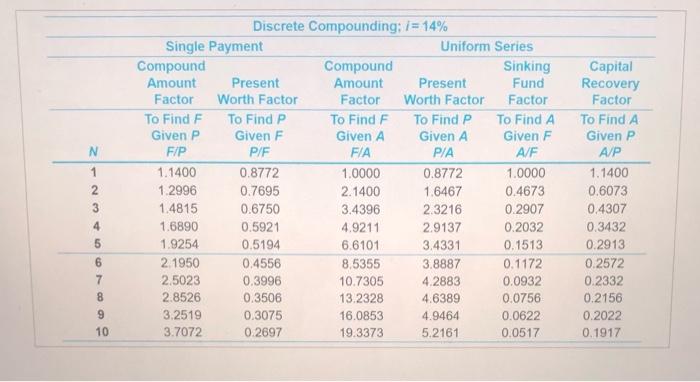

Question: N 1 2 3 4 5 6 Discrete Compounding; i = 14% Single Payment Uniform Series Compound Compound Sinking Amount Present Amount Present Fund Factor

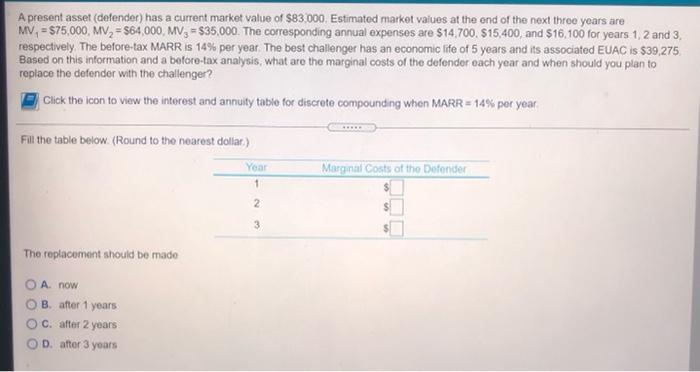

N 1 2 3 4 5 6 Discrete Compounding; i = 14% Single Payment Uniform Series Compound Compound Sinking Amount Present Amount Present Fund Factor Worth Factor Factor Worth Factor Factor To Find F To Find P To Find F To Find P To Find A Given P Given F Given A Given A Given F F/P P/F FIA PIA A/F 1.1400 0.8772 1.0000 0.8772 1.0000 1.2996 0.7695 2.1400 1.6467 0.4673 1.4815 0.6750 3.4396 2.3216 0.2907 1.6890 0.5921 4.9211 2.9137 0.2032 1.9254 0.5194 6.6101 3.4331 0.1513 2. 1950 0.4556 8,5355 3.8887 0.1172 2.5023 0.3996 10.7305 4.2883 0.0932 2.8526 0.3506 13.2328 4.6389 0.0756 3.2519 0.3075 16.0853 4.9464 0.0622 3.7072 0.2697 19.3373 5.2161 0.0517 Capital Recovery Factor To Find A Given P A/P 1.1400 0.6073 0.4307 0.3432 0.2913 0.2572 0.2332 0.2156 0.2022 0.1917 7 8 9 10 A present asset (defender) has a current market value of $83.000. Estimated market values at the end of the next three years are MV, = $75,000, MV2 = $64.000, MV, = $35,000. The corresponding annual expenses are $14.700, $15,400, and $16,100 for years 1, 2 and 3, respectively. The before-tax MARR IS 14% per year. The best challenger has an economic life of 5 years and its associated EUAC is $39,275 Based on this information and a before-tax analysis, what are the marginal costs of the defender each year and when should you plan to replace the defender with the challenger? Click the icon to view the interest and annuity table for discrete compounding when MARR = 14% per year Fill the table below. (Round to the nearest dollar) Year 1 Marginal Costs of the Defender 2 3 The replacement should be made A now OB. after 1 years C. after 2 years OD. after 3 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts