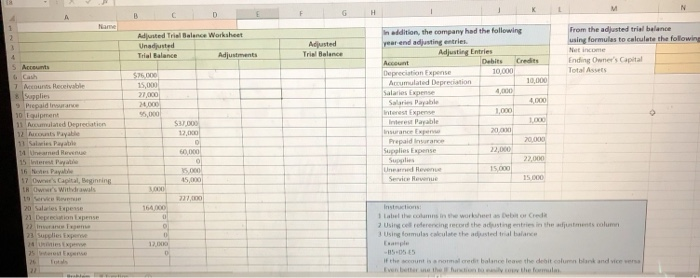

Question: N K c G B D Name 2 Adjusted Trial Balance Worksheet Unadjusted Trial Balance Adjustments Adjusted Trial Balance From the adjusted trial balance using

N K c G B D Name 2 Adjusted Trial Balance Worksheet Unadjusted Trial Balance Adjustments Adjusted Trial Balance From the adjusted trial balance using formulas to calculate the following Net income Ending Owner's Capital Total Assets 4 $76.000 In addition, the company had the following yearend adjusting entries. Adjusting Entries Account Debits Credits Depreciation Expense 10.000 Accumulated Depreciation 10,000 Salaries Expense Salaris Payable 4000 interest Expense 1,000 Interest Payable 1000 5 Acres 6 Cash 7 cu excelle Suppliers 9 Prepaidwar 10 timer 11 Neumulated Depreciation 12 counts Payable 11 Sales Patie 14 Uneamed one 15.000 27,000 20.000 55,00 $37.000 12.000 0 60.000 0 2000 22.000 20 Prepaid in Supplies Expense Supplies Une Revenue Service Revenue 15.000 45,000 15.000 16 Payable 17 Os Capital gaining IR OWwe's Withdrawals 19 20 Sales Expense Instruction 0 2 USi el referencing record the adjusting entries in the adjustments column 3 Using formulas calculate the adjusted trial balance 12. 75 West If the count is normal credit balance leave the debt column bank and vice versa 22

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts