Question: n 1 ing: 1 : 0 1 : 1 6 Question 5 of 3 8 . Which of the following actions would be likely to

n

ing: ::

Question of

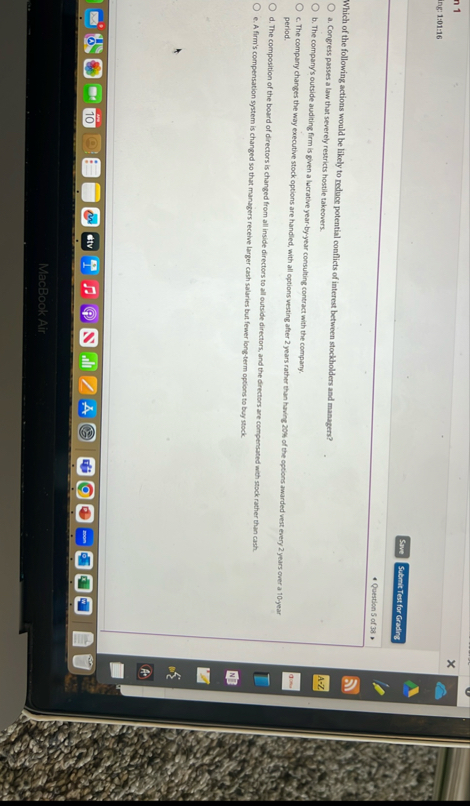

Which of the following actions would be likely to reduce potential conflicts of interest between stockholders and managers?

a Congress passes a law that severely restricts hostile takeovers.

b The company's outside auditing firm is given a lucrative yearbyyear consulting contract with the company.

c The company changes the way executive stock options are handled, with all options vesting after years rather than having of the optons awarded vest every years over a year period.

d The composition of the board of directors is changed from all inside directors to all outside directors, and the directors are compensabed weh sock rather than cash

e A firm's compensation system is changed so that managers recelve larger cash salaries buf fewer long,term options to buy stock

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock