Question: NAME 4. ACC3302 Summer I 2021 - Final I. Multiple Choice Meyer & Smith is a full-service technology company. They provide equipment, installation services as

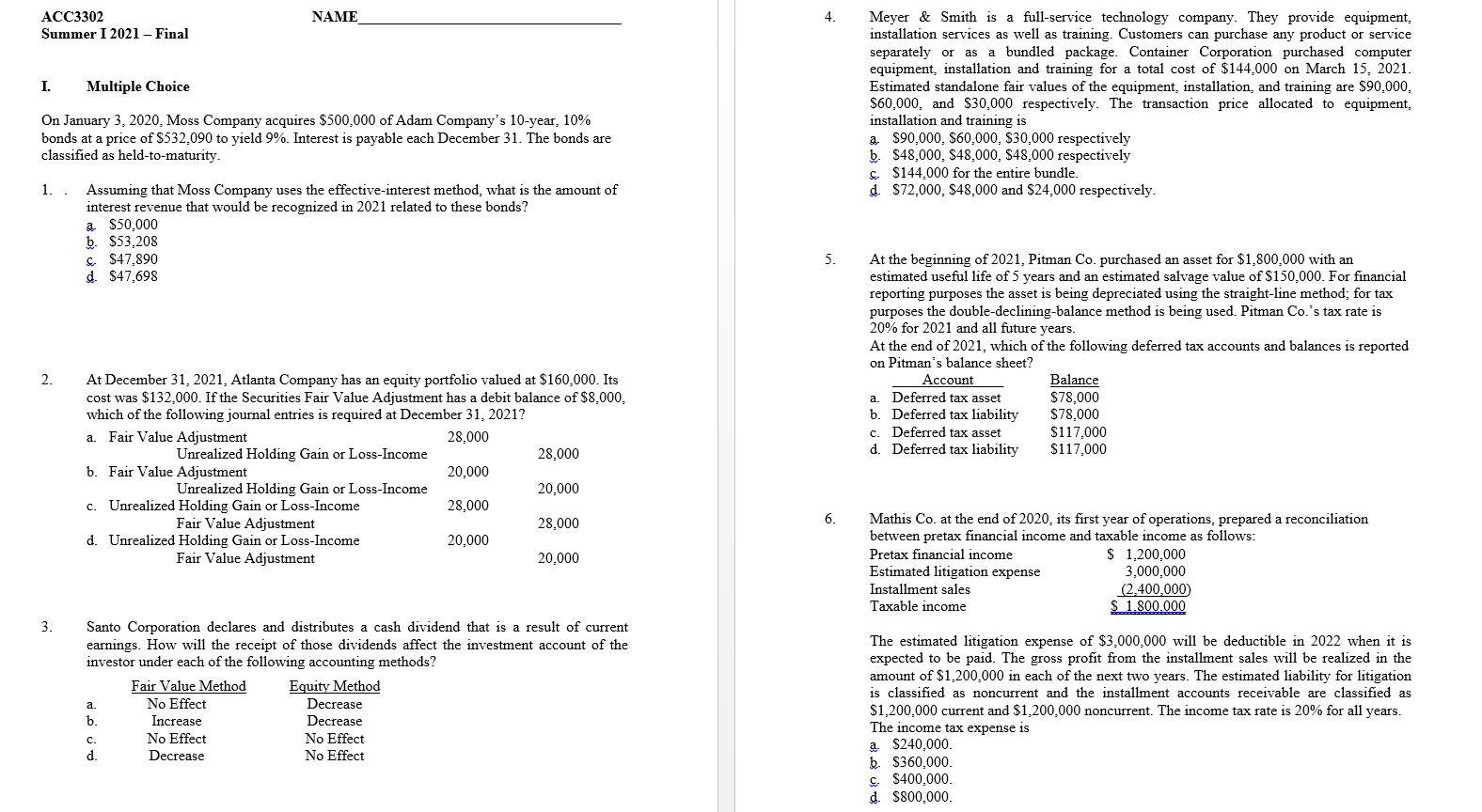

NAME 4. ACC3302 Summer I 2021 - Final I. Multiple Choice Meyer & Smith is a full-service technology company. They provide equipment, installation services as well as training. Customers can purchase any product or service separately or as a bundled package. Container Corporation purchased computer equipment, installation and training for a total cost of $144,000 on March 15, 2021. Estimated standalone fair values of the equipment, installation, and training are $90,000, $60,000, and $30.000 respectively. The transaction price allocated to equipment, installation and training is a $90,000, S60,000, $30,000 respectively b. $48,000, $48.000, $48,000 respectively c. $144,000 for the entire bundle. d. $72,000, $48,000 and $24,000 respectively. On January 3, 2020. Moss Company acquires $500,000 of Adam Company's 10-year, 10% bonds at a price of $532,090 to yield 9%. Interest is payable each December 31. The bonds are classified as held-to-maturity. 1.. Assuming that Moss Company uses the effective-interest method, what is the amount of interest revenue that would be recognized in 2021 related to these bonds? a $50,000 b. $53,208 $ $47,890 d. $47,698 5. At the beginning of 2021, Pitman Co. purchased an asset for $1,800,000 with an estimated useful life of 5 years and an estimated salvage value of $150,000. For financial reporting purposes the asset is being depreciated using the straight-line method; for tax purposes the double-declining-balance method is being used. Pitman Co.'s tax rate is 20% for 2021 and all future years. At the end of 2021, which of the following deferred tax accounts and balances is reported on Pitman's balance sheet? Account Balance Deferred tax asset $78,000 b. Deferred tax liability $78,000 c. Deferred tax asset $117,000 d. Deferred tax liability $117,000 2. a. At December 31, 2021, Atlanta Company has an equity portfolio valued at $160,000. Its cost was $132,000. If the Securities Fair Value Adjustment has a debit balance of $8.000, which of the following journal entries is required at December 31, 2021? a. Fair Value Adjustment 28,000 Unrealized Holding Gain or Loss-Income 28,000 b. Fair Value Adjustment 20,000 Unrealized Holding Gain or Loss-Income 20,000 c. Unrealized Holding Gain or Loss-Income 28,000 Fair Value Adjustment 28,000 d. Unrealized Holding Gain or Loss-Income 20.000 Fair Value Adjustment 20,000 6. Mathis Co. at the end of 2020, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows: Pretax financial income S 1.200.000 Estimated litigation expense 3,000,000 Installment sales (2,400,000 Taxable income $ 1.800.000 3. Santo Corporation declares and distributes a cash dividend that is a result of current earnings. How will the receipt of those dividends affect the investment account of the investor under each of the following accounting methods? Fair Value Method Equity Method No Effect Decrease b. Increase Decrease No Effect No Effect d. Decrease No Effect a The estimated litigation expense of $3,000,000 will be deductible in 2022 when it is expected to be paid. The gross profit from the installment sales will be realized in the amount of $1,200,000 in each of the next two years. The estimated liability for litigation is classified as noncurrent and the installment accounts receivable are classified as $1,200,000 current and $1,200.000 noncurrent. The income tax rate is 20% for all years. The income tax expense is a $240,000 b. $360,000. $ $400,000 d. $800,000 c

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts