Question: my textbook doesn't help us too much. Need help finding at how to work this problem 6 84 F Mostly sunny Question 5 of 10

my textbook doesn't help us too much. Need help finding at how to work this problem

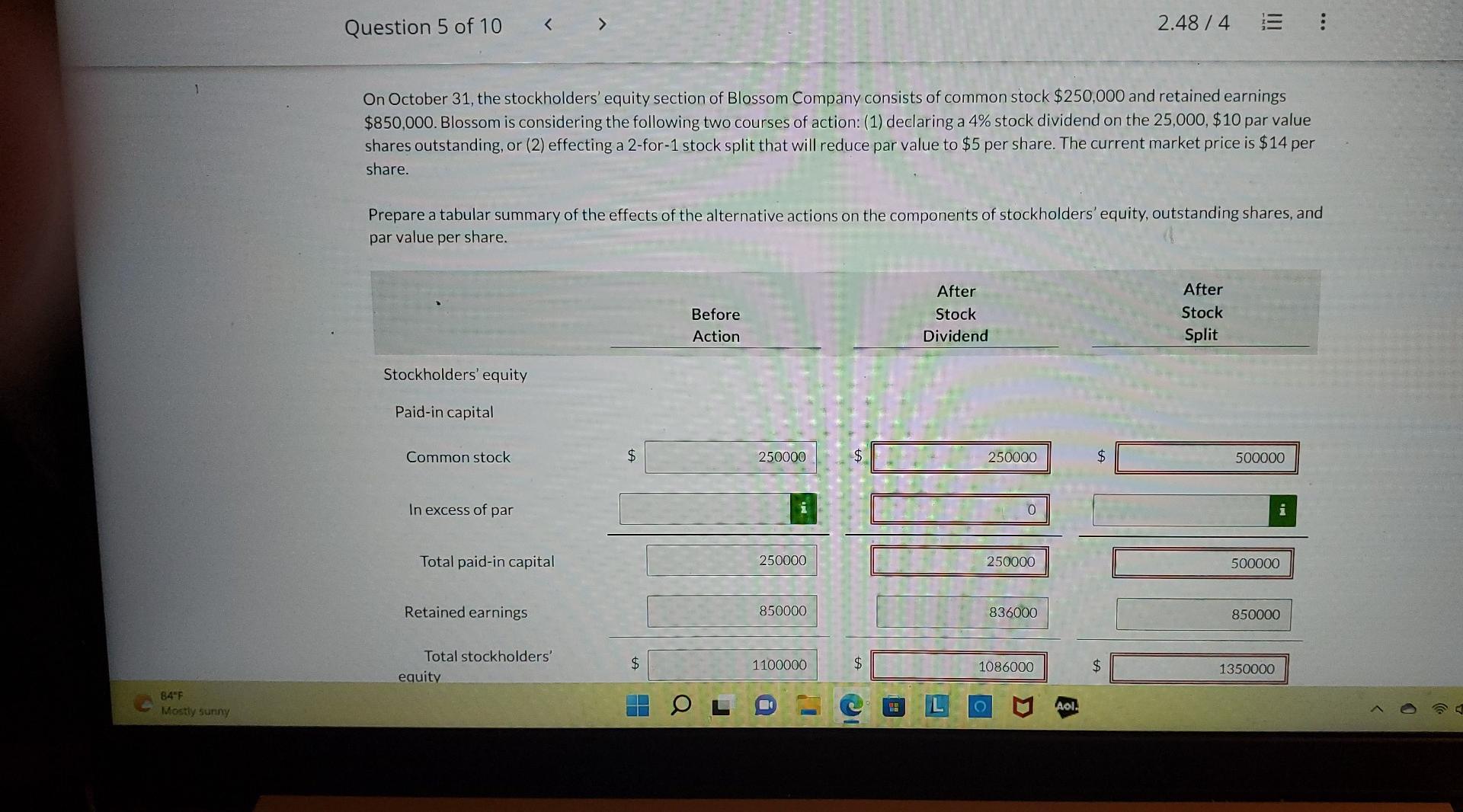

6 84 F Mostly sunny Question 5 of 10 2.48/4 On October 31, the stockholders' equity section of Blossom Company consists of common stock $250,000 and retained earnings $850,000. Blossom is considering the following two courses of action: (1) declaring a 4% stock dividend on the 25,000, $10 par value shares outstanding, or (2) effecting a 2-for-1 stock split that will reduce par value to $5 per share. The current market price is $14 per share. Prepare a tabular summary of the effects of the alternative actions on the components of stockholders' equity, outstanding shares, and par value per share. After After Stock Stock Before Action Dividend Split Stockholders' equity Paid-in capital Common stock In excess of par Total paid-in capital Retained earnings Total stockholders' equity $ $ Q 250000 250000 850000 1100000 1 $ $ 1.9 250000 O 250000 836000 1086000 Aol. $ $ 500000 500000 850000 1350000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts