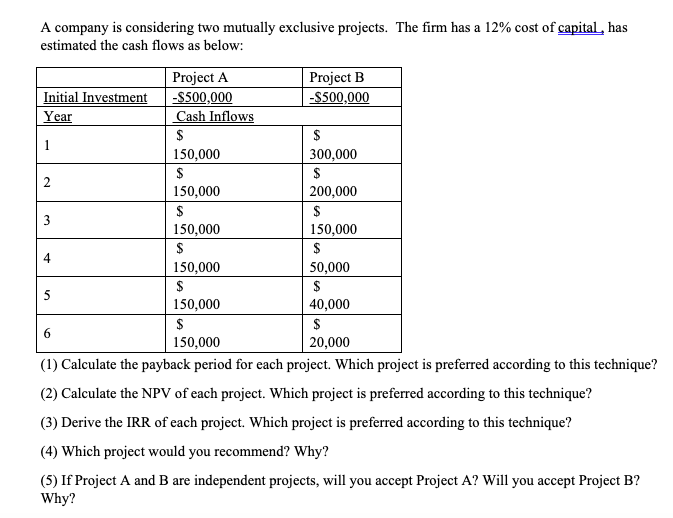

Question: N 3 A company is considering two mutually exclusive projects. The firm has a 12% cost of capital, has estimated the cash flows as below:

N 3 A company is considering two mutually exclusive projects. The firm has a 12% cost of capital, has estimated the cash flows as below: Project A Project B Initial Investment -$500,000 -$500,000 Year Cash Inflows $ $ 1 150,000 300,000 $ $ 150,000 200,000 $ $ 150,000 150,000 $ $ 150,000 50,000 $ 5 $ 150,000 40,000 $ $ 150,000 20,000 (1) Calculate the payback period for each project. Which project is preferred according to this technique? (2) Calculate the NPV of each project. Which project is preferred according to this technique? (3) Derive the IRR of each project. Which project is preferred according to this technique? (4) Which project would you recommend? Why? (5) If Project A and B are independent projects, will you accept Project A? Will you accept Project B? Why? 4 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts