Question: Name Date Test 1 (40 pts.) Identify the following items by indicating your provided. Erasures/alterations are not allowed. answers on the blanks 1. How is

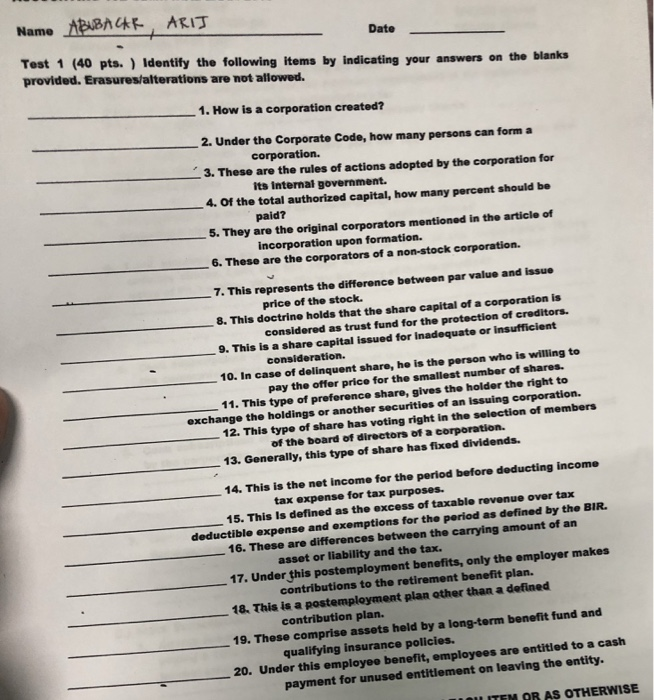

Name Date Test 1 (40 pts.) Identify the following items by indicating your provided. Erasures/alterations are not allowed. answers on the blanks 1. How is a corporation created? 2. Under the Corporate Code, how many persons can form a 3. These are the rules of actions adopted by the corporation for its internal government. paid? incorporation upon formation. 4. Of the total authorized capital, how many percent should be 5. They are the original corporators mentioned in the article of 6. These are the corporators of a non-stock corporation. 7. This represents the difference between par value and issue 8. This doctrine holds that the share capital of a corporation is 9. This is a share capital issued for Inadequate or insufficient 10. In case of delinquent share, he is the person who is willing to 11. This type of preference share, gives the holder the right to 12. This type of share has voting right in the selection of members 13. Generally, this type of share has fixed dividends. 14. This is the net income for the period before deducting income 15. This Is defined as the excess of taxable revenue over tax 16. These are differences between the carrying amount of an 17. Under this postemployment benefits, only the employer makes 18. This is a postemployment plan other than a defined 19. These comprise assets held by a long-term benefit fund and 20. Under this employee benefit, employees are entitled to a cash price of the stock. considered as trust fund for the protection of creditors. consideration. pay the offer price for the smallest number of shares. exchange the holdings or another securities of an issuing corporation. of the board of directors of a corporation. tax expense for tax purposes. deductible expense and exemptions for the period as defined by the BIR asset or liability and the tax. contributions to the retirement benefit plan. contribution plan. qualifying insurance policies. payment for unused entitlement on leaving the entity LITEM OR AS OTHERWISE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts