Question: n 1 (200 points) : Prepare journal entries to record the December transactions in the General Journal Tab in the excel template file Accounting Cycle

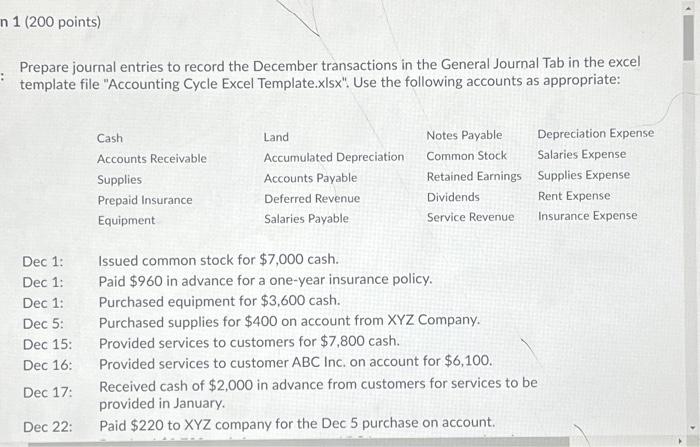

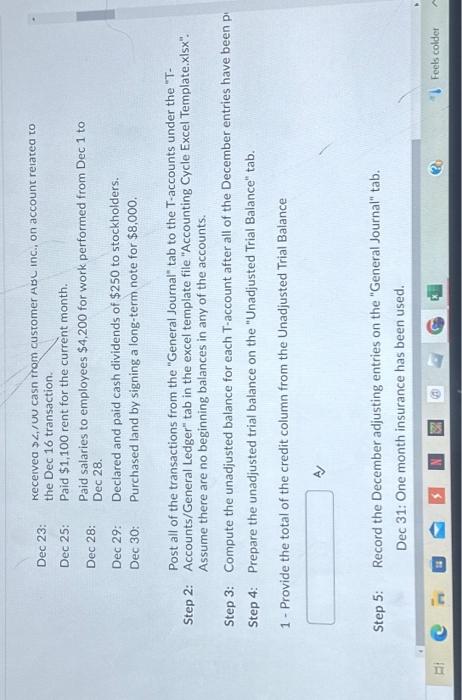

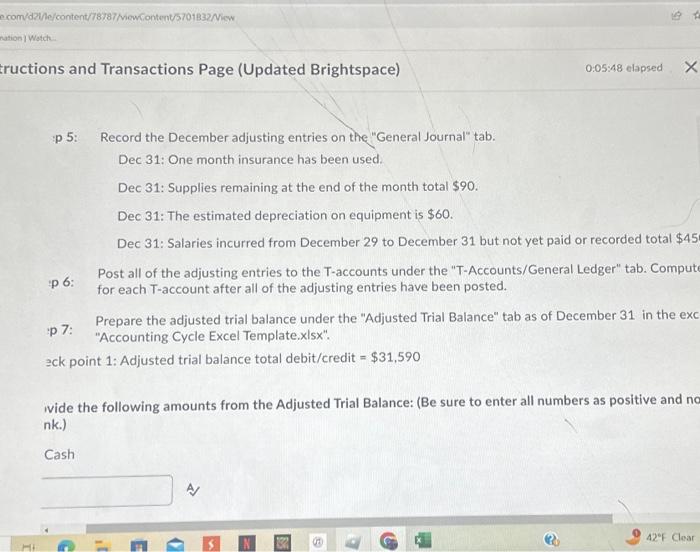

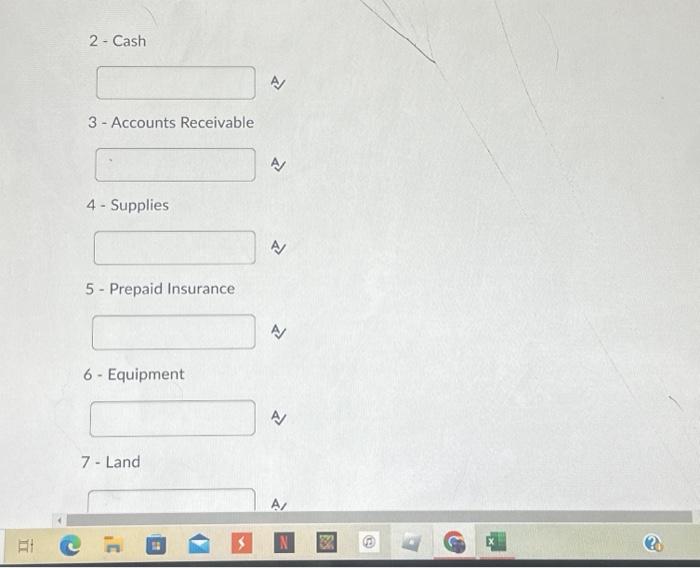

Prepare journal entries to record the December transactions in the General Journal Tab in the excel template file "Accounting Cycle Excel Template.xlsx": Use the following accounts as appropriate: Dec 1: Issued common stock for $7,000 cash. Dec 1: Paid $960 in advance for a one-year insurance policy. Dec 1: Purchased equipment for $3,600 cash. Dec 5: Purchased supplies for $400 on account from XYZ Company. Dec 15: Provided services to customers for $7,800 cash. Dec 16: Provided services to customer ABC Inc. on account for $6,100. Dec 17: Received cash of $2,000 in advance from customers for services to be provided in January. Dec 22: Paid $220 to XYZ company for the Dec 5 purchase on account. Dec 23: Kecervea $, /UU casn from customer ABL inc., on account relatea to the Dec 16 transaction. Dec 25: Paid $1,100 rent for the current month. Dec 28: Paid salaries to employees $4,200 for work performed from Dec 1 to Dec 28. Dec 29: Declared and paid cash dividends of $250 to stockholders. Dec 30: Purchased land by signing a long-term note for $8,000. Post all of the transactions from the "General Journal" tab to the T-accounts under the "T- Step 2: Accounts/General Ledger" tab in the excel template file "Accounting Cycle Excel Template.x/sx". Assume there are no beginning balances in any of the accounts. Step 3: Compute the unadjusted balance for each T-account after all of the December entries have been p: Step 4: Prepare the unadjusted trial balance on the "Unadjusted Trial Balance" tab. 1 - Provide the total of the credit column from the Unadjusted Trial Balance A Step 5: Record the December adjusting entries on the "General Journal" tab. Dec 31: One month insurance has been used. Ictions and Transactions Page (Updated Brightspace) 0:05:48 elapsed p 5: Record the December adjusting entries on the "General Journal" tab. Dec 31: One month insurance has been used. Dec 31: Supplies remaining at the end of the month total $90. Dec 31: The estimated depreciation on equipment is $60. Dec 31: Salaries incurred from December 29 to December 31 but not yet paid or recorded total $45 p: Post all of the adjusting entries to the T-accounts under the "T-Accounts/General Ledger" tab. Comput for each T-account after all of the adjusting entries have been posted. p 7: Prepare the adjusted trial balance under the "Adjusted Trial Balance" tab as of December 31 in the ex 7: "Accounting Cycle Excel Template.xIsx". zck point 1: Adjusted trial balance total debit/credit =$31,590 ivide the following amounts from the Adjusted Trial Balance: (Be sure to enter all numbers as positive and nk.) Cash 3-Accounts Receivable 4 - Supplies 5 - Prepaid Insurance 6 - Equipment 7 - Land

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts