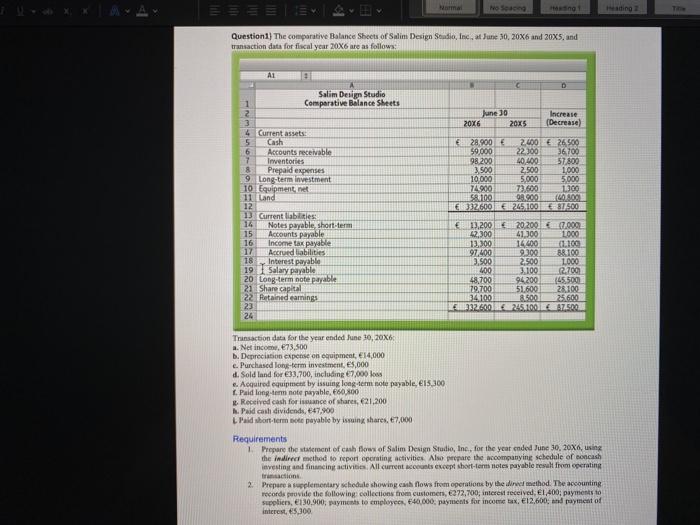

Question: ==== Name No Send Heading Te Question. The comparative Balance Sheets of Salim Design Studio, Inc. at June 30, 20X6 and 20X5, and transaction data

==== Name No Send Heading Te Question. The comparative Balance Sheets of Salim Design Studio, Inc. at June 30, 20X6 and 20X5, and transaction data for fiscal year 20X6 are as follows: AI D June Jo 2026 2025 Increase (Decrease) Salim Design Studio Comparative Balance Sheets 2 3 4 Current assets: 5 Cash 6 Accounts receivable 7 Inventories 8 Prepaid expenses 9. Long-term investment 10 Equipment, net 11 Land 12 13. Current liabilities: 14 Notes payable short-term Accounts payable Income tax payable 17 Accrued liabilities 18 Interest payable 19 Salary payable 20 Long-term note payable 21 Share capital 22 Retained earnings 23 24 28.900 2.000 26.500 59,000 22100 36700 98 200 10400 57.800 3.500 2.500 1000 10.000 5.000 5.000 74.900 73,600 1300 58100 99.000 0:00 332600626510037500 15 16 12.2001 20200 67.009 42,300 41.300 L000 12.300 14400 (1100 97.400 9300 88100 3,500 2.500 L000 400 3.100 2.700 48,700 94200 45.500 79,700 51 600 28.100 344100 8.500 25.600 26001245.100 7500 Transaction data for the year ended June 30, 20X6 a. Net incom. 73.500 b. Depreciation expense on guipment, 14,000 e. Purchased long-term investment, E5,000 d. Sold land for 33.700, including 7,000 koos Acquired equipment by issuing long-term note payable, 615.300 Paid long-term note payable, 60.00 Received cash formance of shares, 21,200 h. Pald casi dividendi, 47,900 LPld short-term De payable by issuing shares, 17.000 Requirements 1. Prepare the statement of cash flow of Salim Design Studio, Inc., for the year ended June 30, 20X6, using the Indirect method to report operating activities. Also prepare the accompanying schedule of Doncash investing and financing activities. All current accounts except short-term roles payable from operating tractions 2. Prepare a supplementary schedule showing cash flows from operation by the ind method. The accounting records provide the following collections from customers, 272,700; interest received, E1,400, payments to suppliers, 130,900, payment to employees, 40.000, payments for income tax, E12,600 and payment of Interest, 5,300

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts