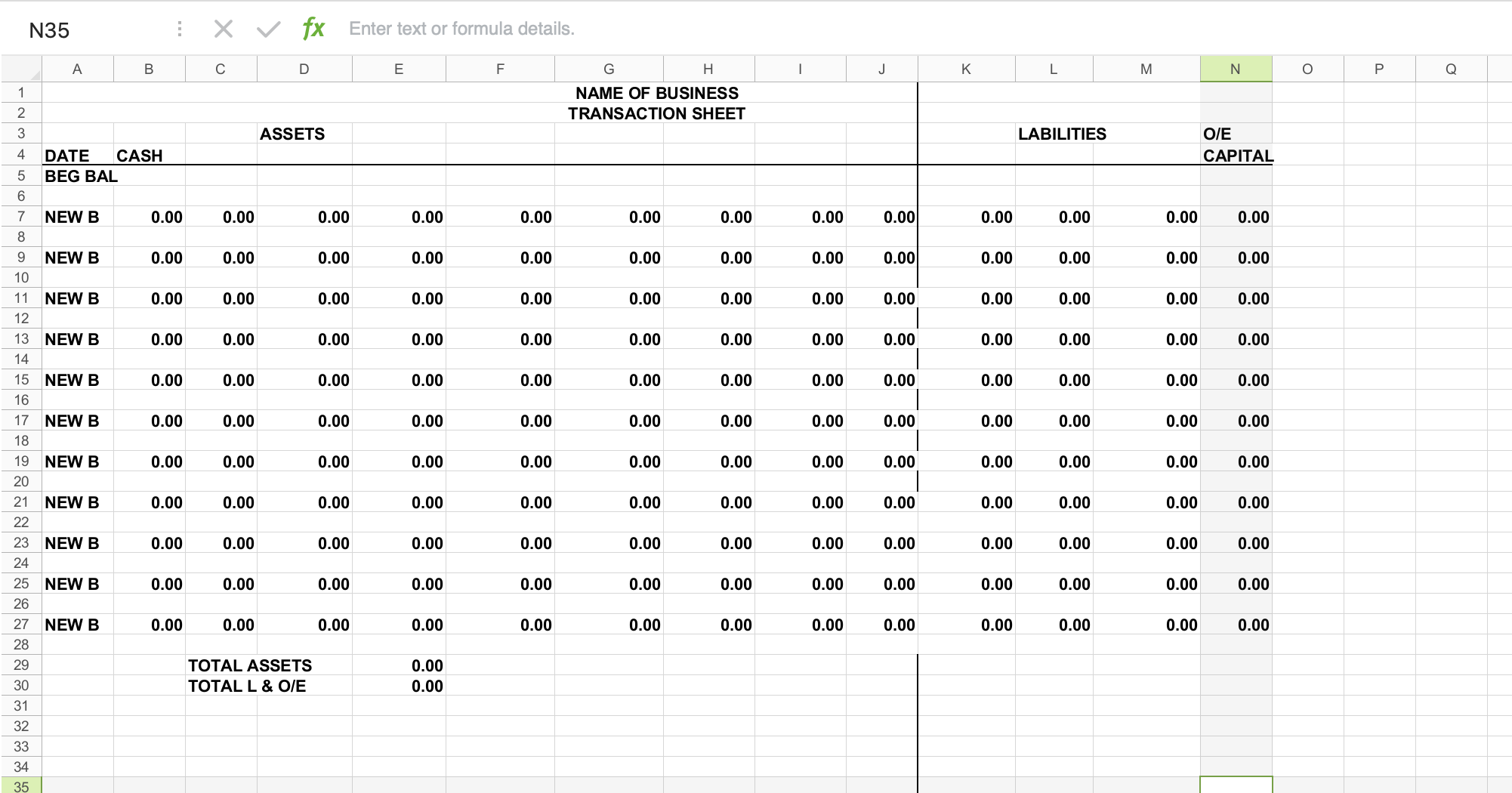

Question: N35 X V fx Enter text or formula details. A B C D E F G H I J K L M N NAME OF

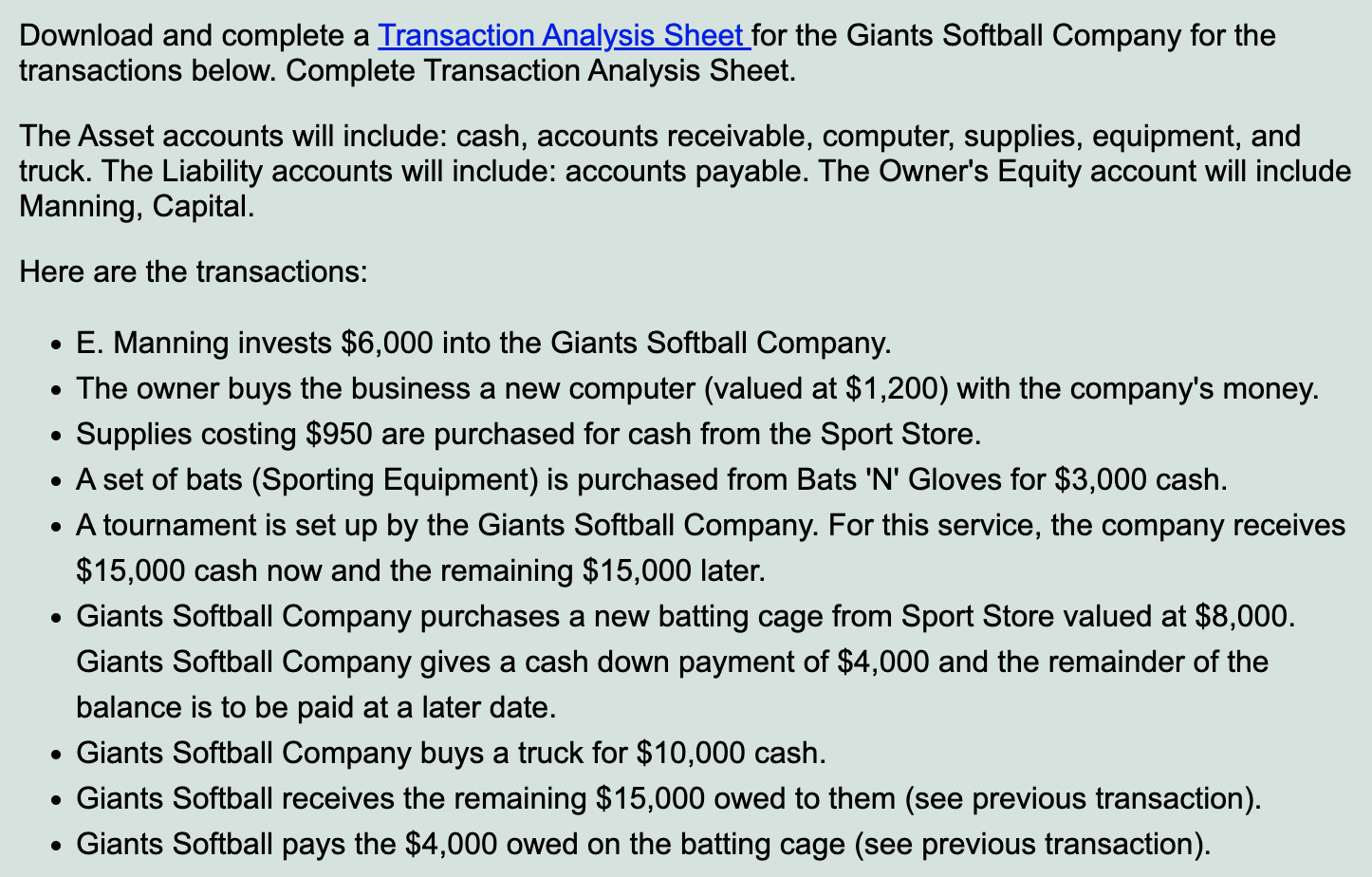

N35 X V fx Enter text or formula details. A B C D E F G H I J K L M N NAME OF BUSINESS O P Q W N - TRANSACTION SHEET ASSETS 4 DATE CASH LABILITIES O/E 5 BEG BAL CAPITAL 6 7 NEW B 0.00 0.00 0.00 0.00 8 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 9 NEW B 0.00 0.00 0.00 0.00 10 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 11 NEW B 0.00 0.00 0.00 0.00 12 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 13 NEW B 0.00 0.00 0.00 0.00 14 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 15 NEW B 0.00 0.00 0.00 0.00 16 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 17 NEW B 0.00 0.00 0.00 0.00 18 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 19 NEW B 0.00 0.00 0.00 20 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 21 NEW B 0.00 0.00 0.00 0.00 22 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 23 NEW B 0.00 0.00 0.00 24 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 25 NEW B 0.00 0.00 0.00 0.00 26 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 27 NEW B 0.00 0.00 0.00 0.00 28 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 29 TOTAL ASSETS 0.00 30 TOTAL L & O/E 31 0.00 32 33 34 35Download and complete a Transaction Analysis Sheet for the Giants Softball Company for the transactions below. Complete Transaction Analysis Sheet. The Asset accounts will include: cash, accounts receivable, computer, supplies, equipment, and truck. The Liability accounts will include: accounts payable. The Owner's Equity account will include Manning, Capital. Here are the transactions: . E. Manning invests $6,000 into the Giants Softball Company. . The owner buys the business a new computer (valued at $1,200) with the company's money. . Supplies costing $950 are purchased for cash from the Sport Store. . Aset of bats (Sporting Equipment) is purchased from Bats 'N' Gloves for $3,000 cash. . Atournament is set up by the Giants Softball Company. For this service, the company receives $15,000 cash now and the remaining $15,000 later. . Giants Softball Company purchases a new batting cage from Sport Store valued at $8,000. Giants Softball Company gives a cash down payment of $4,000 and the remainder of the balance is to be paid at a later date. . Giants Softball Company buys a truck for $10,000 cash. . Giants Softball receives the remaining $15,000 owed to them (see previous transaction). . Giants Softball pays the $4,000 owed on the batting cage (see previous transaction)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts