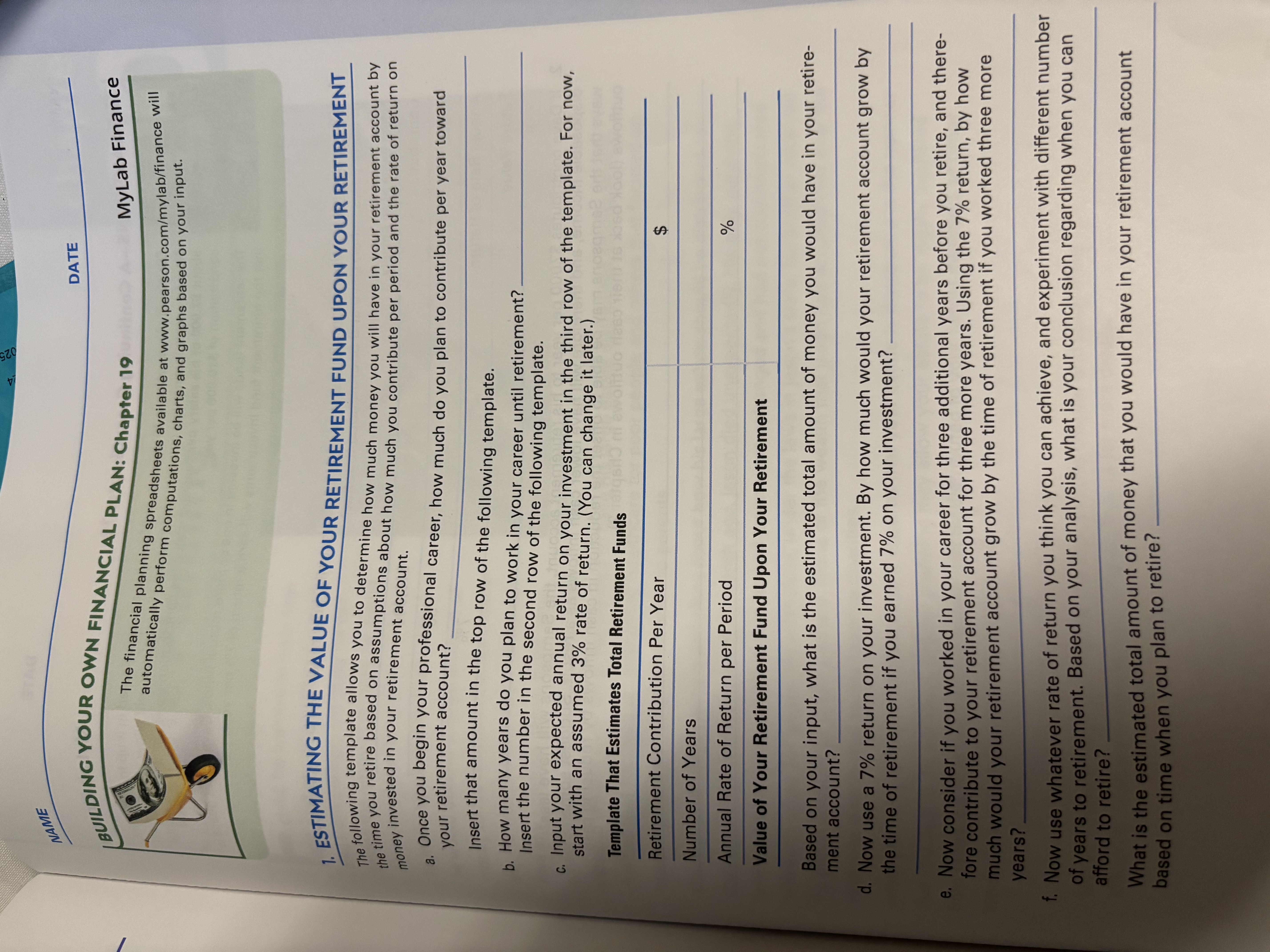

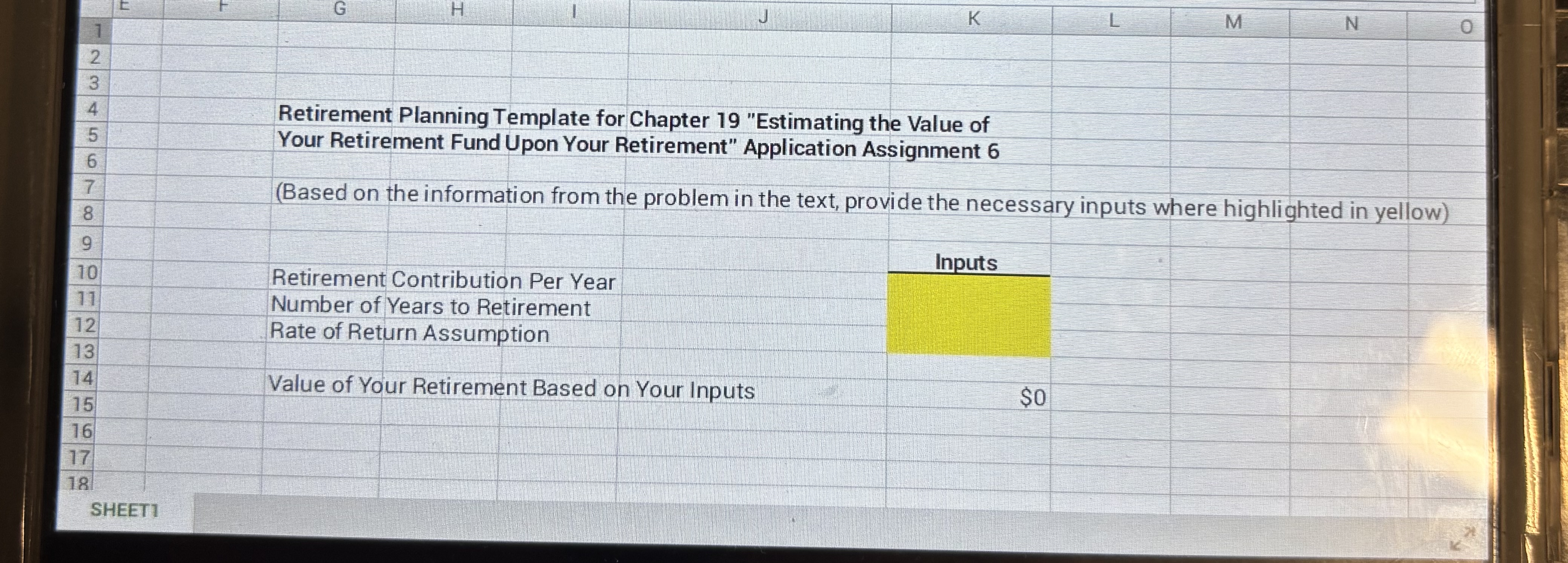

Question: NAME DATE BUILDING YOUR OWN FINANCIAL PLAN: Chapter 19 MyLab Finance The financial planning spreadsheets available at www.pearson.com/mylab/finance will automatically perform computations, charts, and graphs

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock