Question: nance 444-Spring 2019-Chapter 3 Practice Problem s 0213 I bought a straddle on a stock with an exercise price of 50. Recall that a straddle

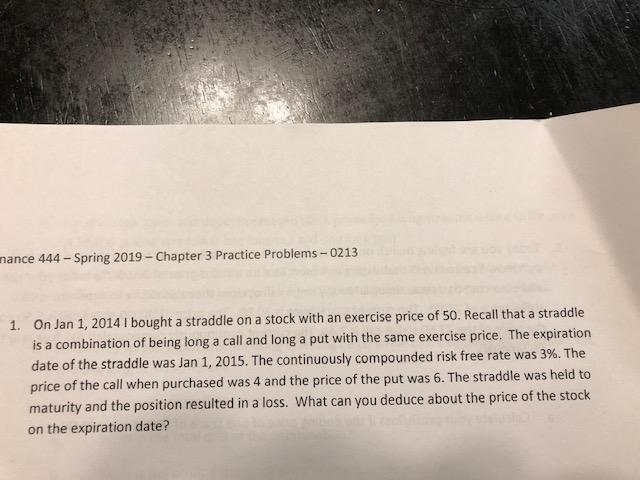

nance 444-Spring 2019-Chapter 3 Practice Problem s 0213 I bought a straddle on a stock with an exercise price of 50. Recall that a straddle bination of being long a call and long a put with the same exercise price. The expiration risk free rate was 3%. The 1. On Jan 1, 2014 is a com date of the straddle was Jan 1, 2015. The continuously compounded price of the call when purchased was 4 and the price of the put was 6. The straddle was held to maturity and the position resulted in a loss. What can you deduce about the price of the stock on the expiration date

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts