Question: Name Team Learning Bond Basics 1. A 3 year bond was issued 1 year ago. Its par is $1000. The amount paid by each investor

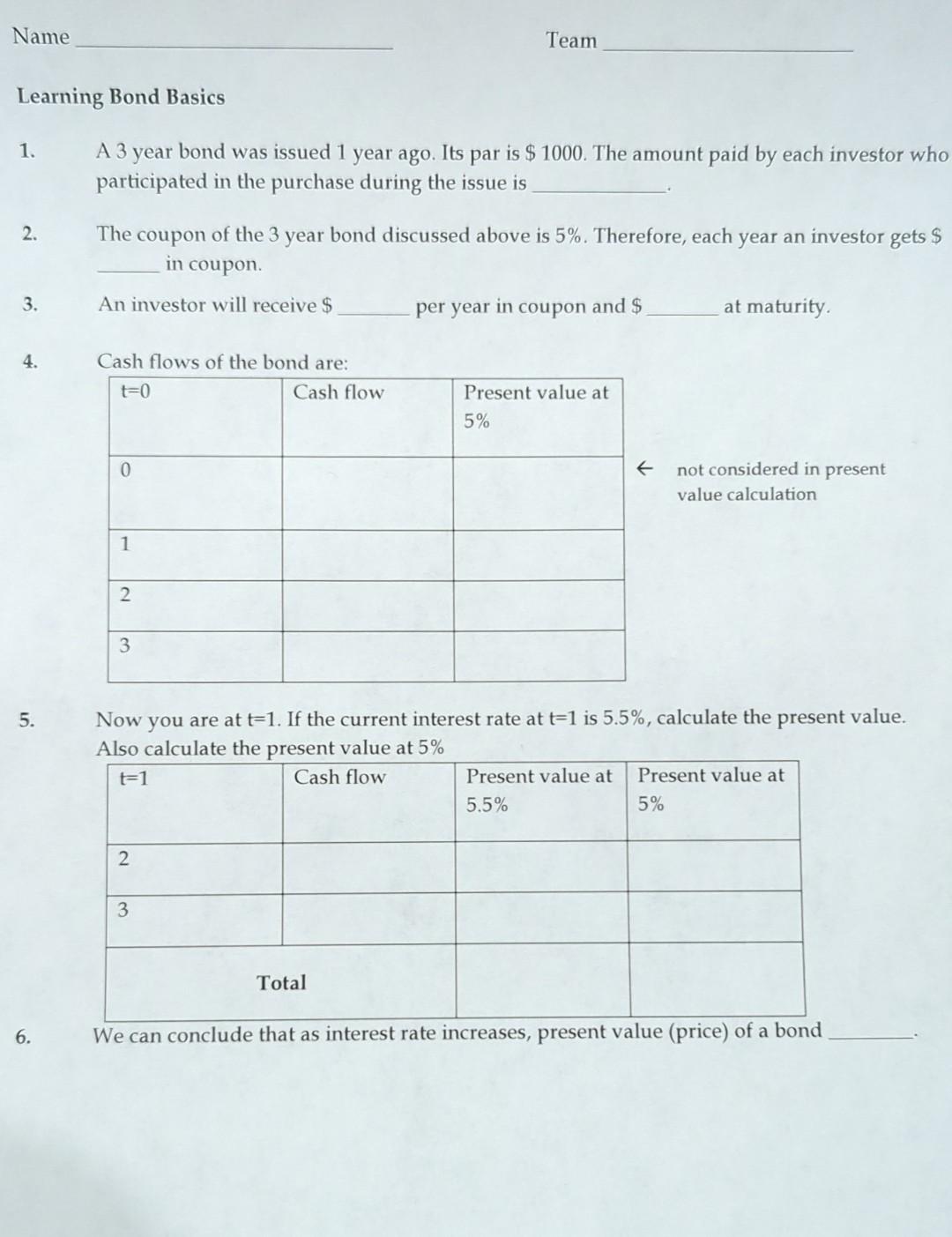

Name Team Learning Bond Basics 1. A 3 year bond was issued 1 year ago. Its par is $1000. The amount paid by each investor who participated in the purchase during the issue is 2. The coupon of the 3 year bond discussed above is 5%. Therefore, each year an investor gets \$ in coupon. 3. An investor will receive $ per year in coupon and $ at maturity. 4. Cash flows of the hond are. not considered in present value calculation 5. Now you are at t=1. If the current interest rate at t=1 is 5.5%, calculate the present value. Also calculate the present value at 5% 6. We can conclude that as interest rate increases, present value (price) of a bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts