Question: n mention question is here 9. (10 points) In order to construct an optimal portfolio which maximises a client's utility scores, discuss which risky asset,

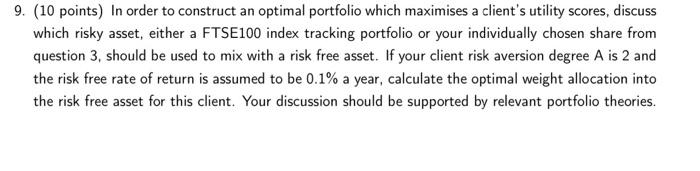

9. (10 points) In order to construct an optimal portfolio which maximises a client's utility scores, discuss which risky asset, either a FTSE100 index tracking portfolio or your individually chosen share from question 3, should be used to mix with a risk free asset. If your client risk aversion degree A is 2 and the risk free rate of return is assumed to be 0.1% a year, calculate the optimal weight allocation into the risk free asset for this client. Your discussion should be supported by relevant portfolio theories

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts