Question: myUCA X Question 7 - Chapter 8 Homewor X M Inbox - kcrabtree@cub.uca.edu - x * Course Hero X + V X C A ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=08launchUrl=https%253A%252F%252Fbblearn.uca.edu%252Fwebapps%252Fportal%252Ffra...

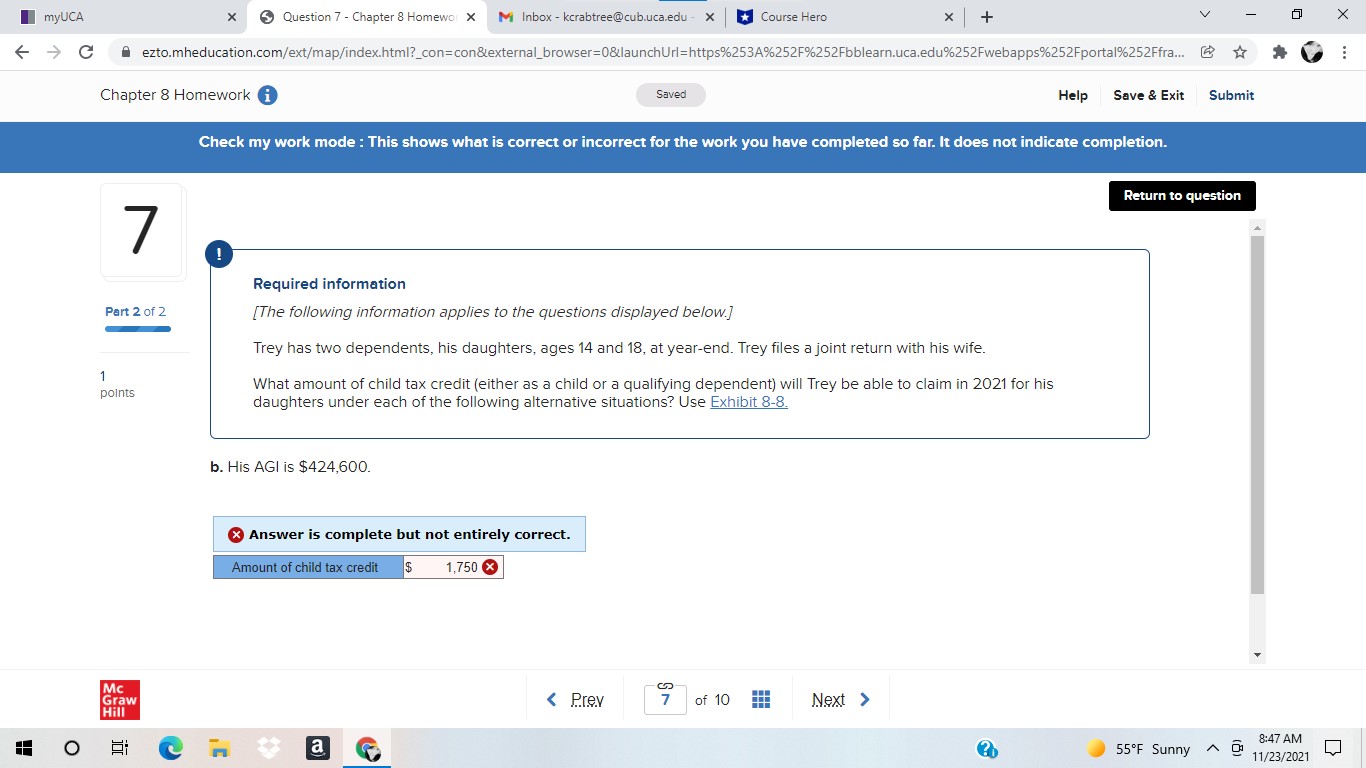

myUCA X Question 7 - Chapter 8 Homewor X M Inbox - kcrabtree@cub.uca.edu - x * Course Hero X + V X C A ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=08launchUrl=https%253A%252F%252Fbblearn.uca.edu%252Fwebapps%252Fportal%252Ffra... @ * Chapter 8 Homework Saved Help Save & Exit Submit Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to question 7 Required information Part 2 of 2 [The following information applies to the questions displayed below.] Trey has two dependents, his daughters, ages 14 and 18, at year-end. Trey files a joint return with his wife. 1 points What amount of child tax credit (either as a child or a qualifying dependent) will Trey be able to claim in 2021 for his daughters under each of the following alternative situations? Use Exhibit 8-8. b. His AGI is $424,600. * Answer is complete but not entirely correct. Amount of child tax credit $ 1,750 x Mc Graw of 10 Hill O a 55 F Sunny ~ D 8:47 AM 11/23/2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts