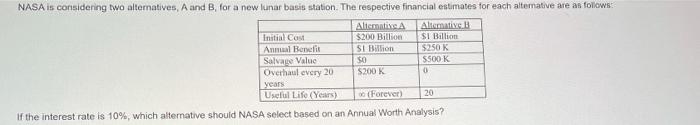

Question: NASA is considering two alternatives, A and B. for a new lunar basis station. The respective financial estimates for each alternative are as follows: Alternative

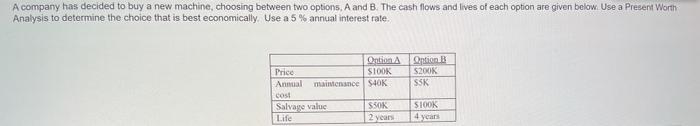

NASA is considering two alternatives, A and B. for a new lunar basis station. The respective financial estimates for each alternative are as follows: Alternative Alamative Initial Cost $200 Billion SI Billion Annual Benefit SI Billion $250 K Salvage Value SO $500K Overhaul every 20 $200 K years Useful Life (years) (Forever 20 If the interest rate is 10%, which alternative should NASA select based on an Annual Worth Analysis? 0 A company has decided to buy a new machine, choosing between two options, A and B. The cash flows and lives of each option are given below. Use a Present Worth Analysis to determine the choice that is best economically. Use a 5% annual interest rate Anton B $200K SSK Ontion A Price SIOOK Annual maintenance S40K cost Salvage value SSOK Life 2 years $100K 4 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts