Question: N (2) 1/Y (1) PV (1) Question 5 (20 points) Question 5 options: Hulk Laboratories had someone smash up their lab and decides to issue

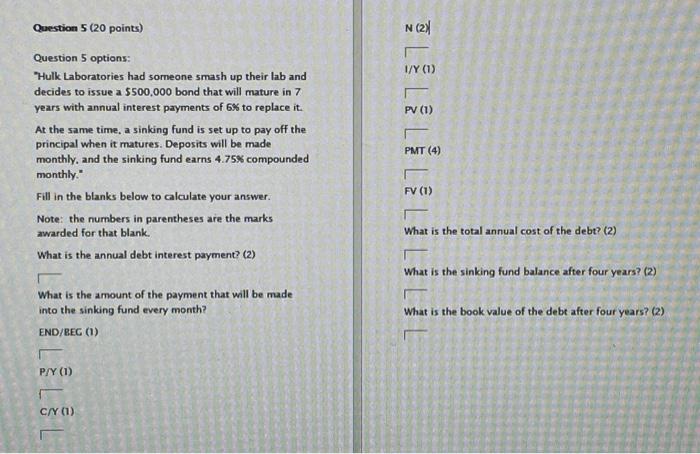

N (2) 1/Y (1) PV (1) Question 5 (20 points) Question 5 options: "Hulk Laboratories had someone smash up their lab and decides to issue a $500,000 bond that will mature in 7 years with annual interest payments of 6% to replace it. At the same time, a sinking fund is set up to pay off the principal when it matures. Deposits will be made monthly, and the sinking fund earns 4.75% compounded monthly Fill in the blanks below to calculate your answer. Note: the numbers in parentheses are the marks awarded for that blank. What is the annual debt interest payment (2) PMT (4) FV (1) What is the total annual cost of the debt? (2) What is the sinking fund balance after four years? (2) What is the amount of the payment that will be made into the sinking fund every month? END/BEG (1) What is the book value of the debt after four years? (2) P/Y (1) C/Y (1) N (2) 1/Y (1) PV (1) Question 5 (20 points) Question 5 options: "Hulk Laboratories had someone smash up their lab and decides to issue a $500,000 bond that will mature in 7 years with annual interest payments of 6% to replace it. At the same time, a sinking fund is set up to pay off the principal when it matures. Deposits will be made monthly, and the sinking fund earns 4.75% compounded monthly Fill in the blanks below to calculate your answer. Note: the numbers in parentheses are the marks awarded for that blank. What is the annual debt interest payment (2) PMT (4) FV (1) What is the total annual cost of the debt? (2) What is the sinking fund balance after four years? (2) What is the amount of the payment that will be made into the sinking fund every month? END/BEG (1) What is the book value of the debt after four years? (2) P/Y (1) C/Y (1)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts