Question: NASA is considering two materials for use in a space vehicle tracking station in Nevada. The estimates are shown below. MARR is 10%? a) Draw

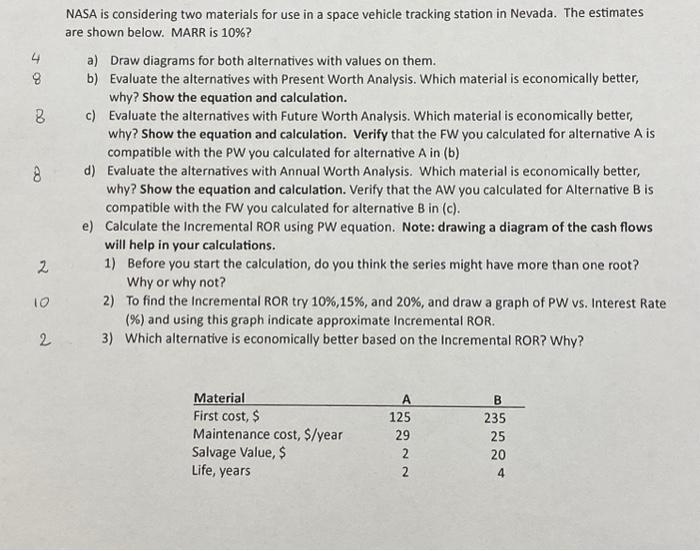

NASA is considering two materials for use in a space vehicle tracking station in Nevada. The estimates are shown below. MARR is 10% ? a) Draw diagrams for both alternatives with values on them. b) Evaluate the alternatives with Present Worth Analysis. Which material is economically better, why? Show the equation and calculation. c) Evaluate the alternatives with Future Worth Analysis. Which material is economically better, why? Show the equation and calculation. Verify that the FW you calculated for alternative A is compatible with the PW you calculated for alternative A in (b) d) Evaluate the alternatives with Annual Worth Analysis. Which material is economically better, why? Show the equation and calculation. Verify that the AW you calculated for Alternative B is compatible with the FW you calculated for alternative B in (c). e) Calculate the Incremental ROR using PW equation. Note: drawing a diagram of the cash flows will help in your calculations. 1) Before you start the calculation, do you think the series might have more than one root? Why or why not? 2) To find the Incremental ROR try 10%,15%, and 20%, and draw a graph of PW vs. Interest Rate (\%) and using this graph indicate approximate Incremental ROR. 2 3) Which alternative is economically better based on the Incremental ROR? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts