Question: My question is 5.28. attached is the exercises linked into it 5.28 (LO 4) Preparing a cash budget John Wills, Bates & Hill Fabricators' budget

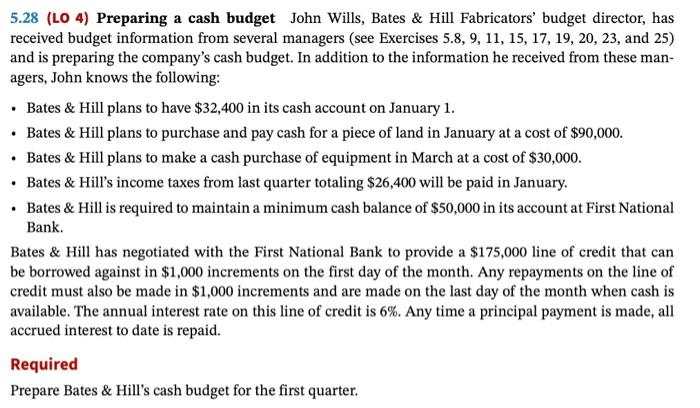

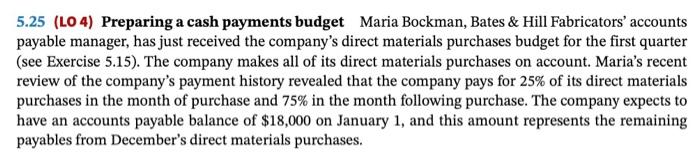

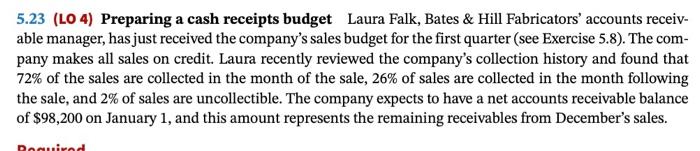

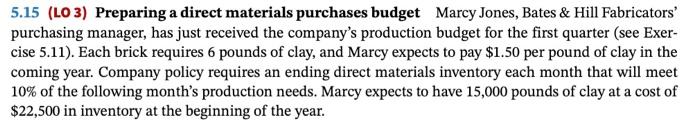

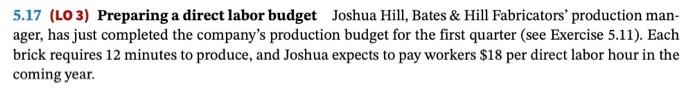

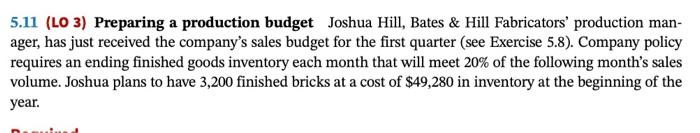

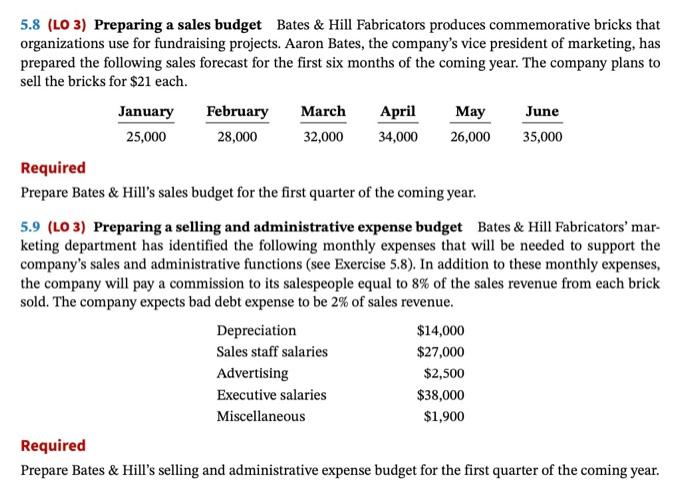

5.28 (LO 4) Preparing a cash budget John Wills, Bates \& Hill Fabricators' budget director, has received budget information from several managers (see Exercises 5.8, 9, 11, 15, 17, 19, 20, 23, and 25) and is preparing the company's cash budget. In addition to the information he received from these managers, John knows the following: - Bates \& Hill plans to have $32,400 in its cash account on January 1 . - Bates \& Hill plans to purchase and pay cash for a piece of land in January at a cost of $90,000. - Bates \& Hill plans to make a cash purchase of equipment in March at a cost of $30,000. - Bates \& Hill's income taxes from last quarter totaling $26,400 will be paid in January. - Bates \& Hill is required to maintain a minimum cash balance of $50,000 in its account at First National Bank. Bates \& Hill has negotiated with the First National Bank to provide a $175,000 line of credit that can be borrowed against in $1,000 increments on the first day of the month. Any repayments on the line of credit must also be made in $1,000 increments and are made on the last day of the month when cash is available. The annual interest rate on this line of credit is 6%. Any time a principal payment is made, all accrued interest to date is repaid. Required Prepare Bates \& Hill's cash budget for the first quarter. 5.25 (LO 4) Preparing a cash payments budget Maria Bockman, Bates \& Hill Fabricators' accounts payable manager, has just received the company's direct materials purchases budget for the first quarter (see Exercise 5.15). The company makes all of its direct materials purchases on account. Maria's recent review of the company's payment history revealed that the company pays for 25% of its direct materials purchases in the month of purchase and 75% in the month following purchase. The company expects to have an accounts payable balance of $18,000 on January 1 , and this amount represents the remaining payables from December's direct materials purchases. 5.23 (LO 4) Preparing a cash receipts budget Laura Falk, Bates \& Hill Fabricators' accounts receivable manager, has just received the company's sales budget for the first quarter (see Exercise 5.8). The company makes all sales on credit. Laura recently reviewed the company's collection history and found that 72% of the sales are collected in the month of the sale, 26% of sales are collected in the month following the sale, and 2% of sales are uncollectible. The company expects to have a net accounts receivable balance of $98,200 on January 1, and this amount represents the remaining receivables from December's sales. 5.19 (LO 3) Preparing a manufacturing overhead budget Joshua Hill, Bates \& Hill Fabricators' production manager, has just completed the company's production budget and direct labor budget for the first quarter (see Exercises 5.11 and 5.17). He has identified the following monthly expenses that will be needed to support the company's manufacturing process. The company applies manufacturing overhead based on direct labor hours, and the current predetermined rates are $12.25 per direct labor hour for fixed manufacturing overhead and $1.75 per direct labor hour for variable manufacturing overhead. Required Prepare Bates \& Hill's manufacturing overhead budget for the first quarter. 5.20 (LO 3) Preparing an ending inventory budget Joshua Hill, Bates \& Hill Fabricators' production manager, has just completed the company's production budget (see Exercise 5.11) and manufacturing overhead budget (see Exercise 5.19) for the first quarter. He also has received the direct materials purchases budget (see Exercise 5.15) and direct labor budget (see Exercise 5.17). 5.15 (LO 3) Preparing a direct materials purchases budget Marcy Jones, Bates \& Hill Fabricators' purchasing manager, has just received the company's production budget for the first quarter (see Exercise 5.11). Each brick requires 6 pounds of clay, and Marcy expects to pay $1.50 per pound of clay in the coming year. Company policy requires an ending direct materials inventory each month that will meet 10% of the following month's production needs. Marcy expects to have 15,000 pounds of clay at a cost of $22,500 in inventory at the beginning of the year. 5.17 (LO 3) Preparing a direct labor budget Joshua Hill, Bates \& Hill Fabricators' production manager, has just completed the company's production budget for the first quarter (see Exercise 5.11). Each brick requires 12 minutes to produce, and Joshua expects to pay workers $18 per direct labor hour in the coming year. 5.11 (LO 3) Preparing a production budget Joshua Hill, Bates \& Hill Fabricators' production manager, has just received the company's sales budget for the first quarter (see Exercise 5.8). Company policy requires an ending finished goods inventory each month that will meet 20% of the following month's sales volume. Joshua plans to have 3,200 finished bricks at a cost of $49,280 in inventory at the beginning of the year. 5.8 (LO 3) Preparing a sales budget Bates \& Hill Fabricators produces commemorative bricks that organizations use for fundraising projects. Aaron Bates, the company's vice president of marketing, has prepared the following sales forecast for the first six months of the coming year. The company plans to sell the bricks for $21 each. Required Prepare Bates \& Hill's sales budget for the first quarter of the coming year. 5.9 (LO 3) Preparing a selling and administrative expense budget Bates \& Hill Fabricators' marketing department has identified the following monthly expenses that will be needed to support the company's sales and administrative functions (see Exercise 5.8). In addition to these monthly expenses, the company will pay a commission to its salespeople equal to 8% of the sales revenue from each brick sold. The company expects bad debt expense to be 2% of sales revenue. Required Prepare Bates \& Hill's selling and administrative expense budget for the first quarter of the coming year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts