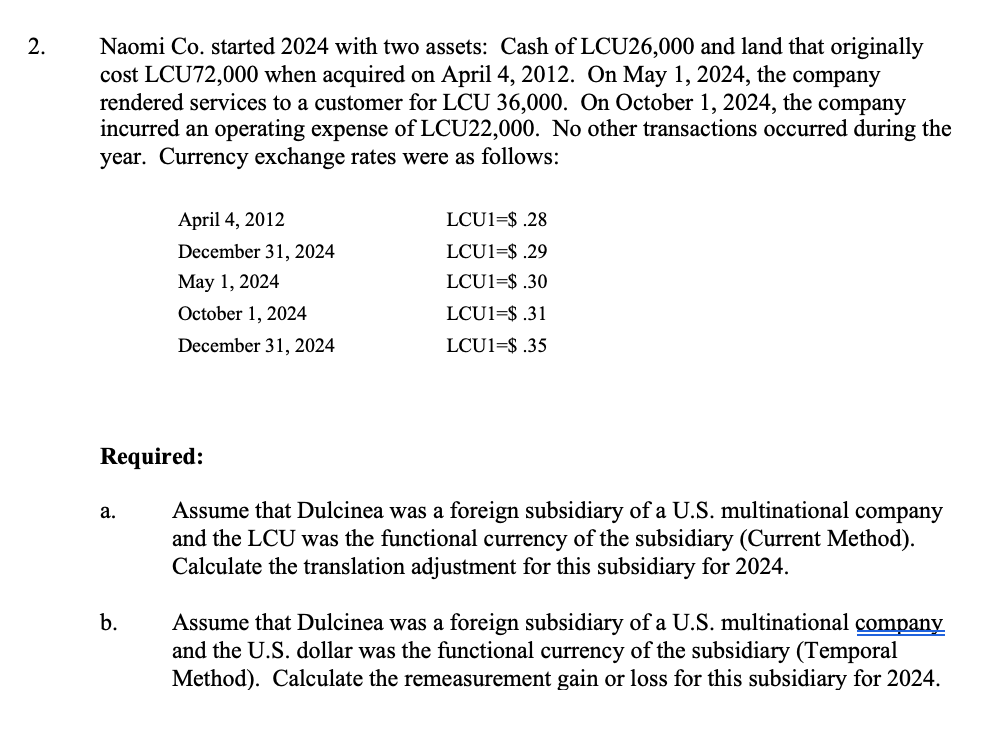

Question: Naomi C o . started 2 0 2 4 with two assets: Cash o f LCU 2 6 , 0 0 0 and land that

Naomi started with two assets: Cash LCU and land that originally

LCU when acquired April May the company

rendered services a customer for LCU October the company

incurred operating expense LCU other transactions occurred during the

year. Currency exchange rates were follows:

April

December

May

October

December

LCU$

LCU$

LCU$

LCU$

LCU$

Required:

Assume that Dulcinea was a foreign subsidiary multinational company

and the LCU was the functional currency the subsidiary Method

Calculate the translation adjustment for this subsidiary for

Assume that Dulcinea was a foreign subsidiary multinational company

and the dollar was the functional currency the subsidiary

Method Calculate the remeasurement gain loss for this subsidiary for

ORGANIZE WAS EXCEL SHEET PLEASE.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock