consumer has no bank accounts of any kind-no savings, no checking, no loans. An "underbanked" consumer may have a savings and/or a checking account but may also use nonbanking financial outlets such payday loan or check-cashing services. In contrast, our current typical rewards member has a household income of $85,000 a year and purchases their membership online with a credit or debit card. Most purchases and points redemptions made through this membership are also done online. How to Reach Our New Target Market While social media marketing strategies should still be employed, the missing or reduced access to Internet technologies among low-income populations indicate a need for additional channels. Direct mailings to individuals in the targeted areas will be one option. But because many of the members of the community may not be on the mailing lists, we will want to go beyond direct mail. We would also use a temporary hiring agency to recruit members of the community to distribute leaflets and fliers to their neighbors, and to place them in community centers and other public spaces. By "other public spaces," we include such strategies as tacking or taping fliers on trees and buildings in the neighborhood, placing fliers under car windshields wipers, handing fliers out on busy intersections, creating doorknob tags, or stuffing fliers into mailboxes. Which combination of outreach tactics we use would depend on the geography and infrastructure of the community. To augment the youth market outreach, we propose two approaches. First, we will partner with high schools to create a card that can be customized to use school colors, logos, and mascots. In return, the schools will receive a regular donation from us based on a percent of sales generated by those who carry and use the school-associated loyalty card. As an extension of the school partnership, we will identify students who are influencers among their peers. We will recruit them to be ambassadors via discounted memberships and membership points awards credited to their accounts. Because we want to reach younger adults who are emerging buyers, these ambassadors will receive tshirts branded with our logo and the school's mascot so that being a part of the rewards program is associated with peer activities and considered "cool." The rewards to ambassador accounts will be based on the growth of memberships associated with the high school card. Memberships can come from other students or their family members. Secondly, we also propose partnering directly with brick-and-mortar merchants to set up kiosks with information about the rewards program and ways to sign up in person. We plan to identify merchants who own local businesses or franchises - corner grocer, for example. Our employees representing the diversity of the community served would also be available to give presentations at stores and community centers. Combining the Rewards Program with Other Sales Initiatives We currently run ad campaigns in local newspapers, via social media, and other distribution channels that target low-income consumers with discount coupons. We recognize that low-income rewards members may make purchases that combine the use of the membership card with the use of the discount coupon. That is, if two or more items are purchased, it is possible that one of them will have a coupon. For award points accounting simplicity, we propose to base awards points on having the coupon discount rate apply to the entire purchase and not just to the one item the coupon was for. This practice is known as pro-rata coupon accounting and is a common rewards program accounting method. Here is an example of how it works. Imagine a customer purchases two items: Item A at $10 and Item B at $20. In a non-coupon transaction, the customer would have $30 applied to their rewards points. If the customer uses a 20% off coupon for Item B, the final purchase price is $26. However, in pro-rata coupon accounting, the discount rate is applied to the entire $30 for rewards purposes, meaning the customer will be credited for a $24 purchase. The efficiencies of this method will reduce accounting costs, off-setting some of the increased costs associated with reliance on our paper-based marketing campaigns. Selling and Implementing the Program The same brick-and-mortar small business partners who market the program could also enable sales to cash customers and provide a physical card for customers without smartphone access to earn or redeem points. These key partners would receive an incentive in two ways. First, our credit fees are 2.5% for swiped cards and 3.5% for keyed-in transactions. We would offer our partners 2% for each cash transaction. Second, we would give each participating local business owner partner a gratis loyalty membership. In addition to that free membership, for every 25 rewards memberships a partner sells, we would provide $50 in bonus points to their loyalty membership account. Third, because many of these consumers will be new customers, we would tailor the membership application to collect useful engagement data. For example, we can ask for mailing addresses, the option for parents to provide the names and birthdates of children so that we can send them discounts codes and coupons for age-appropriate merchandise as birthdays approach. Ad Lines for the Marketing and Sales Campaign We propose the following marketing and sales themes and campaign lines. We know from demographic research that many low-income communities have people and families who are supportive of others: they donate to foodbanks, run errands for neighbors, and help in emergencies. These following lines appeal to these qualities and instincts while capturing the benefits of membership and the savings members accrue. - Membership pays for itself - Purchases become rewards - The more you buy, the more you give to your [school], [community], [local charities] - There is no better way to give - The best way to help your neighbor is to help yourself to our loyalty membership Individual Incentives The key to this program's success is proper selection of brick-and-mortar partnerships. We need to be where our customers go to shop, such as grocery stores, gas stations, and local retailers. Individual rewards redemptions would focus on any purchase of our products or services. It is essential to distinguish between rewards earned by individuals and rewards earned for the community. The value of community-based incentives would be determined by the number of customers enrolled in a given community, while the distribution of incentives could be selected by the consumer or based upon the type of purchase made. For example, grocery store purchases could earn points for local food banks and homeless shelters; sporting good purchases could benefit community recreation centers; and educational and technology purchases could benefit local schools. And as stated earlier, the membership card for young adults tied to the high school would benefit the high school specifically. Why We Are Doing This: Benefits to TBL In accordance with our commitment to corporate social responsibility, we are evaluating all initiatives against the three Ps of the triple bottom line (TBL): People, Planet, and Profit. This initiative should be viewed as both a moral and economic opportunity. We must be alert to the profit opportunities in providing affordable products and services to a previously overlooked population. At the same time, we must approach this opportunity in such a way that the rewards we offer to low-income populations benefit them and their communities. If we do this right, we foresee the dual benefits of increased profits while helping people who are struggling. Finally, we must ensure that the measures we take to market are environmentally neutral. If properly implemented, profits realized through this program could be reinvested with companies that support green initiatives, further enhancing our positive impact on the planet. Enter your Revised Strategies, Objectives, KPI and KPI Measurement Below KPI and Triple Bottom Line Balanced Scorecard (Sales \& Marketing) Consolidated Income Statement for the year ended 31 December I Liabilities Current liabilities Accounts and other payables Short-term debt Deferred revenue Other current liabilities \begin{tabular}{|r|r|r|} \hline 7,768 & 7,457 & 6,426 \\ \hline 3,691 & 2,613 & 7,378 \\ \hline 898 & 1,445 & 1,088 \\ \hline 620 & 624 & 525 \\ \hline 12,977 & 12,139 & 15,417 \\ \hline \end{tabular} Non-current liabilities Long-term debt Other non-current liabilities Total liabilities Equity Shareholders' equity Common Stock Additional Paid-in-Capital Retained earnings Total equity Total liabilities and equity \begin{tabular}{rrr|} 134 & 120 & 110 \\ \hline 3,574 & 2,227 & 2,107 \\ \hline 43,788 & 26,223 & 15,800 \\ \hline 47,496 & 28,570 & 18,017 \\ \hline 66,311 & 46,839 & 42,792 \\ \hline \end{tabular} min2 [ a Net Cash Flow: Investing Activities (10,139)(2,396)(225) Cash Flow from Financing Activities: Payments of Long-term debt Change in Other noncurrent liabilities \begin{tabular}{|r|r|r|} \hline(285) & (2,374) & (1,150) \\ \hline (7) & (854) & (24) \\ 14 & 10 & - \\ 1,347 & 120 & - \\ (1,000) & (1,000) & (1,000) \\ \hline 69 & (4,098) & (2,174) \\ \hline \end{tabular} Total Cash Flow increase/(decrease) 1,849 Cash Balance, Beginning 4,272 3,317 1,287 \begin{tabular}{lrrrr} $ & 6,121$ & $ & 3,272 \\ \hline \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts