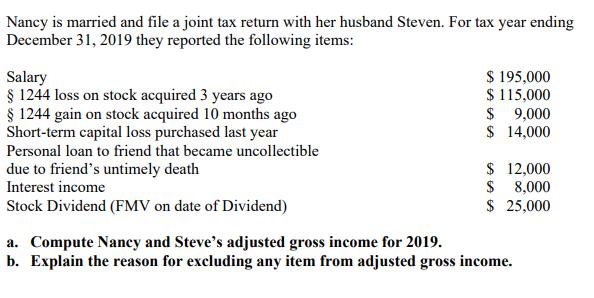

Question: Nancy is married and file a joint tax return with her husband Steven. For tax year ending December 31, 2019 they reported the following

Nancy is married and file a joint tax return with her husband Steven. For tax year ending December 31, 2019 they reported the following items: Salary 1244 loss on stock acquired 3 years ago 1244 gain on stock acquired 10 months ago Short-term capital loss purchased last year Personal loan to friend that became uncollectible due to friend's untimely death Interest income Stock Dividend (FMV on date of Dividend) $ 195,000 $ 115,000 9,000 $ $ 14,000 12,000 $ $ 8,000 $ 25,000 a. Compute Nancy and Steve's adjusted gross income for 2019. b. Explain the reason for excluding any item from adjusted gross income.

Step by Step Solution

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Income they received during the year and then subtract any allowable adjustments to arr... View full answer

Get step-by-step solutions from verified subject matter experts