Question: my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to

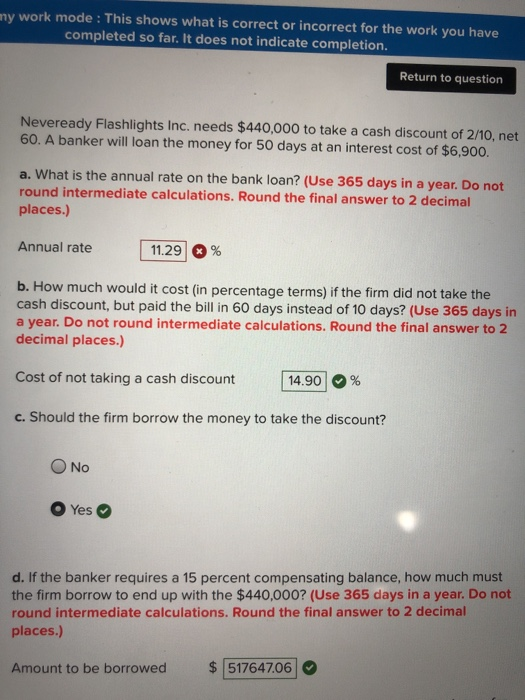

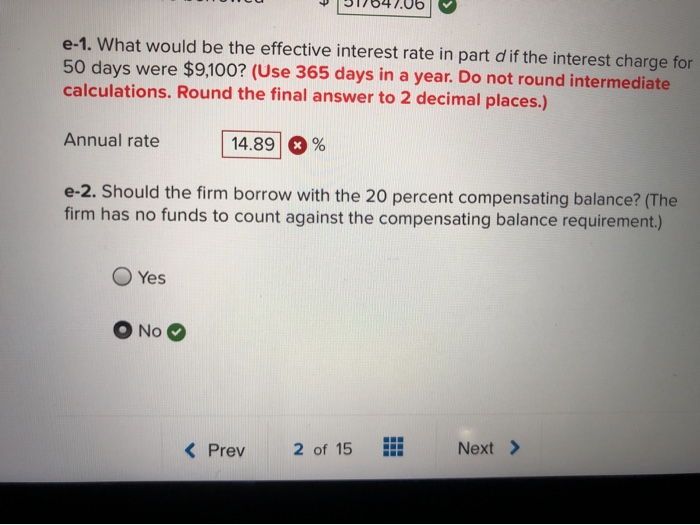

my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to question Neveready Flashlights Inc. needs $440,000 to take a cash discount of 2/10, net 60. A banker will loan the money for 50 days at an interest cost of $6,900. a. What is the annual rate on the bank loan? (Use 365 days in a year. Do not round intermediate calculations. Round the final answer to 2 decimal places.) Annual rate 11.29 % b. How much would it cost (in percentage terms) if the firm did not take the cash discount, but paid the bill in 60 days instead of 10 days? (Use 365 days in a year. Do not round intermediate calculations. Round the final answer to 2 decimal places.) Cost of not taking a cash discount 14.90 % c. Should the firm borrow the money to take the discount? O No Yes d. If the banker requires a 15 percent compensating balance, how much must the firm borrow to end up with the $440,000? (Use 365 days in a year. Do not round intermediate calculations. Round the final answer to 2 decimal places.) Amount to be borrowed $ 517647.06

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts