Question: My question is specifically as it refers to Part B. Can you please explain how the losses of the mezzanine tranche of the MBS are

My question is specifically as it refers to Part B. Can you please explain how the losses of the mezzanine tranche of the MBS are calculated as (8/20) = 40%? I'm not sure where the 8 or the 20 come from and was hoping for some clarification.

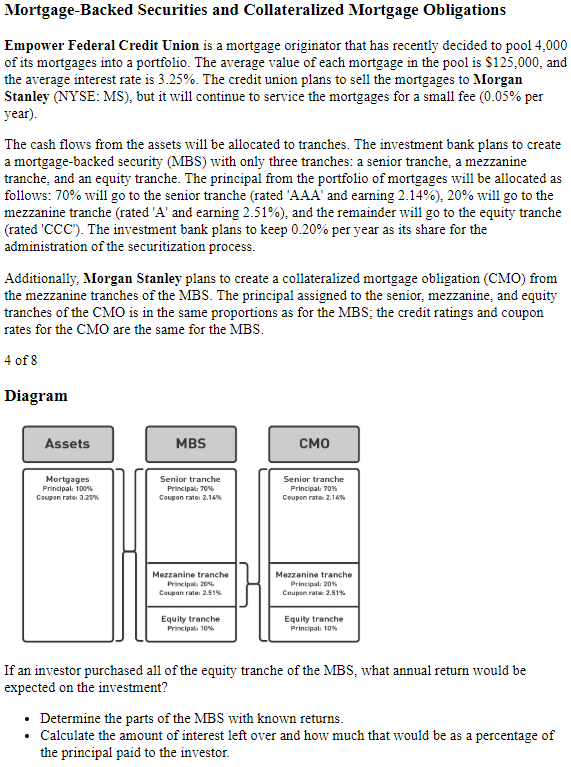

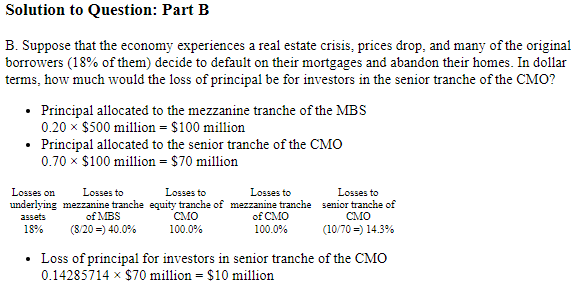

Mortgage-Backed Securities and Collateralized Mortgage Obligations Empower Federal Credit Union is a mortgage originator that has recently decided to pool 4,000 of its mortgages into a portfolio. The average value of each mortgage in the pool is S125,000, and the average interest rate is 3.25%. The credit union plans to sell the mortgages to Morgan Stanley (NYSE: MS), but it will continue to service the mortgages for a small fee (0.05% per year). The cash flows from the assets will be allocated to tranches. The investment bank plans to create a mortgage-backed security (MBS) with only three tranches: a senior tranche, a mezzanine tranche, and an equity tranche. The principal from the portfolio of mortgages will be allocated as follows: 70% will go to the senior tranche (rated 'A AA, and earning 2.14%), 20% will go to the mezzanine tranche (rated 'A' and earning 2.51%), and the remainder will go to the equity tranche (rated 'CCC'). The investment bank plans to keep 0.20% per year as its share for the administration of the securitization process. Additionally, Morgan Stanley plans to create a collateralized mortgage obligation (CMO) from the mezzanine tranches of the MBS. The principal assigned to the senior, mezzanine, and equity tranches of the CMO is in the same proportions as for the MBS, the credit ratings and coupon rates for the CMO are the same for the MBS 4 of 8 Diagram Assets MBS Senior tranche Principal: 70% Senior tranche Principal: 70% Principal: 100% Coupon rate: J .20 rate 2.14% Mezzanine tranche Prixipali 20% Coupon rate: 2.51% Mezzanine tranche Principali 20% Coupon ratk 2.51% Equity tranche Principalt 106 Equity tranche Principal, 10% If an investor purchased all of the equity tranche of the MBS, what annual return would be expected on the investment? .Determine the parts of the MBS with known returns . Calculate the amount of interest left over and how much that would be as a percentage of the principal paid to the investor Solution to Question: Part B B. Suppose that the economy experiences a real estate crisis, prices drop, and many of the original borrowers (18% of them) decide to default on their mortgages and abandon their homes. In dollar terms, how much would the loss of principal be for investors in the senior tranche of the CMO? . Principal allocated to the mezzanine tranche of the MBS 0.20 x $500 million $100 million Principal allocated to the senior tranche of the CMO 0.70 x $100 million . $70 million Losses on underlying assets 18% Losses to mezzanine tranche of CMO 100.0% Losses to senior tranche of (1070-) 14.3% Losses to Losses to mezzanine tranche equity tranche of of MBS CMO 100.0% (820 ) 40.0% Loss of principal for investors in senior tranche of the CMC 0.14285714 x $70 million $10 milion

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts