Question: Nash Corporation purchased a new machine for its assembly process on August 1, 2025. The cost of this machine was $122,700. The company estimated

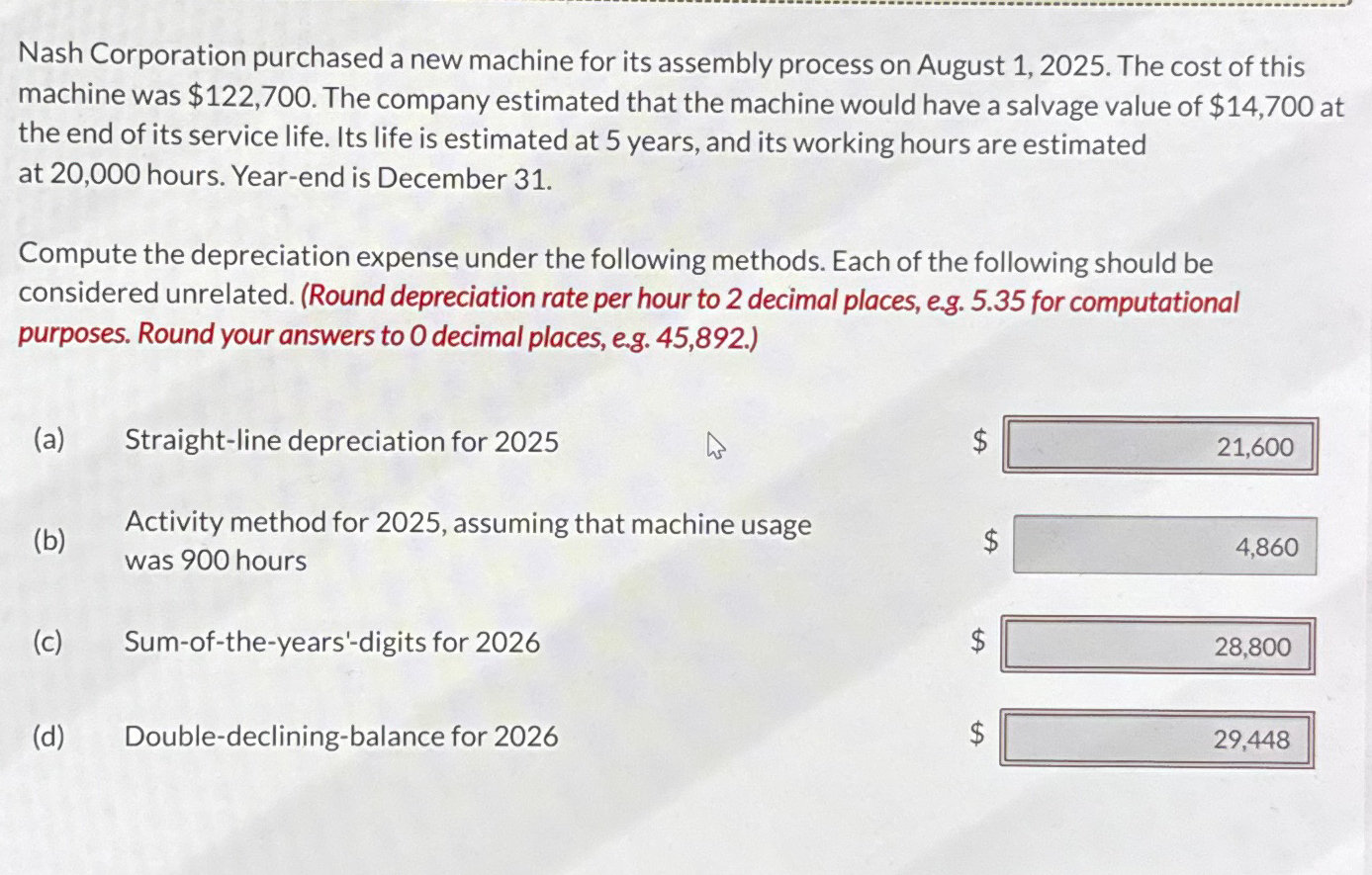

Nash Corporation purchased a new machine for its assembly process on August 1, 2025. The cost of this machine was $122,700. The company estimated that the machine would have a salvage value of $14,700 at the end of its service life. Its life is estimated at 5 years, and its working hours are estimated at 20,000 hours. Year-end is December 31. Compute the depreciation expense under the following methods. Each of the following should be considered unrelated. (Round depreciation rate per hour to 2 decimal places, e.g. 5.35 for computational purposes. Round your answers to O decimal places, e.g. 45,892.) (a) Straight-line depreciation for 2025 $ 21,600 (b) Activity method for 2025, assuming that machine usage was 900 hours 4,860 (c) Sum-of-the-years-digits for 2026 S 28,800 (d) Double-declining-balance for 2026 $ SA 29,448

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts