Question: Nautelus Ltd. signed a lease for a three-year term that requires yearly, beginning of the year payments of $69,000, including $6,000 of annual maintenance and

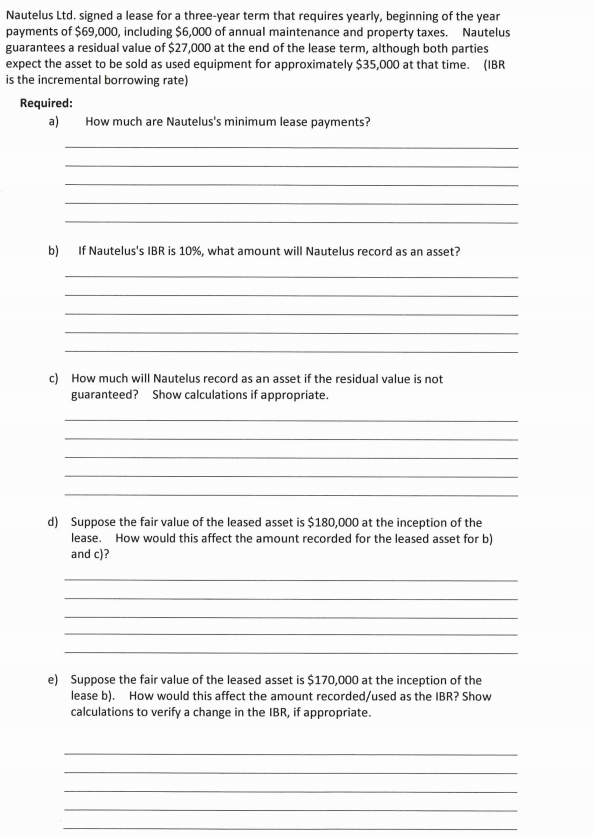

Nautelus Ltd. signed a lease for a three-year term that requires yearly, beginning of the year payments of $69,000, including $6,000 of annual maintenance and property taxes. Nautelus guarantees a residual value of $27,000 at the end of the lease term, although both parties expect the asset to be sold as used equipment for approximately $35,000 at that time. (IBR is the incremental borrowing rate) Required: a) How much are Nautelus's minimum lease payments? b) If Nautelus's IBR is 10%, what amount will Nautelus record as an asset? c) How much will Nautelus record as an asset if the residual value is not guaranteed? Show calculations if appropriate. d) Suppose the fair value of the leased asset is $180,000 at the inception of the lease. How would this affect the amount recorded for the leased asset for b) and c)? e) Suppose the fair value of the leased asset is $170,000 at the inception of the lease b). How would this affect the amount recorded/used as the IBR? Show calculations to verify a change in the IBR, if appropriate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts