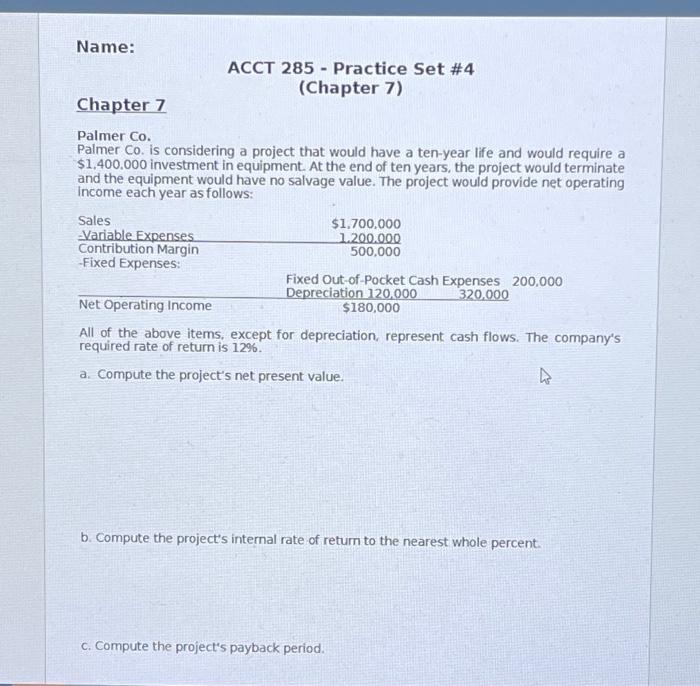

Question: Name: ACCT 285 - Practice Set #4 (Chapter 7) Chapter 7 Palmer Co. Palmer Co. is considering a project that would have a ten-year life

d. Compute the project's simple rate of return to the nearest whole percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts