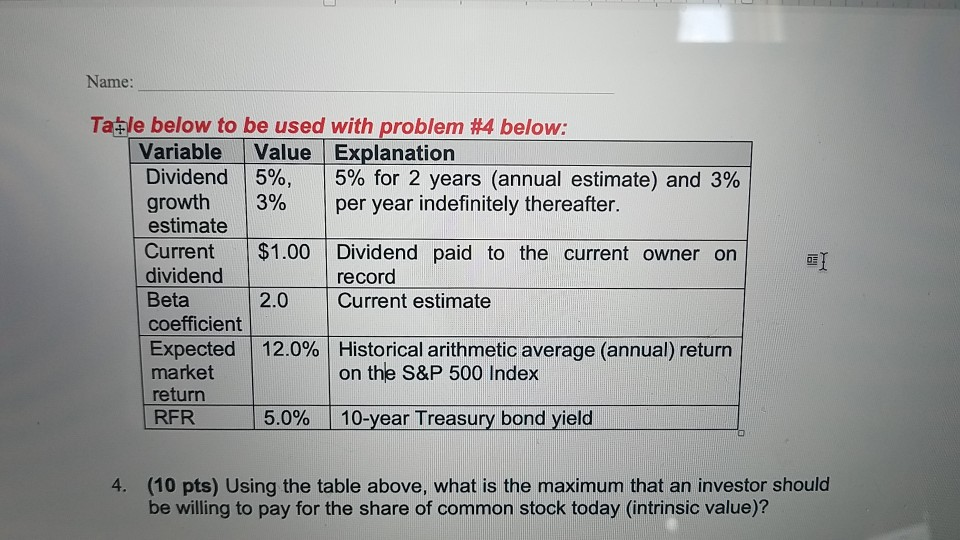

Question: Name: Table below to be used with problem #4 below: Variable Value Explanation Dividend 5%, 5% for 2 years (annual estimate) and 3% growth 3%

Name: Table below to be used with problem #4 below: Variable Value Explanation Dividend 5%, 5% for 2 years (annual estimate) and 3% growth 3% per year indefinitely thereafter. estimate Current $1.00 Dividend paid to the current owner on dividend record Beta 2.0 Current estimate coefficient Expected 12.0% Historical arithmetic average (annual) return market on the S&P 500 Index return RFR 5.0% 10-year Treasury bond yield I 4. (10 pts) Using the table above, what is the maximum that an investor should be willing to pay for the share of common stock today (intrinsic value)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts