Question: Name: Question 15 (CHAPTER 13) You decided that it's time to invest some money into the stock market. You bought a portfolio with the following

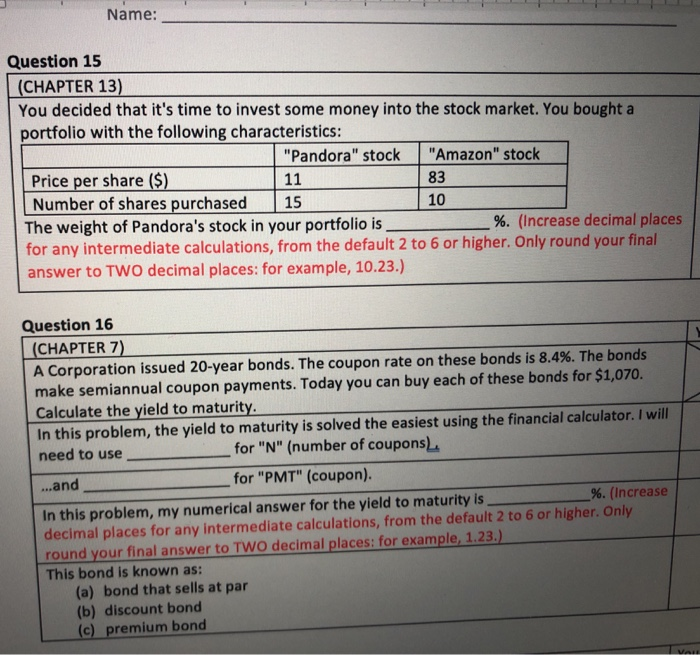

Name: Question 15 (CHAPTER 13) You decided that it's time to invest some money into the stock market. You bought a portfolio with the following characteristics: "Pandora" stock "Amazon" stock Price per share ($) 11 83 Number of shares purchased 15 10 The weight of Pandora's stock in your portfolio is_ %. (Increase decimal places for any intermediate calculations, from the default 2 to 6 or higher. Only round your final answer to Two decimal places: for example, 10.23.) Question 16 (CHAPTER 7) A Corporation issued 20-year bonds. The coupon rate on these bonds is 8.4%. The bonds make semiannual coupon payments. Today you can buy each of these bonds for $1,070. Calculate the yield to maturity. In this problem, the yield to maturity is solved the easiest using the financial calculator. I will need to use for "N" (number of coupons for "PMT" (coupon). %. (Increase In this problem, my numerical answer for the yield to maturity is decimal places for any intermediate calculations, from the default 2 to 6 or higher. Only round your final answer to TWO decimal places: for example, 1.23.) This bond is known as: (a) bond that sells at par (b) discount bond (c) premium bond ...and

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts