Question: Nabil is considering buying a house while he is at university. The house costs $250,000 today. Renting out part of the house and living in

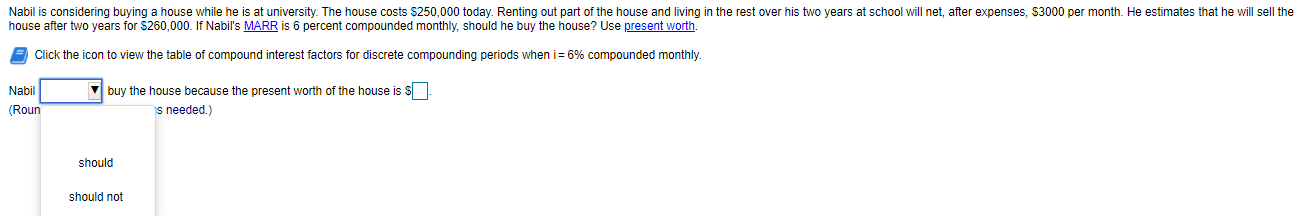

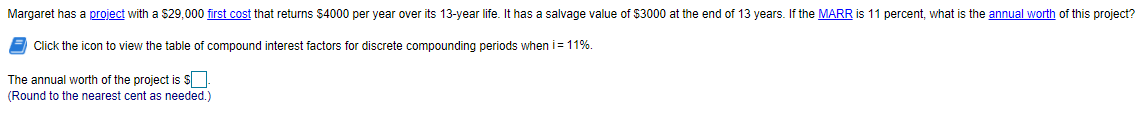

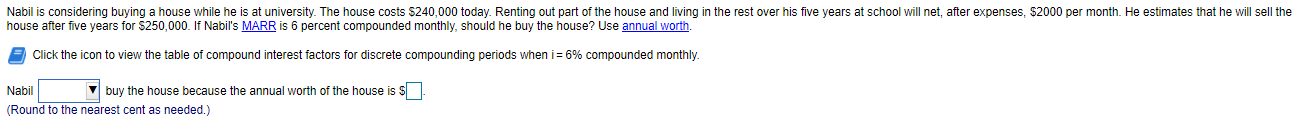

Nabil is considering buying a house while he is at university. The house costs $250,000 today. Renting out part of the house and living in the rest over his two years at school will net, after expenses, $3000 per month. He estimates that he will sell the house after two years for $260,000. If Nabil's MARR is 6 percent compounded monthly, should he buy the house? Use present worth. Click the icon to view the table of compound interest factors for discrete compounding periods when i = 6% compounded monthly Nabil (Roun buy the house because the present worth of the house is $ is needed.) should should not Margaret has a project with a $29,000 first cost that returns $4000 per year over its 13-year life. It has a salvage value of $3000 at the end of 13 years. If the MARR is 11 percent, what is the annual worth of this project? Click the icon to view the table of compound interest factors for discrete compounding periods when i= 11%. The annual worth of the project is so (Round to the nearest cent as needed.) Nabil is considering buying a house while he is at university. The house costs $240,000 today. Renting out part of the house and living in the rest over his five years at school will net, after expenses, $2000 per month. He estimates that he will sell the house after five years for $250,000. If Nabil's MARR is 6 percent compounded monthly, should he buy the house? Use annual worth. Click the icon to view the table of compound interest factors for discrete compounding periods when i=6% compounded monthly Nabil buy the house because the annual worth of the house is $ (Round to the nearest cent as needed.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts