Question: Name ________________________________________________ Exercise Information: 4 Exercises After reading the exercise, you may want to check the Hints in the 'Hints' tab. On January 2, 2018,

| Name ________________________________________________ | ||

| Exercise Information: | 4 Exercises | After reading the exercise, you may want to check the Hints in the 'Hints' tab. |

| On January 2, 2018, Parent Corporation acquired 75% of Subsidiary Company's outstanding common stock. | ||

| In exchange for Subsidiary's stock, Parent issued bonds payable with a par value of $500,000 | ||

| and fair value of $510,000 directly to the selling stockholders of Subsidiary. | ||

| At that date, the fair value of the noncontrolling interest was $170,000. | ||

| The two companies continued to operate as separate entities subsequent to the combination | ||

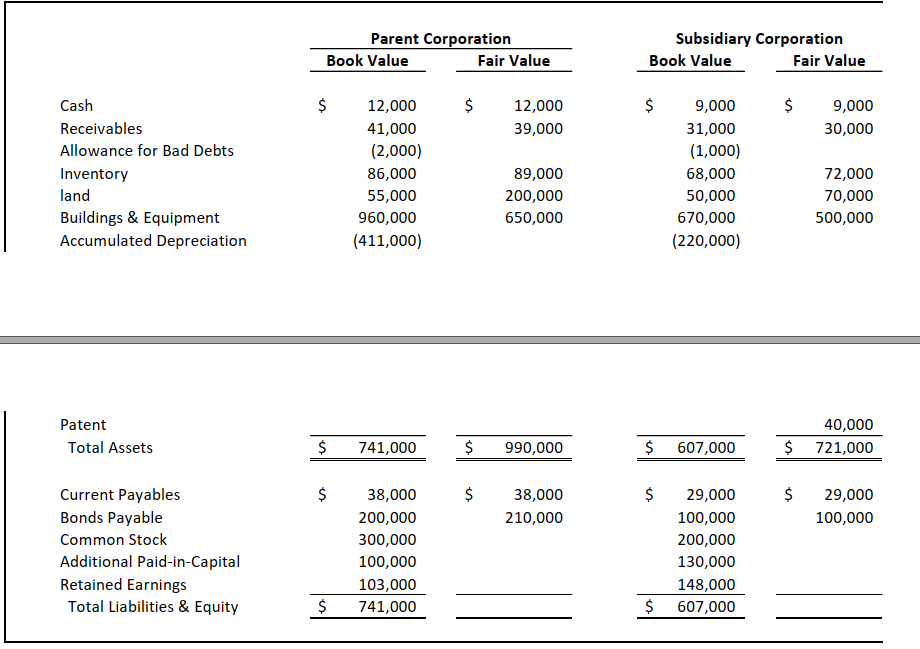

| Immediately prior to the combination the book value and fair value of the companies' assets and liabilities were as follows: | ||

| Also, at the date of combination, Subsidiary owed Parent $6,000 plus accrued interest of $500 on a short-term note. | ||

| Both companies have properly recorded these amounts |

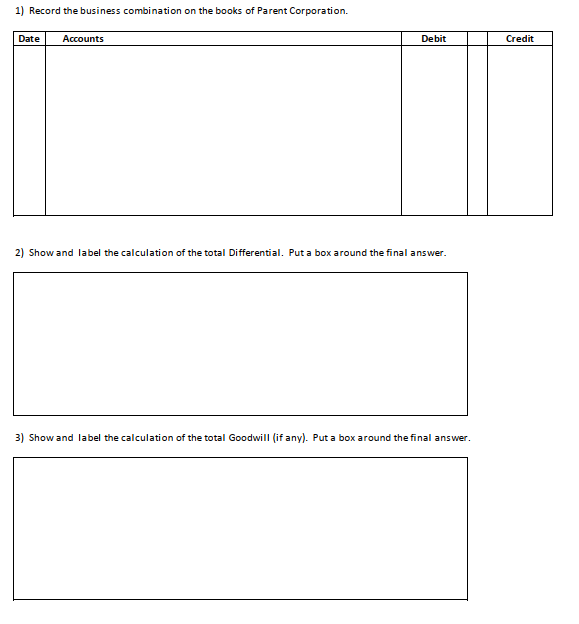

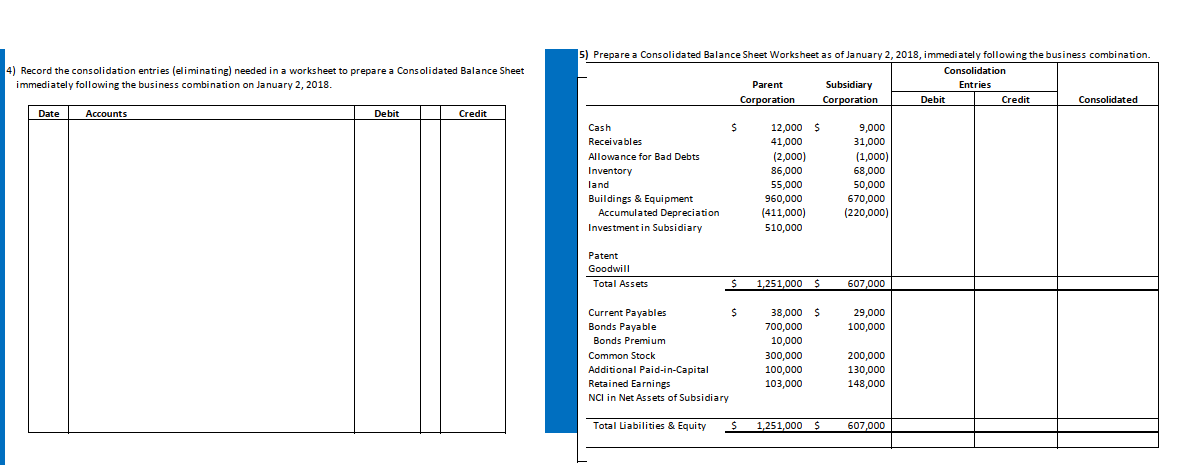

1) Record the business combination on the books of Parent Corporation. 2) Show and Iabel the calculation of the total Differential. Put a box around the final answer. 3) Show and label the calculation of the total Goodwill (if any). Put a box around the final answer. 4) Record the consolidation entries (eliminating) needed in a worksheet to prepare a Consolidated Balance Sheet immediately following the business combination on Ja nuary 2,2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts