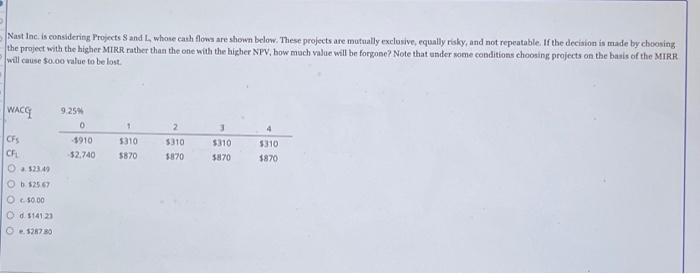

Question: Nast Inc. is considering Projects 8 and I, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. If

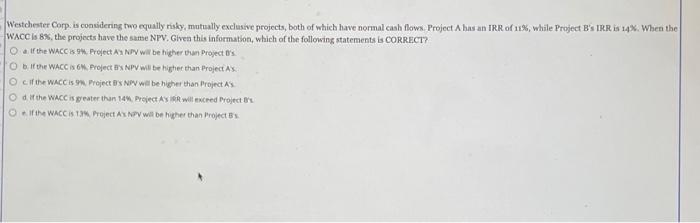

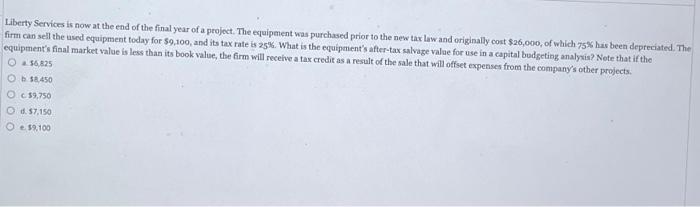

Nast Inc. is considering Projects 8 and I, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. If the decision is made by choosing the project with the higher MIRR rather than the one with the higher NPV, how much value will be forgone? Note that under some conditions choosing projects on the basis of the MIRR will cause $0.00 value to be lost. WACG 9.259 0 -3910 52.740 1 5310 5870 2 $310 5870 3 $310 5870 4 3310 3870 CFS CAL 252349 Ob 52567 O 5000 O 0514121 528780 Westchester Corp. is considering two equally risky, mutually exclusive projects, both of which have normal cash flows Project A has an IRR of 11%, while Project B's IRR is 14%. When the WACC is 8%, the projects have the same NPV. Given this information, which of the following statements CORRECT? a if the WACC & Project A NPV will be higher than Project's Obit the WACC INOM Project by NP will be higher than Project AS che WACC S Project DNP will be higher than Project AS Od if the WACC is greater than 14%Project ASR will excred Project's WACC ist Project AXAPV will be higher than Projects Liberty Services is now at the end of the final year of a project. The equipment was purchased prior to the new tax law and originally cost $26,000, of which 75% has been depreciated. The firm can sell the used equipment today for $9.100, and its tax rate is 25%. What is the equipment's after-tax salvage value for use in a capital budgeting analysis? Note that if the equipment's final market value is less than its book value, the firm will receive a tax credit as a result of the sale that will offset expenses from the company's other projects. 0 256,825 1.450 O 39,750 0.57.150 39.100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts