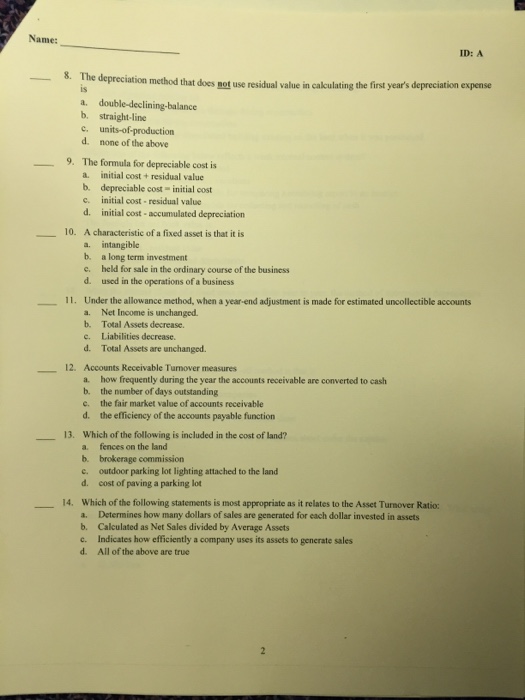

Question: Name: ID: A -8. The depreciation method that does not use residual value in cakculating the first year's depreciation expense a. double-declining-balance b. straight-line c.

Name: ID: A -8. The depreciation method that does not use residual value in cakculating the first year's depreciation expense a. double-declining-balance b. straight-line c. units-of-production d. none of the above 9. The formula for depreciable cost is a. initial cost + residual value b. depreciable cost initial cost c. initial cost-residual value d initial cost-accumulated depreciation 10. A characteristic of a fixed asset is that it is a. intangible b. a long term investment held for sale in the ordinary course of the business d. e. used in the operations of a business 11. Under the allowance method, when a year-end adjustment is made for estimated uncollectible accounts a. Net Income is unchanged. b. Total Assets decrease. c. Liabilities decrease. d. Total Assets are unchanged. 12. Accounts Receivable Tunover measures a. how frequently during the year the accounts receivable are converted to cash b. the number of days outstanding c. the fair market value of accounts receivable d. the efficiency of the accounts payable function --13. Which of the following is included in the cost of land? a. fences on the land b. brokerage commission c outdoor parking lot lighting attached to the land d. cost of paving a parking lot 14. Which of the following statements is most appropriate as it relates to the Asset Turnover Ratio a. Determines how many dollars of sales are Calculated as Net Sales divided by Average Assets Indicates how efficiently a company uses its assets to generate sales All of the above are true a. Determines how many dollars of sales are generated for each dollar invested in assets b. c. d

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts