Question: my UINs last two digits are 28 You will implement the Black-Derman-Toy (1990) interest rate model to value a callable bond and to derive risk

my UINs last two digits are 28

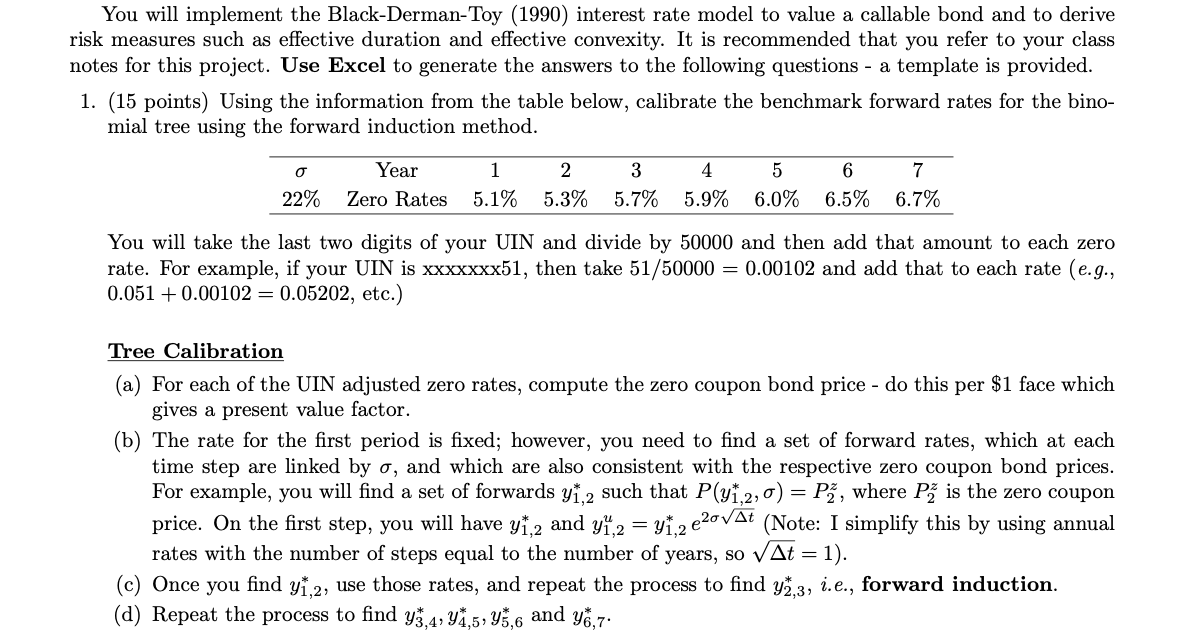

You will implement the Black-Derman-Toy (1990) interest rate model to value a callable bond and to derive risk measures such as effective duration and effective convexity. It is recommended that you refer to your class notes for this project. Use Excel to generate the answers to the following questions - a template is provided. 1. (15 points) Using the information from the table below, calibrate the benchmark forward rates for the bino- mial tree using the forward induction method. 22% Year Zero Rates 1 5.1% 2 5.3% 3 5.7% 4 5.9% 5 6.0% 6 6.5% 7 6.7% You will take the last two digits of your UIN and divide by 50000 and then add that amount to each zero rate. For example, if your UIN is xxxxxxx51, then take 51/50000 = 0.00102 and add that to each rate (e.g., 0.051 +0.00102 = 0.05202, etc.) Tree Calibration (a) For each of the UIN adjusted zero rates, compute the zero coupon bond price - do this per $1 face which gives a present value factor. (b) The rate for the first period is fixed; however, you need to find a set of forward rates, which at each time step are linked by o, and which are also consistent with the respective zero coupon bond prices. For example, you will find a set of forwards y 1.2 such that P(y12,0) = P2, where P is the zero coupon price. On the first step, you will have y12 and y12 = y1220vAt (Note: I simplify this by using annual rates with the number of steps equal to the number of years, so V At = 1). (c) Once you find y1,2, use those rates, and repeat the process to find y2,3, i.e., forward induction. (d) Repeat the process to find y3.4, 42.5, 15.6 and 46.7. You will implement the Black-Derman-Toy (1990) interest rate model to value a callable bond and to derive risk measures such as effective duration and effective convexity. It is recommended that you refer to your class notes for this project. Use Excel to generate the answers to the following questions - a template is provided. 1. (15 points) Using the information from the table below, calibrate the benchmark forward rates for the bino- mial tree using the forward induction method. 22% Year Zero Rates 1 5.1% 2 5.3% 3 5.7% 4 5.9% 5 6.0% 6 6.5% 7 6.7% You will take the last two digits of your UIN and divide by 50000 and then add that amount to each zero rate. For example, if your UIN is xxxxxxx51, then take 51/50000 = 0.00102 and add that to each rate (e.g., 0.051 +0.00102 = 0.05202, etc.) Tree Calibration (a) For each of the UIN adjusted zero rates, compute the zero coupon bond price - do this per $1 face which gives a present value factor. (b) The rate for the first period is fixed; however, you need to find a set of forward rates, which at each time step are linked by o, and which are also consistent with the respective zero coupon bond prices. For example, you will find a set of forwards y 1.2 such that P(y12,0) = P2, where P is the zero coupon price. On the first step, you will have y12 and y12 = y1220vAt (Note: I simplify this by using annual rates with the number of steps equal to the number of years, so V At = 1). (c) Once you find y1,2, use those rates, and repeat the process to find y2,3, i.e., forward induction. (d) Repeat the process to find y3.4, 42.5, 15.6 and 46.7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts