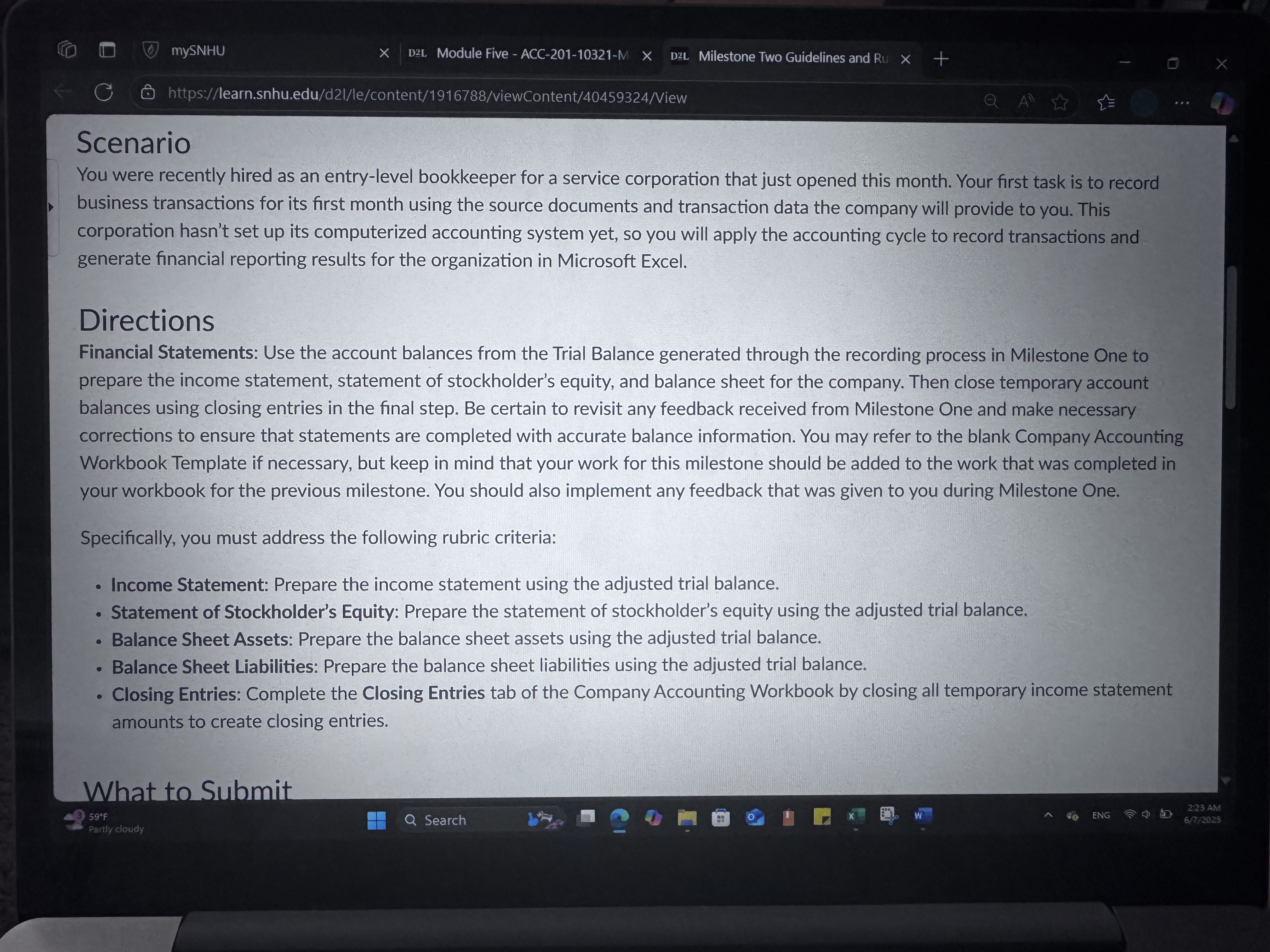

Question: mySNHU X D21 Module Five - ACC-201-10321-M X D2L Milestone Two Guidelines and Ru X + X G https://learn.snhu.edu/d21/le/content/1916788/viewContent/40459324/View . . . Scenario You were

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock