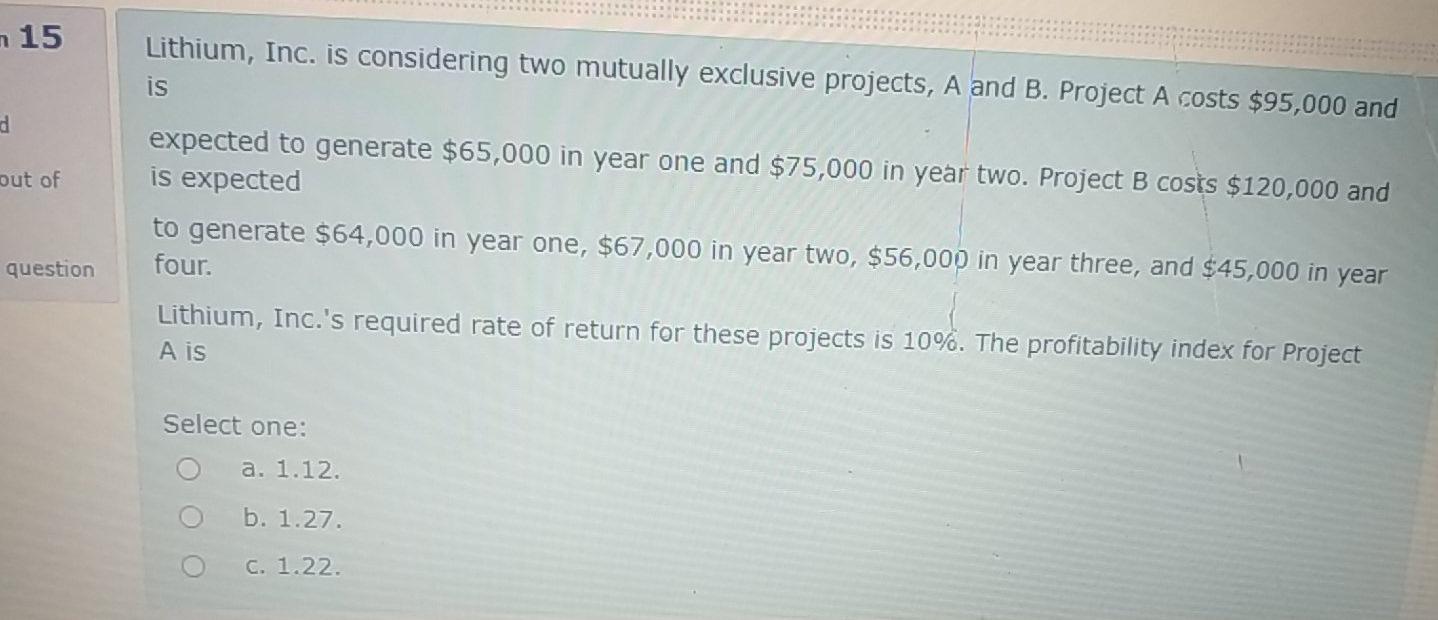

Question: n 15 Lithium, Inc. is considering two mutually exclusive projects, A and B. Project A costs $95,000 and is d out of expected to generate

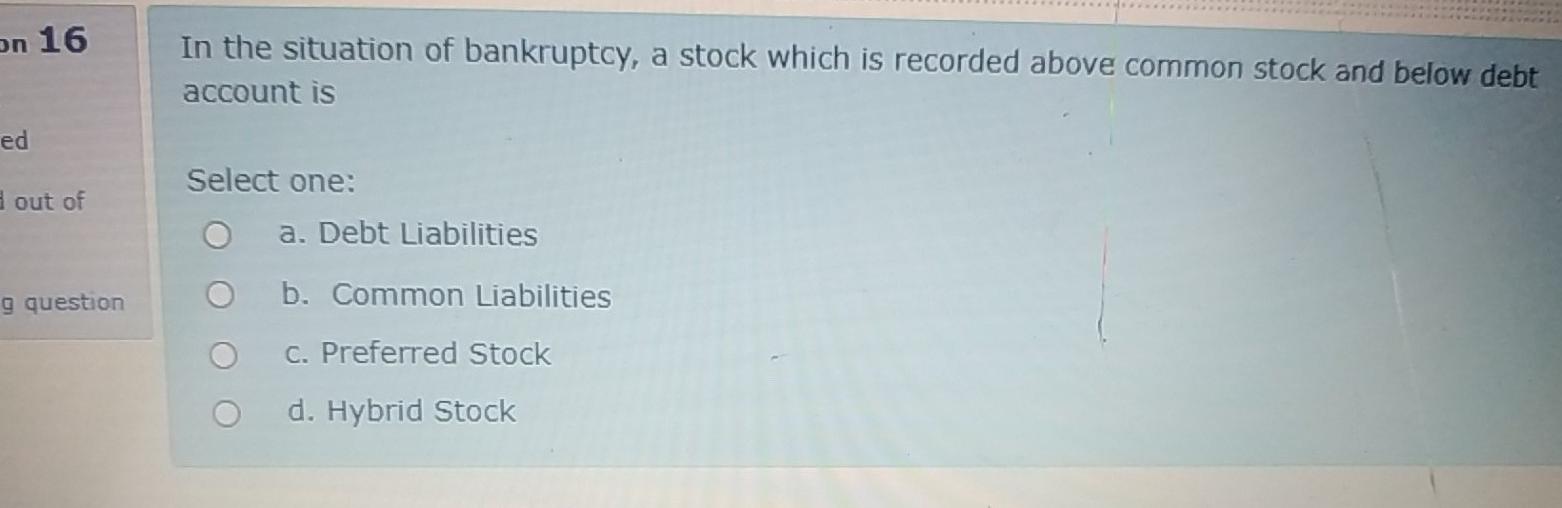

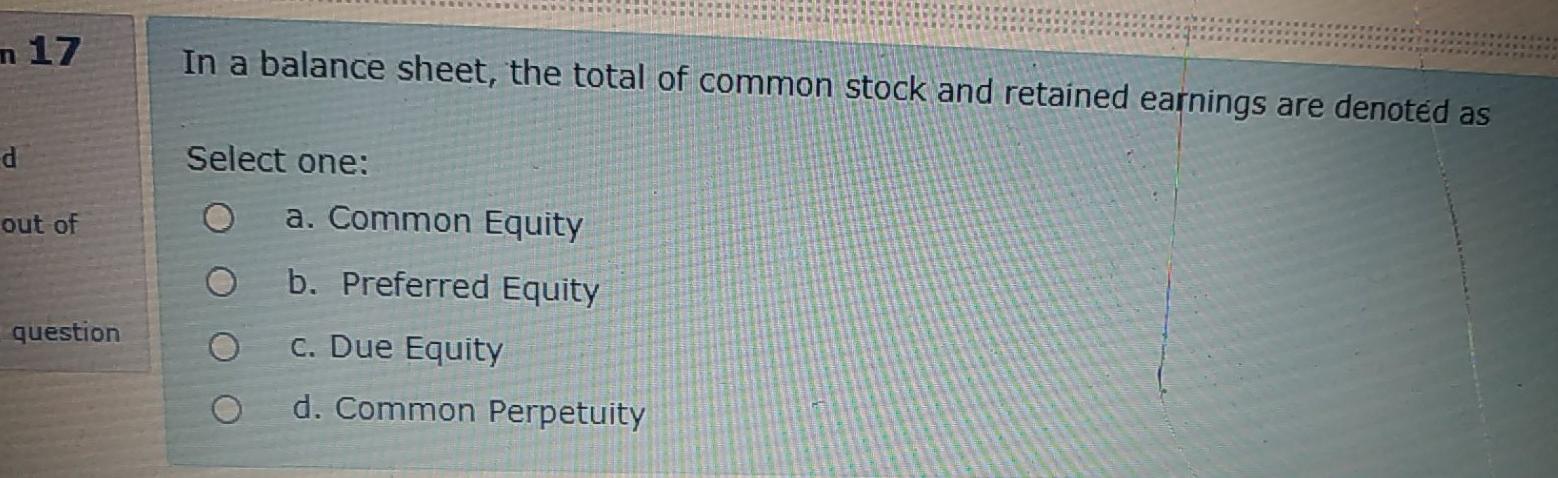

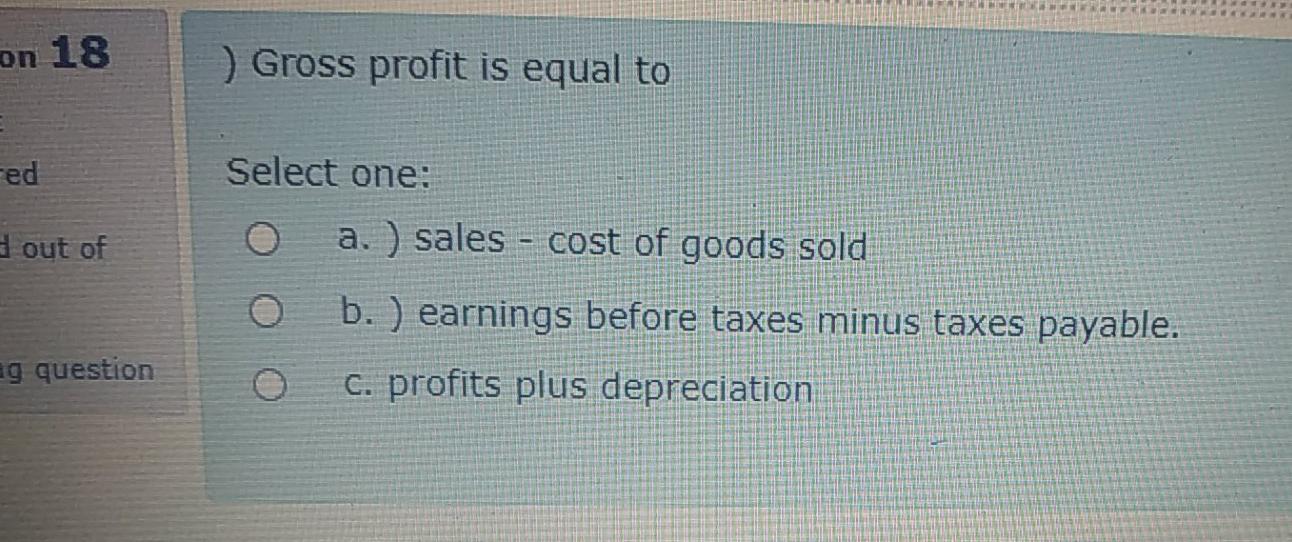

n 15 Lithium, Inc. is considering two mutually exclusive projects, A and B. Project A costs $95,000 and is d out of expected to generate $65,000 in year one and $75,000 in year two. Project B costs $120,000 and is expected to generate $64,000 in year one, $67,000 in year two, $56,000 in year three, and $45,000 in year four. Lithium, Inc.'s required rate of return for these projects is 10%. The profitability index for Project A is question Select one: a. 1.12. b. 1.27. C. 1.22. On 16 In the situation of bankruptcy, a stock which is recorded above common stock and below debt account is ed out of Select one: a. Debt Liabilities g question b. Common Liabilities C. Preferred Stock d. Hybrid Stock n 17 In a balance sheet, the total of common stock and retained earnings are denoted as d Select one: O a. Common Equity out of question O b. Preferred Equity C. Due Equity d. Common Perpetuity EN on 18 ) Gross profit is equal to red Select one: a. ) sales - cost of goods sold out of O b. ) earnings before taxes minus taxes payable. ag question C. profits plus depreciation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts