Question: Name: TA: Disc #: BUS ADM 2 0 1 Introduction to Financial Accounting SPRING 2 0 2 4 ACCOUNTING CYCLE PROJECT II Due at 9

Name:

TA:

Disc #:

BUS ADM Introduction to Financial Accounting

SPRING

ACCOUNTING CYCLE PROJECT II

Due at : PM on Wednesday, April

INSTRUCTIONS:

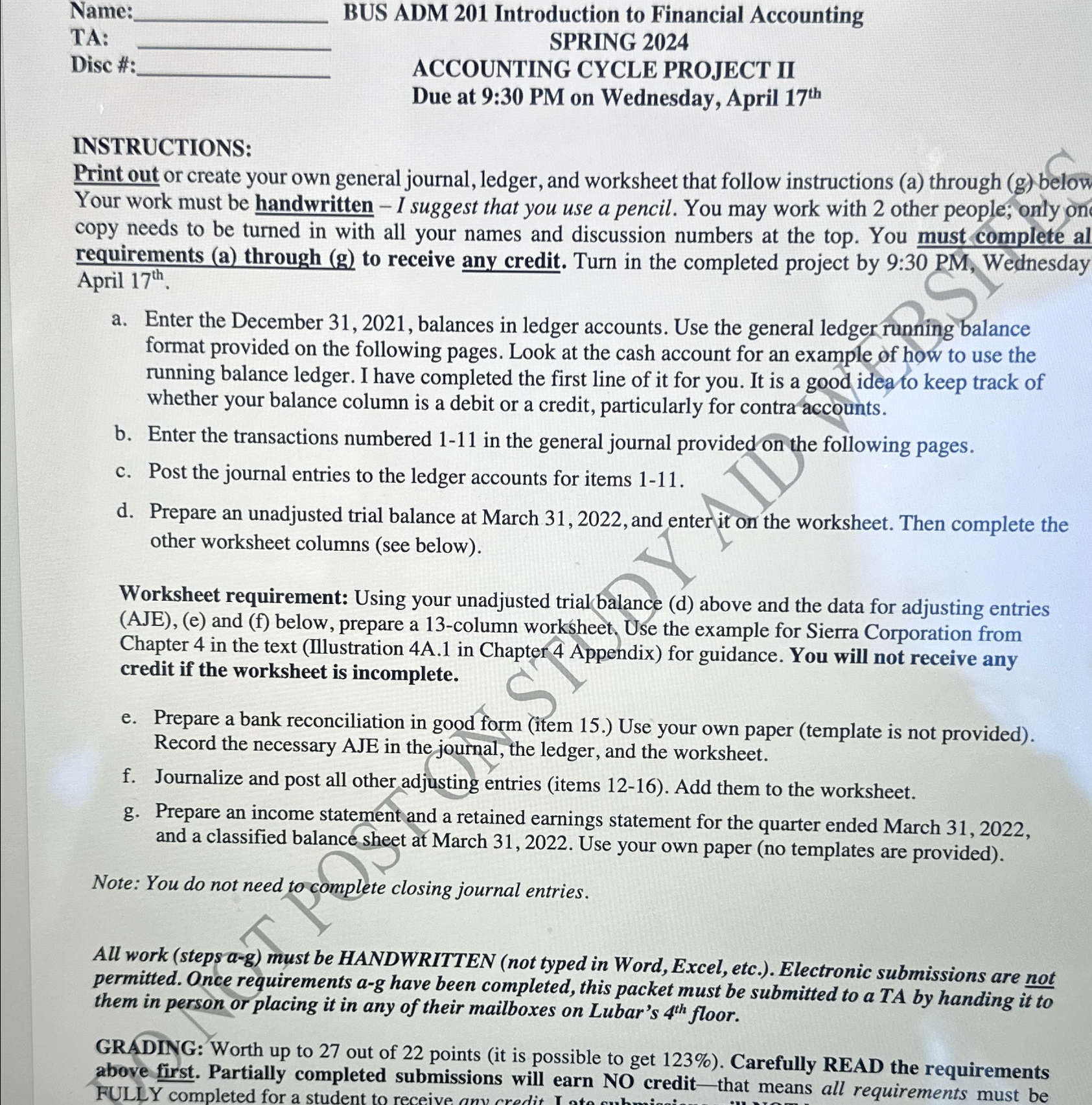

Print out or create your own general journal, ledger, and worksheet that follow instructions a through g below Your work must be handwritten I suggest that you use a pencil. You may work with other people; only on copy needs to be turned in with all your names and discussion numbers at the top. You must complete al requirements a through g to receive any credit. Turn in the completed project by : PM Wednesday April

a Enter the December balances in ledger accounts. Use the general ledger running balance format provided on the following pages. Look at the cash account for an example of how to use the running balance ledger. I have completed the first line of it for you. It is a good idea to keep track of whether your balance column is a debit or a credit, particularly for contra accounts.

b Enter the transactions numbered in the general journal provided on the following pages.

c Post the journal entries to the ledger accounts for items

d Prepare an unadjusted trial balance at March and enter it on the worksheet. Then complete the other worksheet columns see below

Worksheet requirement: Using your unadjusted trial balance d above and the data for adjusting entries AJEe and f below, prepare a column worksheet Use the example for Sierra Corporation from Chapter in the text Illustration A in Chapter Appendix for guidance. You will not receive any credit if the worksheet is incomplete.

e Prepare a bank reconciliation in good form item Use your own paper template is not provided Record the necessary AJE in the journal, the ledger, and the worksheet.

f Journalize and post all other adjusting entries items Add them to the worksheet.

g Prepare an income statement and a retained earnings statement for the quarter ended March and a classified balance sheet at March Use your own paper no templates are provided

Note: You do not need to complete closing journal entries.

All work steps ag must be HANDWRITTEN not typed in Word, Excel, etc. Electronic submissions are not permitted. Once requirements ag have been completed, this packet must be submitted to a TA by handing it to them in person or placing it in any of their mailboxes on Lubar's floor.

GRADING: Worth up to out of points it is possible to get Carefully READ the requirements above first. Partially completed submissions will earn NO creditthat means all requirements must be

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock