Question: NAME: (4 points) Use the DCF model for the Steel Dynamics we used in class to update the Steel Dynamics valuation using the most recent

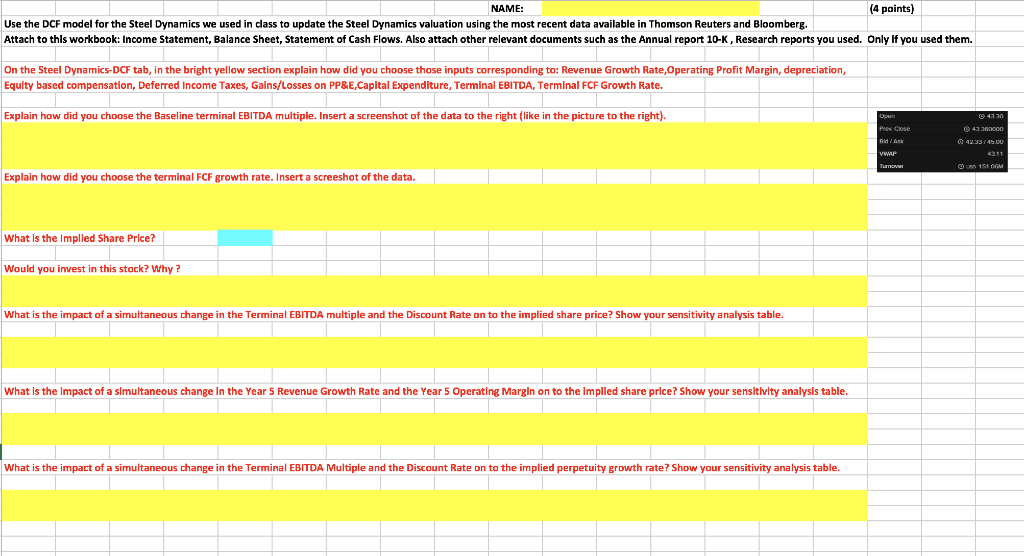

NAME: (4 points) Use the DCF model for the Steel Dynamics we used in class to update the Steel Dynamics valuation using the most recent data available in Thomson Reuters and Bloomberg. Attach to this workbook: Income Statement, Balance Sheet, Statement of Cash Flows. Also attach other relevant documents such as the Annual report 10-K, Research reports you used. Only If you used them. On the Steel Dynamics-DCF tab, in the bright yellow section explain how did you choose those inputs corresponding to: Revenue Growth Rate, Operating Profit Margin, depreciation, Equity based compensation, Deferred Income Taxes, Gains/Losses on PP&E, Capital Expenditure, Terminal EBITDA, Terminal FCF Growth Rate. Explain how did you choose the Baseline terminal EBITDA multiple. Insert a screenshot of the data to the right (like in the picture to the right). 4220 Prev. Close 41300000 Rid 4293/45.00 Explain how did you choose the terminal FCF growth rate. Insert a screeshot of the data. of the data. What is the Implled Share Price? Would you invest in this stock? Why? What is the impact of a simultaneous change in the Terminal EBITDA multiple and the Discount Rate on to the implied share price? Show your sensitivity analysis table. What is the Impact of a simultaneous change in the Year 5 Revenue Growth Rate and the Year 5 Operating Margin on to the Implied share price? Show your sensitivity analysis table. What is the impact of a simultaneous change in the Terminal EBITDA Multiple and the Discount Rate on to the implied perpetuity growth rate? Show your sensitivity analysis table. NAME: (4 points) Use the DCF model for the Steel Dynamics we used in class to update the Steel Dynamics valuation using the most recent data available in Thomson Reuters and Bloomberg. Attach to this workbook: Income Statement, Balance Sheet, Statement of Cash Flows. Also attach other relevant documents such as the Annual report 10-K, Research reports you used. Only If you used them. On the Steel Dynamics-DCF tab, in the bright yellow section explain how did you choose those inputs corresponding to: Revenue Growth Rate, Operating Profit Margin, depreciation, Equity based compensation, Deferred Income Taxes, Gains/Losses on PP&E, Capital Expenditure, Terminal EBITDA, Terminal FCF Growth Rate. Explain how did you choose the Baseline terminal EBITDA multiple. Insert a screenshot of the data to the right (like in the picture to the right). 4220 Prev. Close 41300000 Rid 4293/45.00 Explain how did you choose the terminal FCF growth rate. Insert a screeshot of the data. of the data. What is the Implled Share Price? Would you invest in this stock? Why? What is the impact of a simultaneous change in the Terminal EBITDA multiple and the Discount Rate on to the implied share price? Show your sensitivity analysis table. What is the Impact of a simultaneous change in the Year 5 Revenue Growth Rate and the Year 5 Operating Margin on to the Implied share price? Show your sensitivity analysis table. What is the impact of a simultaneous change in the Terminal EBITDA Multiple and the Discount Rate on to the implied perpetuity growth rate? Show your sensitivity analysis table

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts