Question: My question is for question II). How did they get 2 different IRRs? Thank you (Fall 2012, Q.2) Consider a project with these cash flows:

My question is for question II). How did they get 2 different IRRs? Thank you

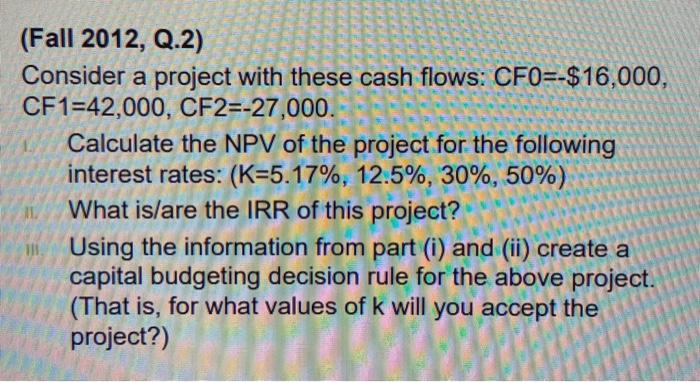

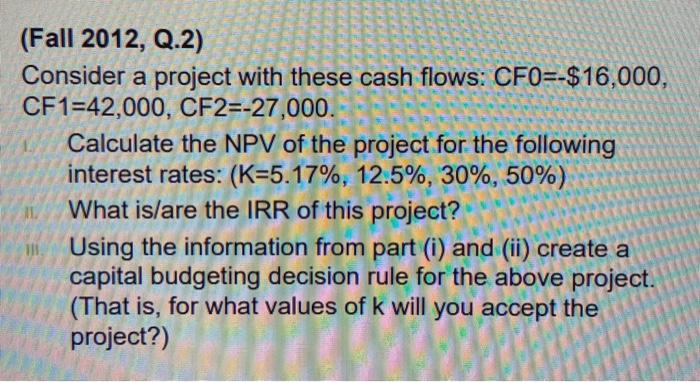

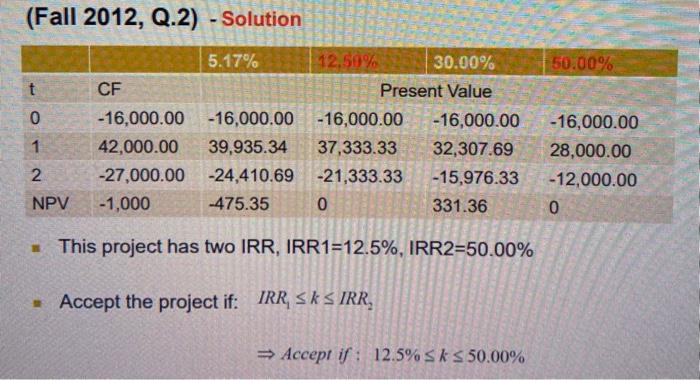

(Fall 2012, Q.2) Consider a project with these cash flows: CF0=$16,000, CF1=42,000,CF2=27,000. Calculate the NPV of the project for the following interest rates: (K=5.17%,12.5%,30%,50%) What is/are the IRR of this project? Using the information from part (i) and (ii) create a capital budgeting decision rule for the above project. (That is, for what values of k will you accept the project?) (Fall 2012, Q.2) - Solution - This project has two IRR, IRR1=12.5\%, IRR2 =50.00% - Accept the project if: IRR1kIRR2 Accept if : 12.5%k50.00%

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock