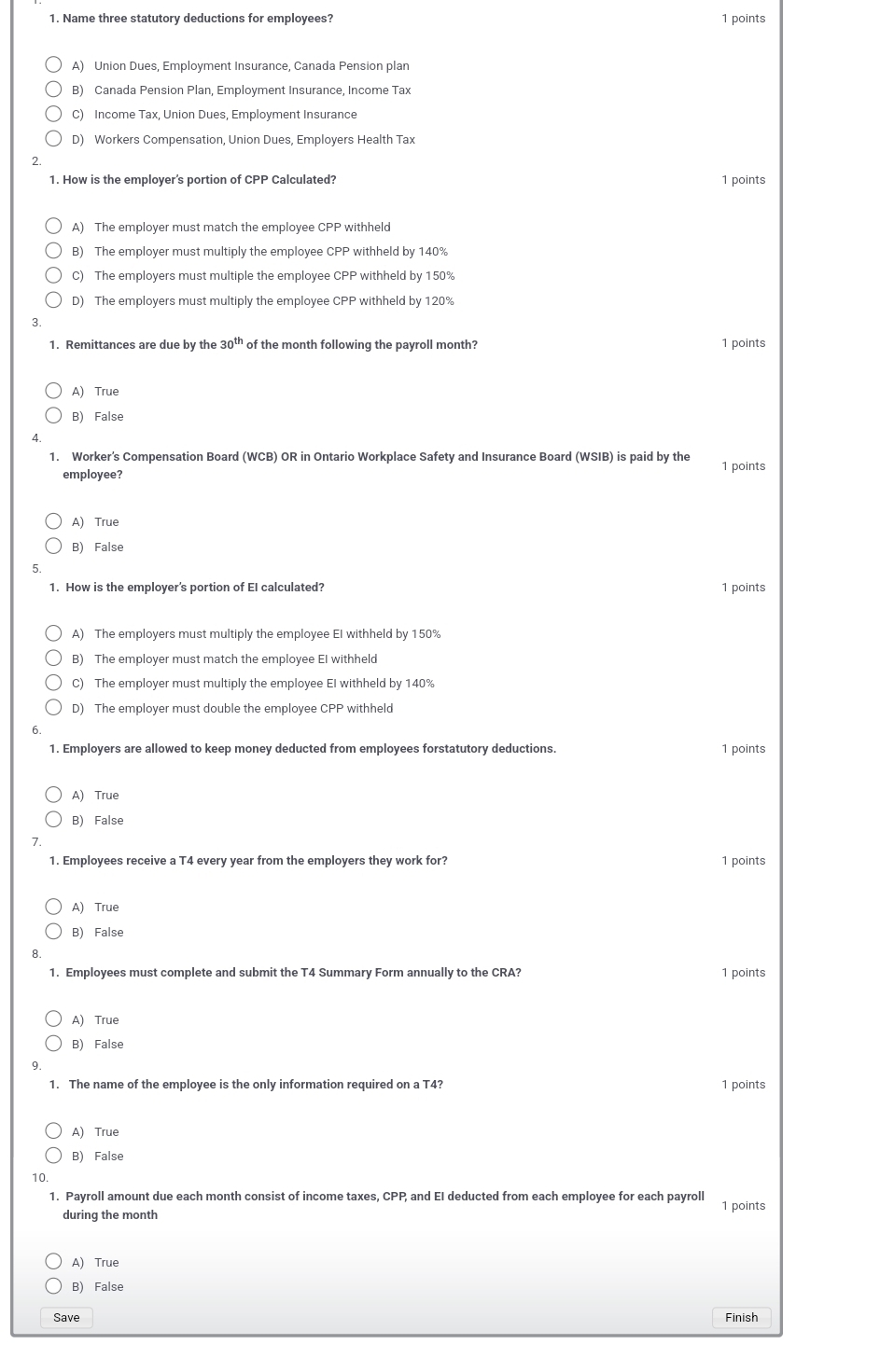

Question: Name three statutory deductions for employees? A ) Union Dues, Employment Insurance, Canada Pension plan B ) Canada Pension Plan, Employment Insurance, Income Tax C

Name three statutory deductions for employees?

A Union Dues, Employment Insurance, Canada Pension plan

B Canada Pension Plan, Employment Insurance, Income Tax

C Income Tax, Union Dues, Employment Insurance

D Workers Compensation, Union Dues, Employers Health Tax

How is the employer's portion of CPP Calculated?

A The employer must match the employee CPP withheld

B The employer must multiply the employee CPP withheld by

C The employers must multiple the employee CPP withheld by

D The employers must multiply the employee CPP withheld by

Remittances are due by the of the month following the payroll month?

A True

B False

Worker's Compensation Board WCB OR in Ontario Workplace Safety and Insurance Board WSIB is paid by the

employee?

A True

B False

How is the employer's portion of El calculated?

A The employers must multiply the employee El withheld by

B The employer must match the employee El withheld

C The employer must multiply the employee El withheld by

D The employer must double the employee CPP withheld

Employers are allowed to keep money deducted from employees forstatutory deductions.

A True

B False

Employees receive a T every year from the employers they work for?

A True

B False

Employees must complete and submit the T Summary Form annually to the CRA?

A True

B False

The name of the employee is the only information required on a T

A True

B False

Payroll amount due each month consist of income taxes, CPP and El deducted from each employee for each payroll

during the month

A True

B False

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock