Question: MyExcelsior - Exc X Chapter 6 Practic X M Question 6 - Cha X Search Results | C X Nova Web X G - Grammarly

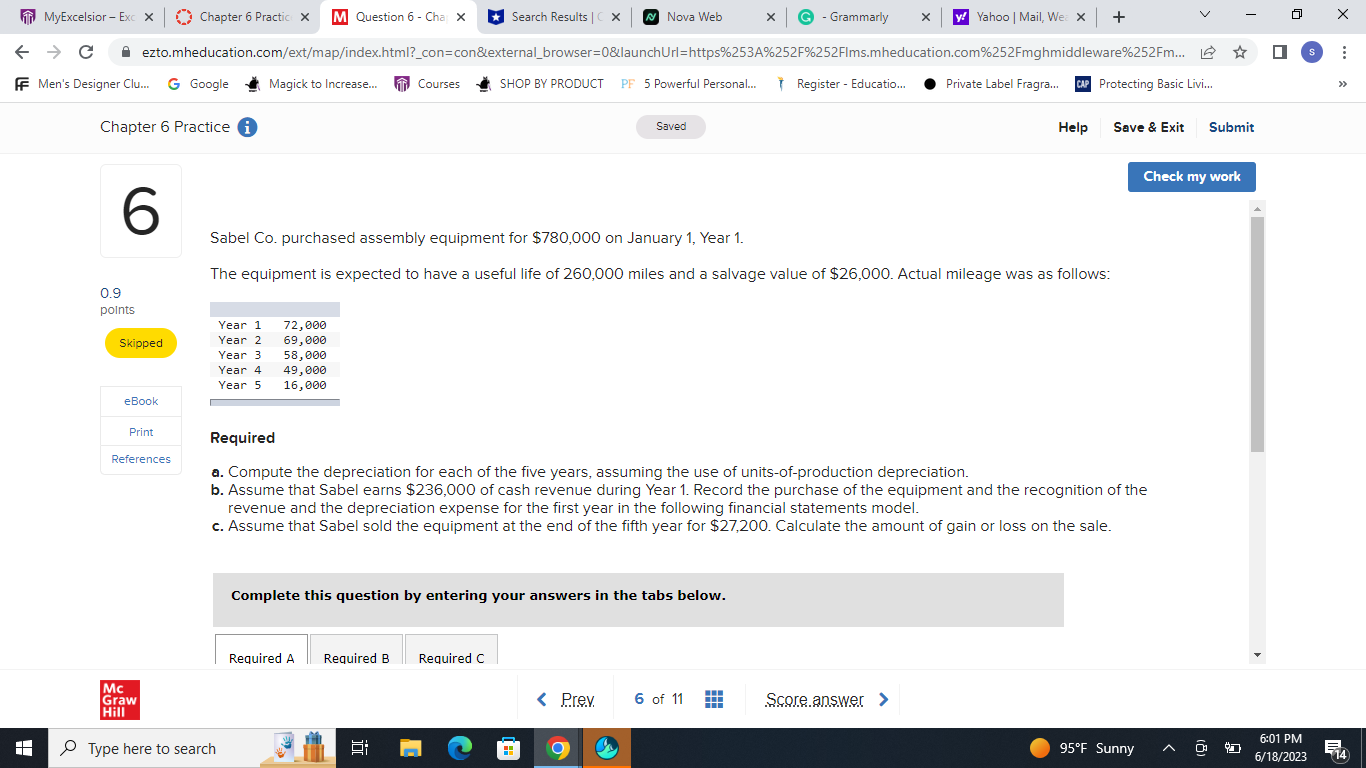

MyExcelsior - Exc X <_> Chapter 6 Practic X M Question 6 - Cha X Search Results | C X Nova Web X G - Grammarly X y! Yahoo | Mail, We: X + V X - C ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252FIms.mheducation.com%252Fmghmiddleware%252Fm... > > ... Men's Designer Clu... G Google Magick to Increase. T Courses SHOP BY PRODUCT PF 5 Powerful Personal.. Register - Education.. . Private Label Fragra,. CAP Protecting Basic Livi... Chapter 6 Practice i Saved Help Save & Exit Submit Check my work 6 Sabel Co. purchased assembly equipment for $780,000 on January 1, Year 1. The equipment is expected to have a useful life of 260,000 miles and a salvage value of $26,000. Actual mileage was as follows: 0.9 points Year 1 72,060 Skipped Year 2 69,000 Year 3 58, 000 Year 4 49, 000 Year 5 16, 000 eBook Print Required References a. Compute the depreciation for each of the five years, assuming the use of units-of-production depreciation. b. Assume that Sabel earns $236,000 of cash revenue during Year 1. Record the purchase of the equipment and the recognition of the revenue and the depreciation expense for the first year in the following financial statements model. c. Assume that Sabel sold the equipment at the end of the fifth year for $27,200. Calculate the amount of gain or loss on the sale. Complete this question by entering your answers in the tabs below. Required A Required B Required C Mc Graw Hill Type here to search O 6:01 PM 95 F Sunny 6/18/2023

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts