Question: Name A B C D E F G H 186 D. stated value. 187 188 31. The average collection period is determined by dividing: 189

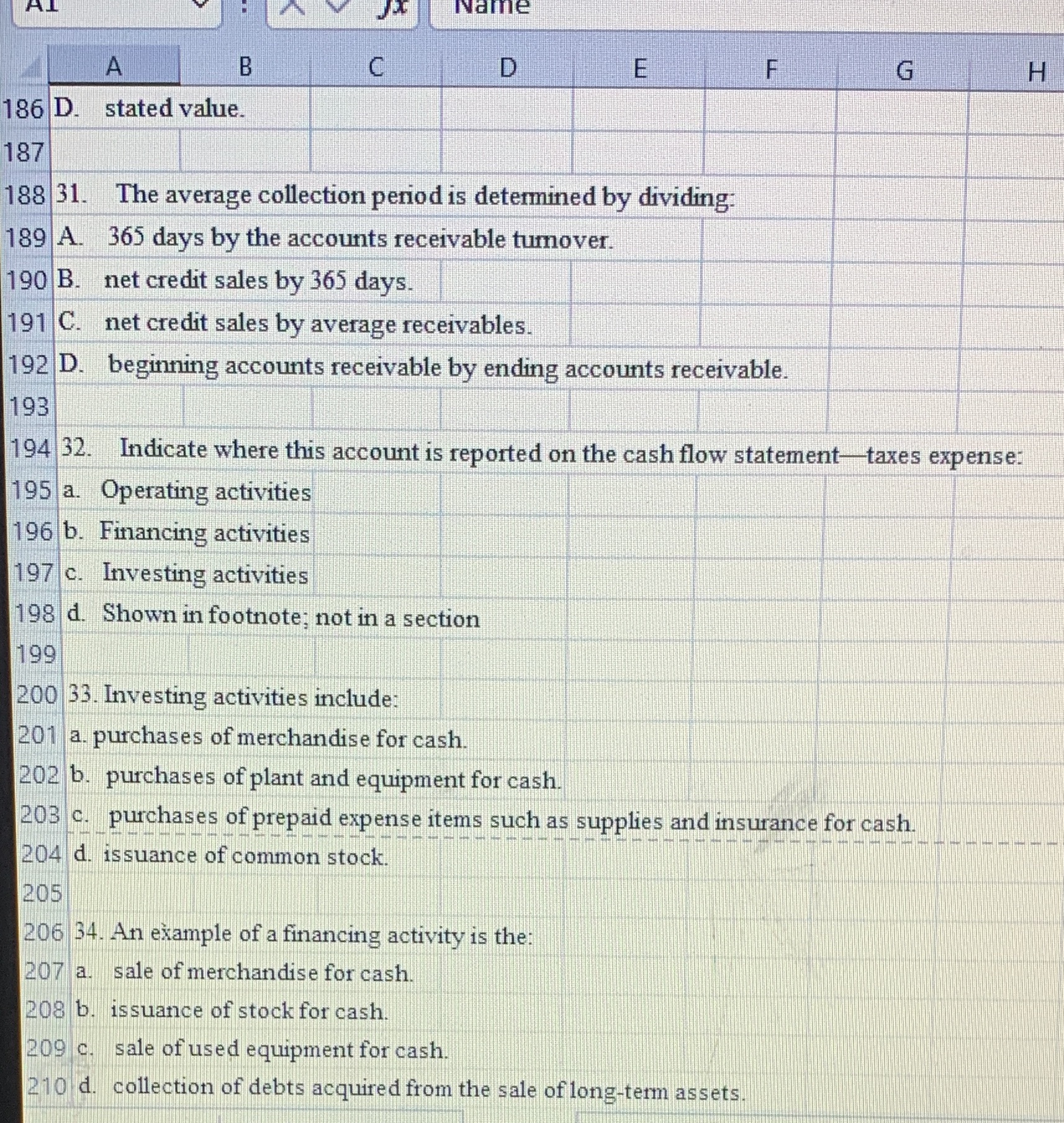

Name A B C D E F G H 186 D. stated value. 187 188 31. The average collection period is determined by dividing: 189 A. 365 days by the accounts receivable tumover. 190 B. net credit sales by 365 days. 191 C. net credit sales by average receivables. 192 D. beginning accounts receivable by ending accounts receivable. 193 194 32. Indicate where this account is reported on the cash flow statement-taxes expense. 195 a. Operating activities 196 b. Financing activities 197 c. Investing activities 198 d. Shown in footnote; not in a section 199 200 33. Investing activities include: 201 a. purchases of merchandise for cash. 202 b. purchases of plant and equipment for cash. 203 c. purchases of prepaid expense items such as supplies and insurance for cash. 204 d. issuance of common stock. 205 206 34. An example of a financing activity is the: 207 a. sale of merchandise for cash. 208 b. issuance of stock for cash. 209 c. sale of used equipment for cash. 210 d. collection of debts acquired from the sale of long-term assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts