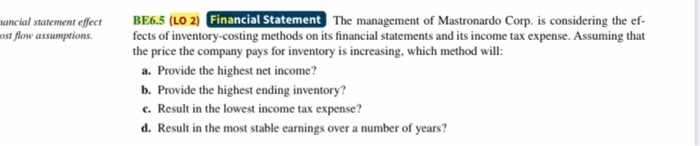

Question: nancial statement effect most flow assumptions BE6.5 (LO 2) Financial Statement The management of Mastronardo Corp. is considering the ef- fects of inventory-costing methods on

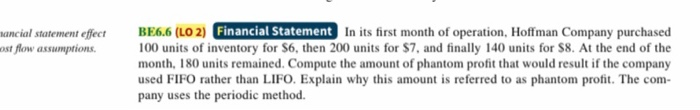

nancial statement effect most flow assumptions BE6.5 (LO 2) Financial Statement The management of Mastronardo Corp. is considering the ef- fects of inventory-costing methods on its financial statements and its income tax expense. Assuming that the price the company pays for inventory is increasing, which method will: a. Provide the highest net income? b. Provide the highest ending inventory? c. Result in the lowest income tax expense? d. Result in the most stable earnings over a number of years? ancial statement effect most flow assumptions BE6.6 (LO2) Financial Statement in its first month of operation, Hoffman Company purchased 100 units of inventory for S6, then 200 units for $7, and finally 140 units for $8. At the end of the month, 180 units remained. Compute the amount of phantom profit that would result if the company used FIFO rather than LIFO. Explain why this amount is referred to as phantom profit. The com- pany uses the periodic method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts