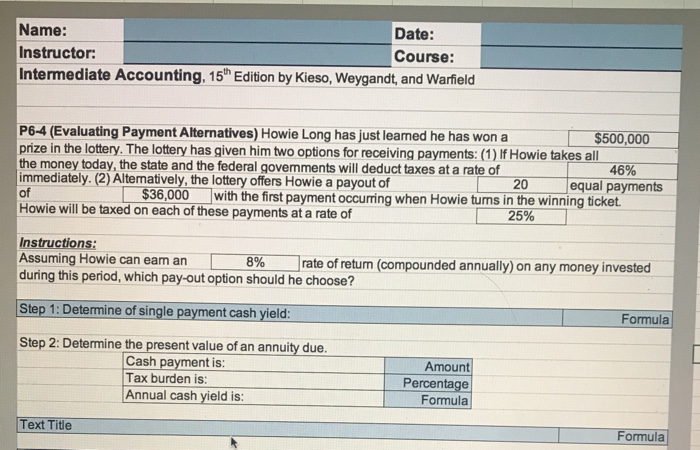

Question: Name: Date: Instructor: Course: Intermediate Accounting, 15th Edition by Kieso, Weygandt, and Warfield P6-4 (Evaluating Payment Alternatives) Howie Long has just leared he has won

Name: Date: Instructor: Course: Intermediate Accounting, 15th Edition by Kieso, Weygandt, and Warfield P6-4 (Evaluating Payment Alternatives) Howie Long has just leared he has won a $500,000 prize in the lottery. The lottery has given him two options for receiving payments: (1) If Howie takes all the money today, the state and the federal governments will deduct taxes at a rate of 46% immediately. (2) Alternatively, the lottery offers Howie a payout of 20 equal payments of $36,000 with the first payment occurring when Howie turns in the winning ticket. Howie will be taxed on each of these payments at a rate of 25% Instructions: Assuming Howie can eam an 8% rate of return (compounded annually) on any money invested during this period, which pay-out option should he choose? Step 1: Determine of single payment cash yield: Formula Step 2: Determine the present value of an annuity due. Cash payment is: Tax burden is: Annual cash yield is: Amount Percentage Formula Text Title Formula

Step by Step Solution

There are 3 Steps involved in it

To determine which payment option Howie should choose we need to compare the present value of both o... View full answer

Get step-by-step solutions from verified subject matter experts