Question: My question for 3.8 is: when using straight line method depreciation, are both constuction and land expenses factored or just the constuction? Should I be

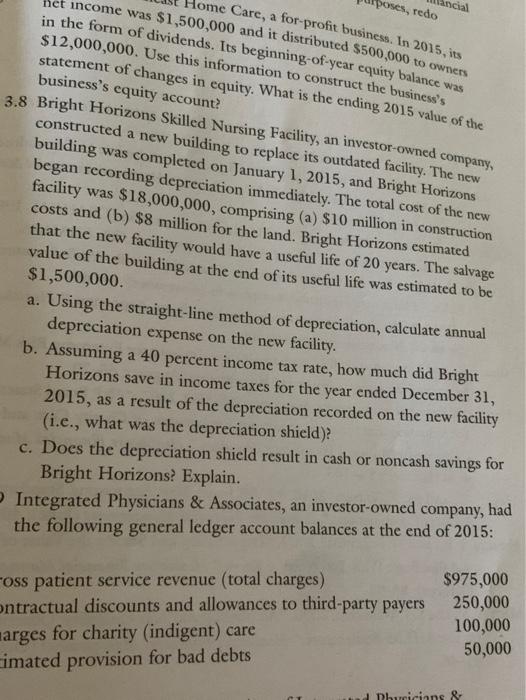

Poses, redo ncial Home Care, a for-profit business. In 2015, its net income was $1,500,000 and it distributed $500,000 to owners in the form of dividends. Its beginning-of-year equity balance was $12,000,000. Use this information to construct the business's statement of changes in equity. What is the ending 2015 value of the business's equity account? 3.8 Bright Horizons Skilled Nursing Facility, an investor-owned company, constructed a new building to replace its outdated facility. The new building was completed on January 1, 2015, and Bright Horizons began recording depreciation immediately. The total cost of the new facility was $18,000,000, comprising (a) $10 million in construction costs and (b) $8 million for the land. Bright Horizons estimated that the new facility would have a useful life of 20 years. The salvage value of the building at the end of its useful life was estimated to be $1,500,000. a. Using the straight-line method of depreciation, calculate annual depreciation expense on the new facility. b. Assuming a 40 percent income tax rate, how much did Bright Horizons save in income taxes for the year ended December 31, 2015, as a result of the depreciation recorded on the new facility (i.e., what was the depreciation shield)? c. Does the depreciation shield result in cash or noncash savings for Bright Horizons? Explain. Integrated Physicians & Associates, an investor-owned company, had the following general ledger account balances at the end of 2015: oss patient service revenue (total charges) $975,000 250,000 ontractual discounts and allowances to third-party payers 100,000 marges for charity (indigent) care 50,000 imated provision for bad debts 1 Dhuricians

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts