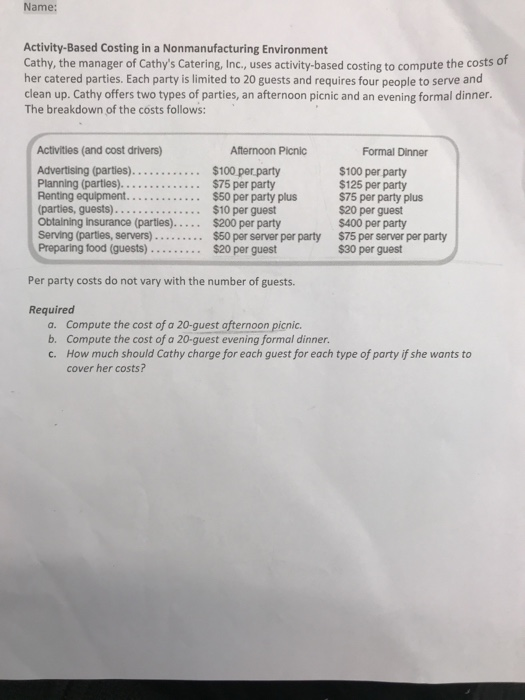

Question: Name: Activity-Based Costing in a Nonmanufacturing Environment Cathy, the manager of Cathy's Catering, Inc., uses activity-based costing to compute the costs of her catered parties.

Name: Activity-Based Costing in a Nonmanufacturing Environment Cathy, the manager of Cathy's Catering, Inc., uses activity-based costing to compute the costs of her catered parties. Each party is limited to 20 guests and requires four people to serve and clean up. Cathy offers two types of parties, an afternoon picnic and an evening formal dinner. The breakdown of the costs follows: Activities (and cost drivers) Afternoon Picnic Formal Dinner $100 per party $125 per party $75 per party plus $20 per guest $400 per party Renting equipment..... . . . . . $50 per party plus Obtaining Insurance (parties)..$200 per party Serving (parties, servers) . . .. .. .. $50 per server per party $75 per server per party Preparing food (guests)....$20 per guest $30 per guest Per party costs do not vary with the number o guests Required Compute the cost of a 20-quest afternoon picnic. Compute the cost of a 20-guest evening formal dinner. How much should Cathy charge for each guest for each type of party if she wants to cover her costs? a. b. c

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts