Question: Nadia Inc., a large tech company, is considering making an offer to purchase Shaan Inc., a smaller network company. Both firms are all equity financed.

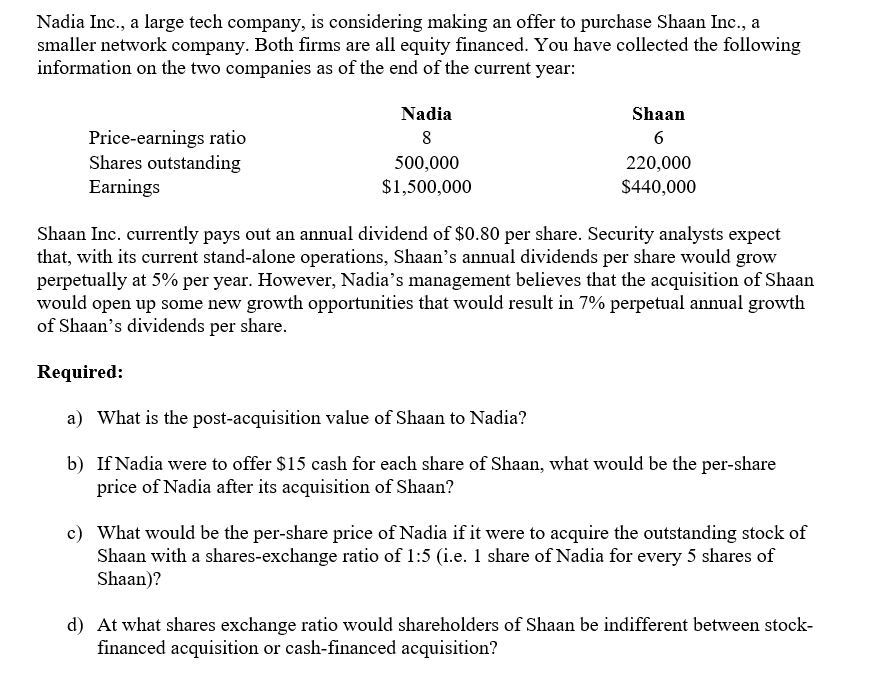

Nadia Inc., a large tech company, is considering making an offer to purchase Shaan Inc., a smaller network company. Both firms are all equity financed. You have collected the following information on the two companies as of the end of the current year: Price-earnings ratio Shares outstanding Earnings Nadia 8 500,000 $1,500,000 Shaan 6 220,000 $440,000 Shaan Inc. currently pays out an annual dividend of $0.80 per share. Security analysts expect that, with its current stand-alone operations, Shaan's annual dividends per share would grow perpetually at 5% per year. However, Nadia's management believes that the acquisition of Shaan would open up some new growth opportunities that would result in 7% perpetual annual growth of Shaans dividends per share. Required: a) What is the post-acquisition value of Shaan to Nadia? b) If Nadia were to offer $15 cash for each share of Shaan, what would be the per-share price of Nadia after its acquisition of Shaan? c) What would be the per-share price of Nadia if it were to acquire the outstanding stock of Shaan with a shares-exchange ratio of 1:5 (i.e. 1 share of Nadia for every 5 shares of Shaan)? d) At what shares exchange ratio would shareholders of Shaan be indifferent between stock- financed acquisition or cash-financed acquisition

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts