Question: My Work: max capacity: $ 787,234.04 Sales $ 740,000.00 $ 860,000.00 Assets $ 450,000.00 $ 450,405.00 New Sales Operating Capacity: 109% % New Assets Required:

My Work:

| max capacity: | $ 787,234.04 | |

| Sales | $ 740,000.00 | $ 860,000.00 |

| Assets | $ 450,000.00 | $ 450,405.00 |

| New Sales Operating Capacity: | 109% | |

| % New Assets Required: | 0.09% | |

| $ New Assets Required: | $ 405.00 | |

I don't understand why my work and answer are wrong. Please explain.

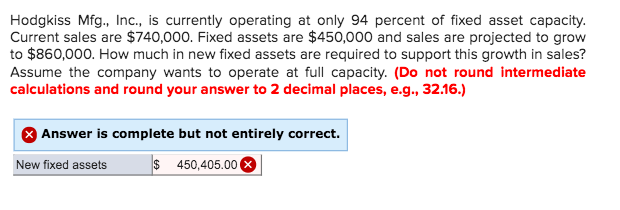

Hodgkiss Mfg., Inc., is currently operating at only 94 percent of fixed asset capacity. Current sales are $740,000. Fixed assets are $450,000 and sales are projected to grow to $860,000. How much in new fixed assets are required to support this growth in sales? Assume the company wants to operate at full capacity. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) & Answer is complete but not entirely correct. New fixed assets $ 450,405.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts