Question: Name: Problem 1 is worth 25 points. Problem 2 is worth 25 points. Problem is worth 20 points. All returns are annual returns unless otherwise

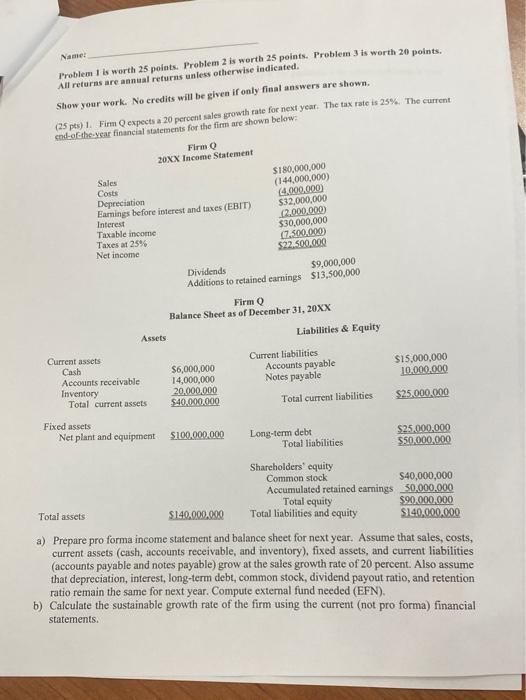

Name: Problem 1 is worth 25 points. Problem 2 is worth 25 points. Problem is worth 20 points. All returns are annual returns unless otherwise indicated. Show your work. No credits will be given if only final answers are shown. (25 pes) 1. Firm expects a 20 percent sales growth rate for next year. The tax rate is 25%. The current end of the year financial statements for the firm are shown below. Firm 20XX Income Statement Sales $180,000,000 Costs (144,000,000) Depreciation 4.000.000 Earnings before interest and taxes (EBIT) $32,000,000 .C2.000.000 Taxable income $30,000,000 Taxes at 25% (7.500.000 Net income $22.500.000 Interest Dividends $9,000,000 Additions to retained earnings $13,500,000 Firm Balance Sheet as of December 31, 20XX Assets Liabilities & Equity Current assets Current liabilities Cash $6,000,000 Accounts payable Accounts receivable 14,000,000 Notes payable Inventory 20.000.000 Total current assets $40.000.000 Total current liabilities $15,000,000 10.000.000 $25.000.000 Fixed assets Net plant and equipment $100,000,000 Long-term debt Total liabilities $25.000.000 550.000.000 Total assets Shareholders' equity Common stock S40,000,000 Accumulated retained earnings 50,000,000 Total equity $90.000.000 $140.000.000 Total liabilities and equity $140.000.000 a) Prepare pro forma income statement and balance sheet for next year. Assume that sales, costs, current assets (cash, accounts receivable, and inventory), fixed assets, and current liabilities (accounts payable and notes payable) grow at the sales growth rate of 20 percent. Also assume that depreciation, interest, long-term debt, common stock, dividend payout ratio, and retention ratio remain the same for next year. Compute external fund needed (EFN). b) Calculate the sustainable growth rate of the firm using the current (not pro forma) financial statements. Name: Problem 1 is worth 25 points. Problem 2 is worth 25 points. Problem is worth 20 points. All returns are annual returns unless otherwise indicated. Show your work. No credits will be given if only final answers are shown. (25 pes) 1. Firm expects a 20 percent sales growth rate for next year. The tax rate is 25%. The current end of the year financial statements for the firm are shown below. Firm 20XX Income Statement Sales $180,000,000 Costs (144,000,000) Depreciation 4.000.000 Earnings before interest and taxes (EBIT) $32,000,000 .C2.000.000 Taxable income $30,000,000 Taxes at 25% (7.500.000 Net income $22.500.000 Interest Dividends $9,000,000 Additions to retained earnings $13,500,000 Firm Balance Sheet as of December 31, 20XX Assets Liabilities & Equity Current assets Current liabilities Cash $6,000,000 Accounts payable Accounts receivable 14,000,000 Notes payable Inventory 20.000.000 Total current assets $40.000.000 Total current liabilities $15,000,000 10.000.000 $25.000.000 Fixed assets Net plant and equipment $100,000,000 Long-term debt Total liabilities $25.000.000 550.000.000 Total assets Shareholders' equity Common stock S40,000,000 Accumulated retained earnings 50,000,000 Total equity $90.000.000 $140.000.000 Total liabilities and equity $140.000.000 a) Prepare pro forma income statement and balance sheet for next year. Assume that sales, costs, current assets (cash, accounts receivable, and inventory), fixed assets, and current liabilities (accounts payable and notes payable) grow at the sales growth rate of 20 percent. Also assume that depreciation, interest, long-term debt, common stock, dividend payout ratio, and retention ratio remain the same for next year. Compute external fund needed (EFN). b) Calculate the sustainable growth rate of the firm using the current (not pro forma) financial statements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts