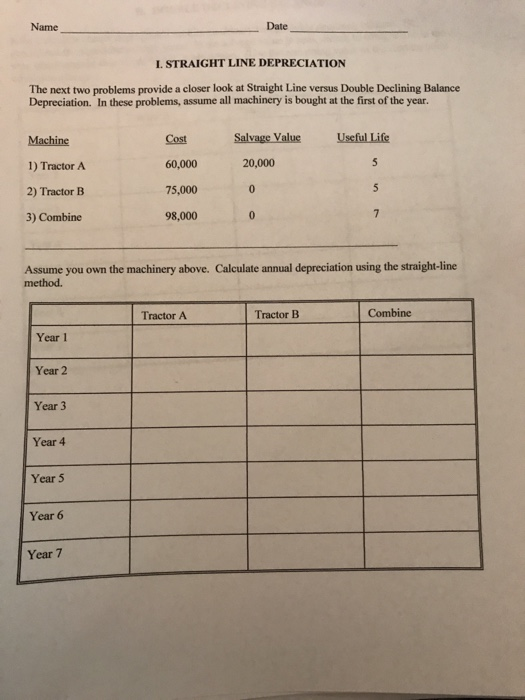

Question: Name Date L. STRAIGHT LINE DEPRECIATION The next two problems provide a closer look at Straight Line versus Double Declining Balance Depreciation. In these problems,

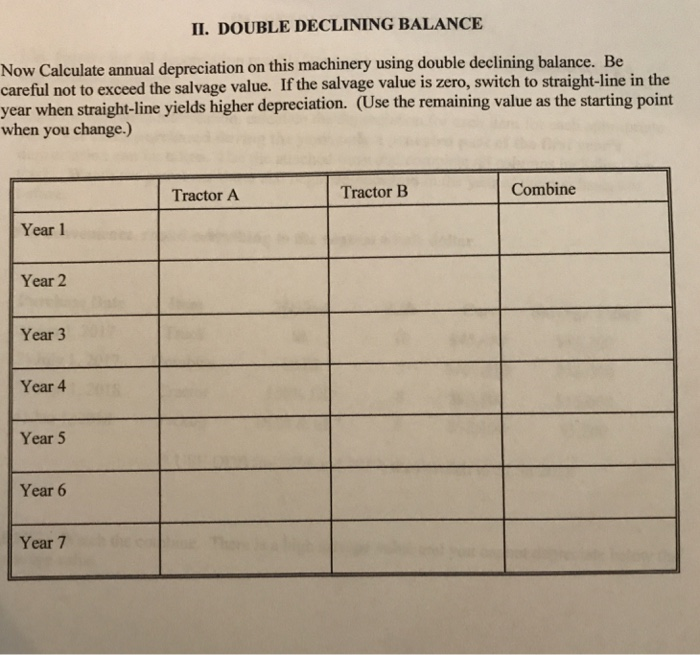

Name Date L. STRAIGHT LINE DEPRECIATION The next two problems provide a closer look at Straight Line versus Double Declining Balance Depreciation. In these problems, assume all machinery is bought at the first of the year. Salvage Value Useful Life 1) Tractor A 2) Tractor B 3) Combine Cost 60,000 75,000 98,000 20,000 Assume you own the machinery above. Calculate annual depreciation using the straight-line method. Tractor A Taector Combine Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 II. DOUBLE DECLINING BALANCE Now Calculate annual depreciation on this machinery using double declining balance. Be careful not to exceed the salvage value. If the salvage value is zero, switch to straight-line in the year when straight-line yields higher depreciation. (Use the remaining value as the starting point when you change.) Tractor A Tractor B Combine Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts